Solana

Solana’s Longs Take a Hit – What Does That Mean for You Now?

- SOL contracts exceeded $5 million, with long positions taking a larger share

- Areas of high liquidity existed between $138 and $140, indicating that the price could fall to these levels.

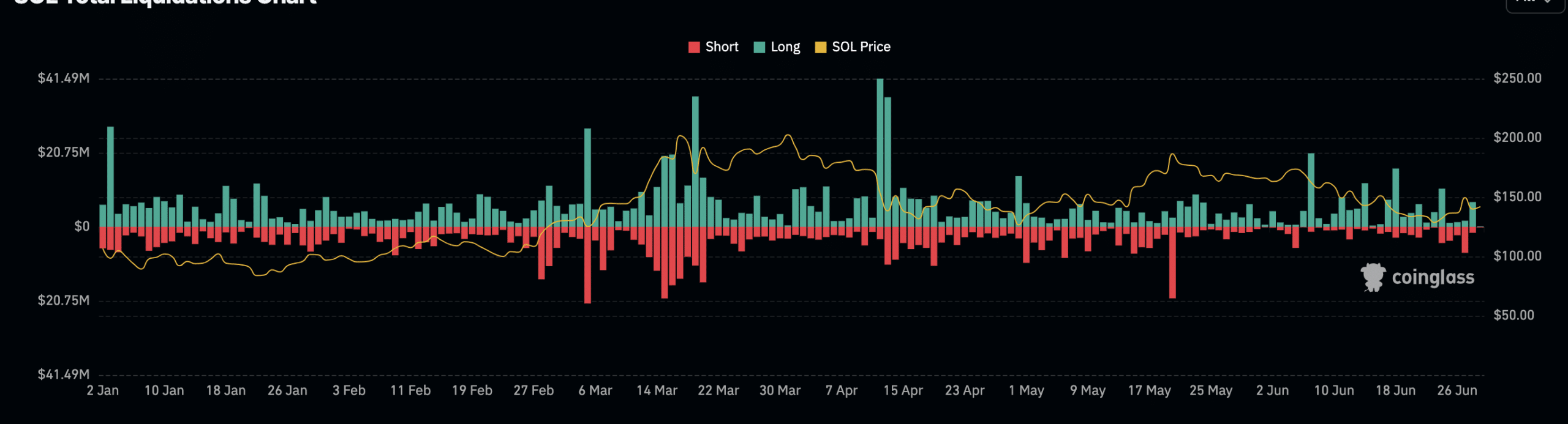

The last 24 hours have been a bad day at the office for traders who chose to bet on a Solana [SOL] price increase. This was demonstrated by Coinglass liquidation data.

According to the derivatives information portal, the total SOL liquidations amounted to $5.47 million. Of this total, long positions accounted for $4.3 million. Short positions, however, settled for just $1.11 million.

Positive expectations did not bear fruit

Liquidation occurs when a trader can no longer meet the margin requirements to keep a contract open. As a result, an exchange closes the trader’s position. This is done to prevent further losses.

While long positions are those that hope to profit from a price increase, short positions bet on a decline. Based on AMBCrypto’s findings, SOL’s price action was the reason behind the increase in long liquidations.

Source: Coinglass

On June 27, the altcoin’s price surged to $150 after news broke that an asset management firm had filed for a Solana spot ETF. The development sparked a wave of positive comments on the social media platform, with many calling for SOL continue the rally.

However, the cryptocurrency had other plans. Shortly after the price rise, SOL began to slowly move down the chart.

At press time, SOL was trading at $141.96, following a 2.39% decline over the past 24 hours. On the contrary, Solana’s funding rate revealed that traders appear unfazed, with some remaining steadfast in their bullish predictions for the cryptocurrency.

This is because the funding rate was positive at the time of going to press. The funding rate here refers to the cost of maintaining open positions in the market.

Traders stick to their gut amid bearish signs

When the rate is positive, it means that long positions are paying short positions to keep their positions open. If so, this implies that participants expect prices to rise.

Conversely, negative financing means that shorts pay longs. In this case, traders’ expectations are bearish. However, rising financing rates and falling prices could affect the value of SOL.

Source: Santiment

Simply put, when this metric increases, it means long positions are aggressive. However, the drop in prices suggests that they are not receiving rewards for their post. In short, this is bearish for the token as spot buyers do not seem to be supporting the bullish trend.

If this were to remain the case in the coming days, SOL could fall below $140. Additionally, AMBCrypto also looked at liquidation levels.

Here, liquidation levels indicate estimated price points where liquidations could occur. If there is a high liquidity pool in a price range, a cryptocurrency may move towards that area.

Source: Hyblock

Is your wallet green? Check it out Solana Profit Calculator

On the positive side, there was no spike in liquidity. This means that the price of SOL may not increase anytime soon.

However, AMBCrypto also noticed areas of high liquidity between $141 and $138. Therefore, the altcoin’s price could drop to these levels in the short term.