Solana

Will Solana reach $200 again? Evaluation of the next weeks for SOL

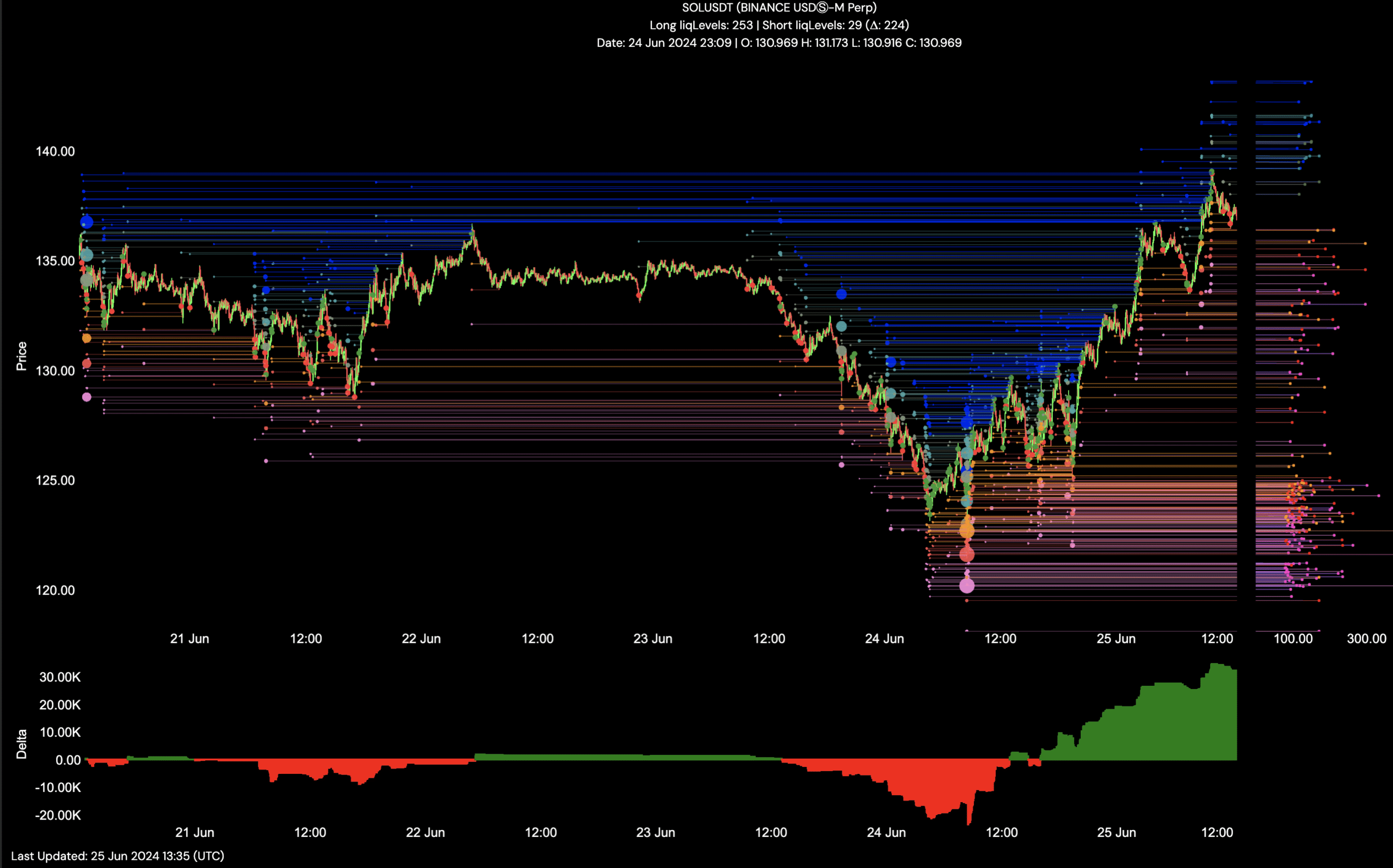

- Liquidation levels suggest that SOL price could rise towards the $140-$146 region.

- Solana Funding Rate Remained Positive, Indicating Bullish Sentiment Among Traders

by Solana [SOL] the price increased by 8.44% in the last 24 hours, making the cryptocurrency the top 10 best performing asset in the last 24 hours. At press time, SOL’s price was $137.24.

As a result, the $200 price prediction has come back to life. The last time SOL hit $200 was in April, indicating that the token has not reached such highs in almost two months.

However, there has been speculation about an altcoin season since Bitcoin [BTC] underperformed compared to other top 10 tokens.

Altcoin season, also known as “alt season,” occurs when non-BTC assets outperform the number one cryptocurrency.

For this to happen, at least 75% of the top 50 cryptocurrencies must outperform Bitcoin. However, it was not the case. But if this happens in the coming weeks, Solana’s native token could have a higher value.

Liquidation levels are an indicator that can help predict price. This indicator helps traders identify where liquidation events might occur. It does this by looking at the entire price set with open long and short positions.

At press time, a liquidity pool existed between $140 and $146. This means that the SOL price could rise towards this region in the short term.

Source: Hyblock

But that would only happen if buying pressure increased. In addition to liquidation levels, it is also important to look at the cumulative liquidation levels delta (CLLD).

The CLLD calculates the sum of the difference between all long liquidations and all short liquidations. A positive value indicates that there are longer liquidations.

However, when the value is negative, it means there are more short liquidations. At press time, Solana’s CLLD was positive. This is evidence of the price retracement, especially since the value had reached $139 earlier.

Additionally, CLLD also provides insight into price direction. It is interesting to note that the CLLD, very positive, was bearish signal for SOL. Indeed, the recent SOL retracement could move lower.

Thus, SOL could erase part of its gains in the coming days. If so, it could take longer for the price to reach $200.

Meanwhile, Solana’s funding rate remained positive. The funding rate measures the fees paid between long and short positions. Positive values indicate that long positions are reporting short positions and that the overall sentiment is bullish.

Source: Santiment

Is your wallet green? Check the Solana Profit Calculator

On the other hand, negative values indicate that shorts are reporting long positions. If so, it means that trader sentiment is bearish.

However, AMBCrypto noticed that funding decreased as the price increased. For this price, this is bullish as it appears spot buying has increased.