Solana

Solana Price Prediction: Will SOL Hit $500 This Cycle?

- Indicators suggest that SOL looks almost certain to hit $334 to start.

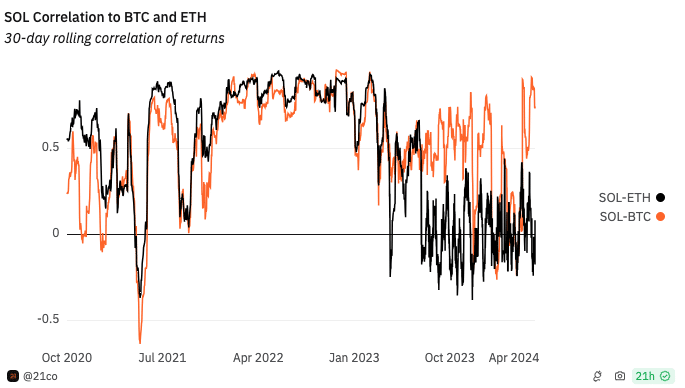

- The token’s correlation with ETH was negative, but with BTC it was strong.

Over the past seven days, by Solana [SOL] price struggled to produce an impressive series. According to data from CoinMarketCap, the price of SOL was $167.12 at press time.

It was approximately the same value as on May 25. On a year-over-year basis (YTD), SOL increased by 52.63%. But that was nothing compared to the token’s performance in 2023.

However, the recent disappointing price action hasn’t stopped Solana bulls from betting on an incredible rally. For most SOL holders, the price of the cryptocurrency would reach at least $500 before this cycle ends.

SOL needs Bitcoin, not ETH

But this same set also predicted that Solana would surpass its all-time high of $260 before the end of the first quarter of 2024. However, this did not happen since the closest SOL to this target was $210 in March.

AMBCrypto analyzed Solana price predictions from an on-chain perspective. First, we examined the correlation with Bitcoin [BTC]and with Ethereum [ETH].

According to data from Dune Analytics, SOL correlation with BTC was 0.83, indicating that prices move in the same direction most of the time.

Source: Dune analysis

For ETH, the reading was 0.10, suggesting divergence between the two cryptocurrencies. As such, if SOL were to reach $500 in the near future, BTC is expected to surpass its all-time high.

Another metric looked at by AMBCrypto was social dominance. Social dominance shows the rate of discussion about a token compared to other cryptocurrencies in the top 100.

Has a good entry surfaced?

According to Santiment data, Solana’s social dominance was 4.938%. Compared to March highs, this figure was low.

However, history has shown that low social dominance can be a good solution. buying opportunity. This is because a decrease in conversations about the token means that it has not reached a high level of demand.

As such, buying SOL between $161 and $168 could be a good entry point before another rally begins. To further support this point, there was Open Interest (OI).

The OI decreases or increases depending on the net positioning. If the indicator increases, it means that money is flowing into contracts linked to the token.

On the other hand, a decrease implies that liquidity is exit the market. As of press time, SOL’s open interest has fallen to $807.25 million.

Source: Santiment

Concerning the price, this fall indicated that Solana could pounce on the underlying support which was $161. However, this does not mean that an increase in open contracts will not occur again.

In the event that SOL’s OI exceeds $2 billion as was the case a few months ago, the price could increase by 100%. Based on the price at press time, this means the token’s target could be around $334 in a few months.

Data indicates “sufficient purchasing power”

In addition to the above metrics, AMBCrypto also look at to the total value locked (TVL) of Solana. TVL tracks whether market participants lock or stake assets in a protocol and withdraw their capital.

When the metric increases, it means that the network is healthy and participants trust the project to produce good output. On the other hand, a decrease implies an increase in the number of assets withdrawn.

According to data from DeFiLlama, Solana’s TVL stood at $4.80 billion. This is an increase of 20.27% over the last 30 days. But the last seven days have not been rosy for the token as it appears some staked SOL has been withdrawn.

Source: DeFiLlama

Regardless of the recent pullout, the channel’s TVL could reach $8 billion, especially since activity on the network was much higher than other projects.

If (when) this happens, the demand for SOL could be incredible, which could cause the price to reach or exceed the $500 mark. Beyond that, Dune data showed that the circulating supply of stablecoins on Solana has increased.

Realistic or not, here is Market capitalization of SOL in terms of ETH

Stablecoins like USDT, USDC and Recently added PYUSD contributed to this hike.

The increase here suggests that the chain’s addresses had sufficient purchasing power to drive up the value of SOL.