Solana

The symbolic movement of 23 million from Solana raises eyebrows: where to go, SOL?

- The data showed that participants are HODLing, but SOL dropped by 6.16%.

- An increase in volume with the current price trend could lead the token to $129.

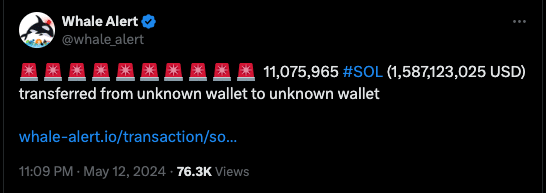

On May 13, 23 million Solana [SOL] was sent to undisclosed wallets, according to Whale Alert data. According to the post shared, the first transaction was worth $1.58 billion.

The second, believed to be the same participant, sent another 11 million tokens, worth around the same price, to another wallet.

Three hours later, another large transaction took place. This time, it was 1 million SOL which was transferred.

One thing AMBCrypto noticed is that none of the transactions were traded. If the tokens had been traded, it would have made it appear as if they were for sale.

Source:

$129 or $155? Where is the next target?

In this case, the SOL price could have recorded a notable decline. Nevertheless, the token’s performance was not better. At press time, the price of SOL was $140.

This value represents a drop of 6.16% in 24 hours, indicating that the so-called HODLing strategy could not free the cryptocurrency from another fall.

The next direction of Solana’s native token could be a concern for long-term investors and traders. As such, AMBCrypto analyzed the potential direction.

The first metric taken into account was that of Solana. chain volume. Volume shows (in monetary terms) how many cryptocurrencies have been traded over a given period of time.

For SOL, Santiment data showed volume was $1.44 billion, an increase from the May 12 figure. An increase in volume as prices decline could be good news for the bears.

Source: Santiment

In fact, the increase in the measure could reinforce the decline. Therefore, if the value continues to increase, the price of SOL could continue to fall.

So, a drop to $129 could be the next plausible target.

On the other hand, a reversal to the upside could change direction. If this happens and volume reaches new highs, SOL price could attempt to reach $155.

Bears are becoming less and less confident

Regarding the market’s perception of SOL, AMBCrypto looked at the weighted sentiment. At press time, weighted sentiment was negative, suggesting an increase in dark remarks.

However, a notable observation was that the the feeling was getting better. If this metric continues to rise, demand for SOL could increase.

An increase in demand could invalidate the bearish forecast at $129. Instead, an upcoming hike to $155 could be next for Solana. Additionally, total open interest (OI) was starting to increase.

Source: Santiment

At the time of writing, the OI stood at $1.46 billion. The OI increases or decreases based on net positioning. In this case, buyers become more aggressive than sellers.

Read by Solana [SOL] Price prediction 2024-2025

If it continues, this increase could lead to a breakout of the SOL. However, interest does not appear to be large enough to confirm the pump in overhead resistance.

As such, SOL may not be able to break above $155 in the near term.