Solana

Solana Falls 10%, But a “Buy” Signal Appears – Will SOL Rise?

- The price of Solana has fallen almost 10% over the past seven days.

- SOL’s metrics seemed optimistic, but indicators suggested otherwise.

Bears took control of the market last week, driving down the prices of several cryptos including Solana [SOL].

Although investors had to bear losses, things for SOL may soon change as a buy signal appears on the token’s chart. Does this mean SOL is ready for a bull rally?

Buy signal on Solana chart

Last week, Solana investors struggled as the token’s price fell almost 10%. At the time of writing this article, SOL was trade at $144.39 with a market capitalization of over $66 billion.

However, investors should not be discouraged. Ali, a popular crypto analyst, recently published a Tweeter highlighting an interesting development.

According to the tweet, a buy signal flashed on Solana Sequential TD near the $141 mark.

Since the token managed to hold this support level, it indicated that the chances of SOL recovering from last week’s losses are high.

AMBCrypto’s view of CGFI.io data revealed that at press time, SOL’s Fear and Greed Index had a value of 37%, meaning that the market was in a “fear” phase.

Whenever the indicator reaches this level, it indicates that the price of a token could soon gain bullish momentum.

Is a bull rally approaching?

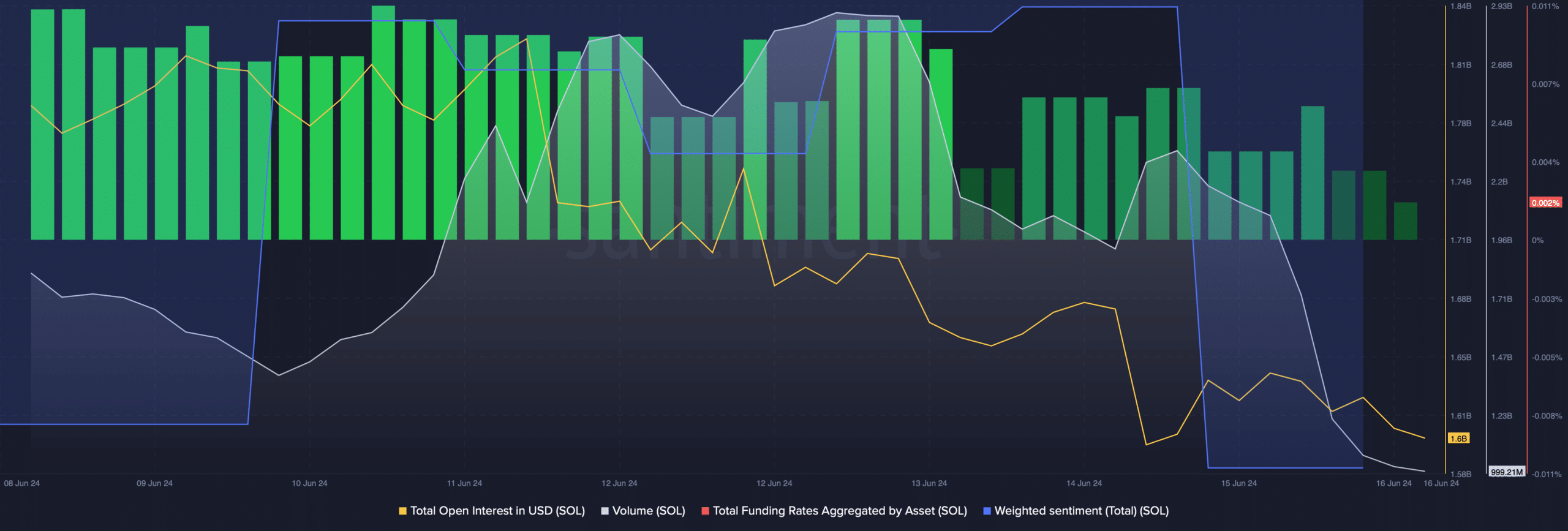

Since the aforementioned data hinted at a trend reversal, AMBCrypto then analyzed SOL’s on-chain metrics to better understand if a bullish rally is possible. According to our analysis, SOL’s funding rate has decreased.

In general, prices tend to move in the opposite direction to the funding rate. Its open interest fell along with its price, hinting at a change in the current downtrend in price.

In addition to this, SOL volume also dropped, indicating a price increase in the coming days. Nonetheless, investor confidence in SOL remained low.

This appears to be the case as its weighted sentiment fell, meaning bearish sentiment around the token was dominant in the market.

Source: Santiment

In fact, market indicators remained bearish. For example, its Relative Strength Index (RSI) saw a slight decline. Chaikin Money Flow (CMF) has also followed a similar downward trend.

Moreover, the MACD displayed a bearish advantage in the market, indicating a further decline in the price of the token in the coming days.

Source: TradingView

Is your wallet green? Check SOL Profit Calculator

Our review of Hyblock Capital data revealed that if the downtrend continues, SOL could fall to $139.

However, if a trend reversal occurs, it will be crucial for Solana to break above $145 as the liquidation would increase sharply. An increase in liquidations often leads to short-term price corrections.

Source: Hyblock Capital