Solana

Solana Price Eyes Retest of $180 as Bulls Make $150 Million Move

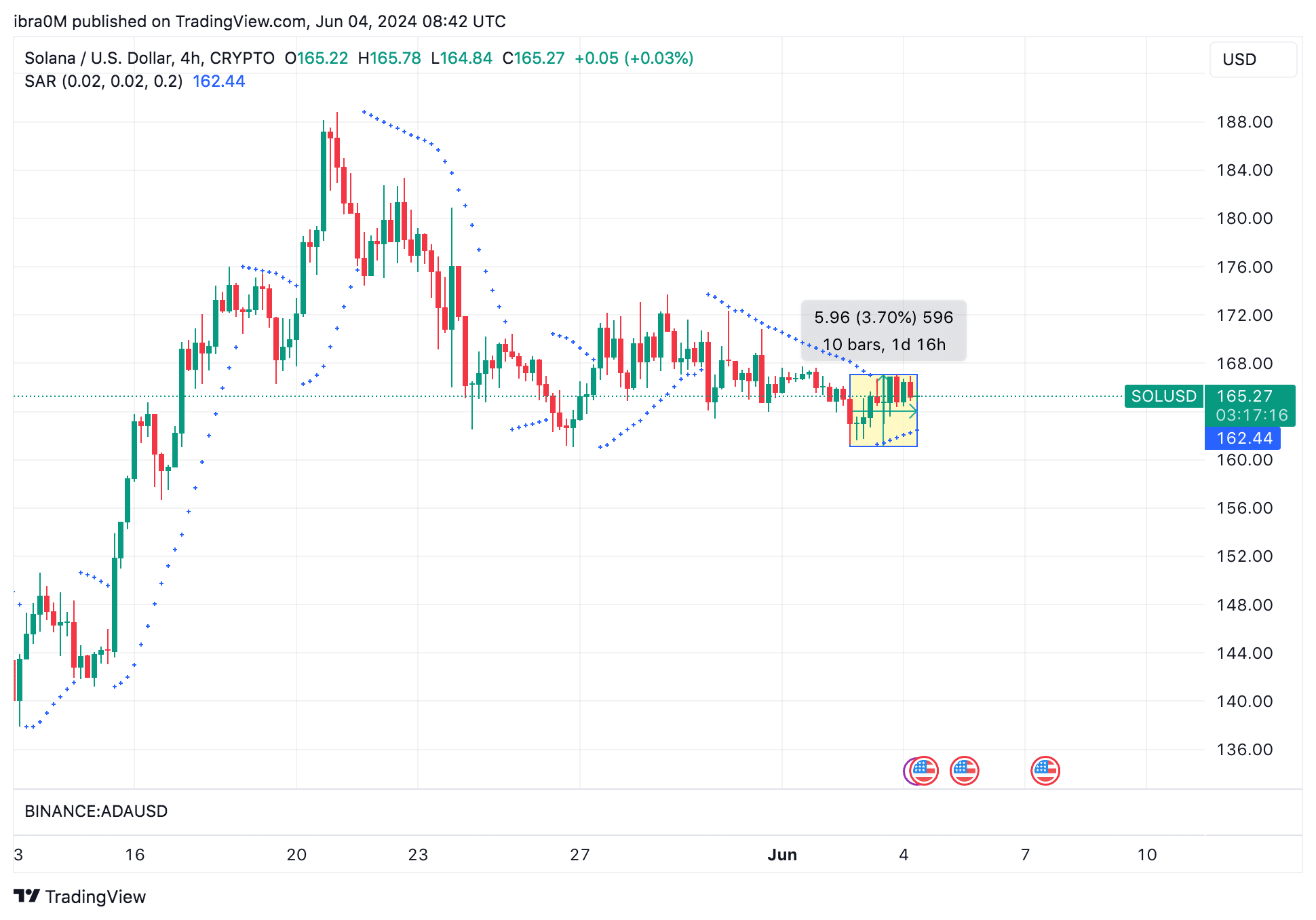

Solana price crossed $165 on June 4, 2024 and increased by 4% over the last 3 days; however, the rise in LONG positions suggests that more upside could follow.

Solana Price reverses last week’s losses

During the last week of May, Solana price struggled to gain traction as the approval of the ETH spot ETF on May 23 brought investor and capital attention to Ethereum DeFi and spot markets. However, as the euphoria surrounding this historic approval has subsided, demand for Solana has taken a positive turn since early June.

Looking at TradingView’s daily price chart, SOL price rose from $161 on June 1, to establish a stable support base above the $165 mark at the time of writing on June 4 .

This sustained rise of 4% over the past 72 hours suggests that bullish momentum is now returning to the SOL markets, following the euphoria of the ETF approval, which saw investments divert capital towards the Ethereum ecosystem.

Traders deploy $150M leverage as bullish momentum returns

Another key indicator of growing bullish sentiment in the Solana markets is the unusually high leveraged LONG positions mounted by speculative traders this week.

Coinglass’ liquidation map data tracks the amount of leveraged contracts currently listed for a specific asset on recognized derivatives trading platforms. It provides clear information on changing investor sentiment towards the near-term price outlook of assets.

– Advertisement –

Solana futures markets attracted an influx of LONG positions this week, far outpacing the volume of active SHORT contracts. As seen above, bullish traders deployed $151.09 million in leverage on LONG positions with limits of 20% of current prices.

At the same time, the total volume of SHORT contracts amounts to $110 million. This $41 million deficit means bullish traders have taken more aggressive positions, with growing confidence that spot prices will rise further and generate amplified profits in the days to come.

Essentially, the chart shows that the bulls now have more leverage in the game and are more likely to make additional spot purchases to make quick profits on their high-risk leveraged positions.

With Solana price currently trading at $165, another major breakout towards $180 could be on the cards if this scenario plays out.

However, if the markets enter a new downtrend, SOL price will likely find formidable short-term support around the $155 level. Given that over 90% of $150 million leveraged contracts are priced between $164 and $154, Solana could therefore attract significant demand in this channel as bulls look to avoid major liquidations.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-