Bitcoin

What is the reason for the sharp drop in Bitcoin price today?

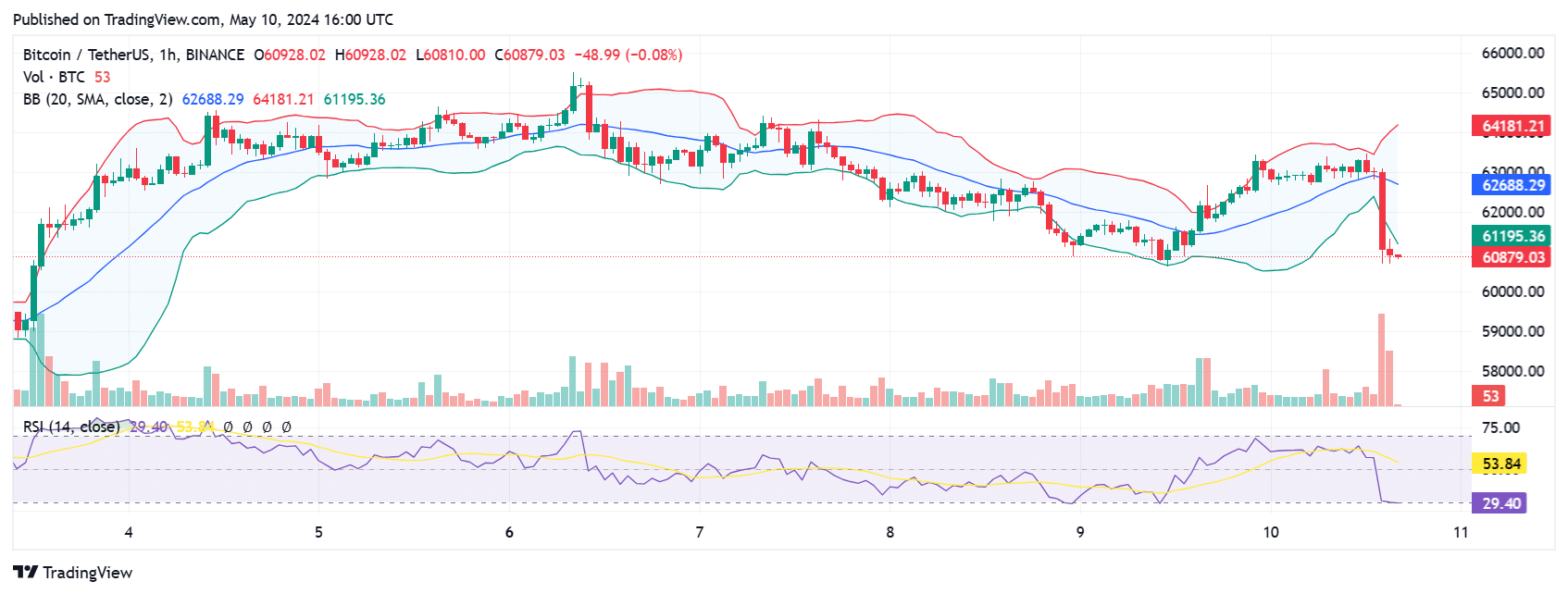

Bitcoin price is struggling to maintain bullish momentum due to tightening economic conditions in the US. The latest inflation data became the main reason for a sharp drop in BTC prices from $63,446 to $60,763 in a few hours. Additionally, US Spot Bitcoin ETFs witnessed large outflows on Friday, May 10, with GBTC accounting for over $100 million of negative flow.

Consumer sentiment data from the University of Michigan revealed a drop from 77.2 in April to 67.4 in May, the lowest value in six months and also missed market expectations of 76. Furthermore, inflation expectations for next year rise to 3.5% , a maximum of six months, compared to 3.2% in April. Also the Five-year inflation outlook reached 3.1% from 3.0%.

Meanwhile, new comments from Fed officials were cautious. Fed Lorie Logan said there are important upside risks to inflation. It is too early to consider a rate cut. We need to be flexible in our policies. Federal Reserve Governor Bowman You said that we need to maintain political stability over a longer period of time.

Crypto Market saw over $50 million liquidated in just a few hours

BTC Price fell more than 4% in a few hours to an intraday low of $60,690. Bitcoin fell from a high of $63,446 as it failed to sustain upward momentum following a recent breakout. Ethereum and other altcoins also fell 2-4%. The recent crash has raised doubts about the crypto market’s recovery later this year.

Currency Currency data shows that more than $150 million was liquidated in the crypto market in the last 24 hours. Between this, $90 million long positions were liquidated and nearly $60 million worth of short positions were liquidated. Most of the settlement happened in one hour, which was recorded at over $51 million.

More than 54,000 traders were liquidated and the largest single liquidation order took place on cryptocurrency exchange Binance when someone sold BTC for USDT valued at $3.56 million.

Senior Commodities Strategist at Bloomberg Mike McGlone said: “Highly volatile and speculative, the 24/7 traded crypto was rising against gold the last time the e-mini S&P 500 future broke above its 50-week moving average in November, but This time the Bitcoin/gold crossover is falling.”

The new inflation data caused US Dollar Index (DXY) rise to 105.40 and the 10-Year US Treasury Yield jumped 0.055% to 4.504%. As Bitcoin moves in the opposite direction to DXY and Treasury yields, a rise in both has caused Bitcoin’s price to fall to $60K, triggering a sell-off in the crypto market.

Read too:

✓ Share:

Varinder has 10 years of experience in the Fintech sector, with more than 5 years dedicated to blockchain, cryptography and Web3 development. Being a technology enthusiast and analytical thinker, he has shared his knowledge on disruptive technologies in over 5000 news, articles and newspapers. With CoinGape Media, Varinder believes in the enormous potential of these innovative technologies of the future. He is currently covering all the latest updates and developments in the crypto industry.

The content presented may include the author’s personal opinion and is subject to market conditions. Do your market research before investing in cryptocurrencies. The author or publication assumes no responsibility for your personal financial loss.