Solana

Solana “beats” Bitcoin on this front, but is bad news coming?

- Solana network activity remained high in May

- SOL’s price action was bullish, but the sentiment around it has turned bearish

Solana [SOL] has been in the spotlight lately due to its achievements in the NFT ecosystem. However, that’s not all, with recent data sets revealing that blockchain has excelled in another area after its switchover. Bitcoin [BTC].

Strong Solana network activity

SolanaFloor, a popular X handle, recently tweeted that blockchain has managed to overtake Bitcoin in terms of revenue generated in the last 24 hours. To be precise, SOL generated $1.65 million in revenue, while BTC “only” generated $1.5 million.

The reason for this performance could be Solana’s robust network activity.

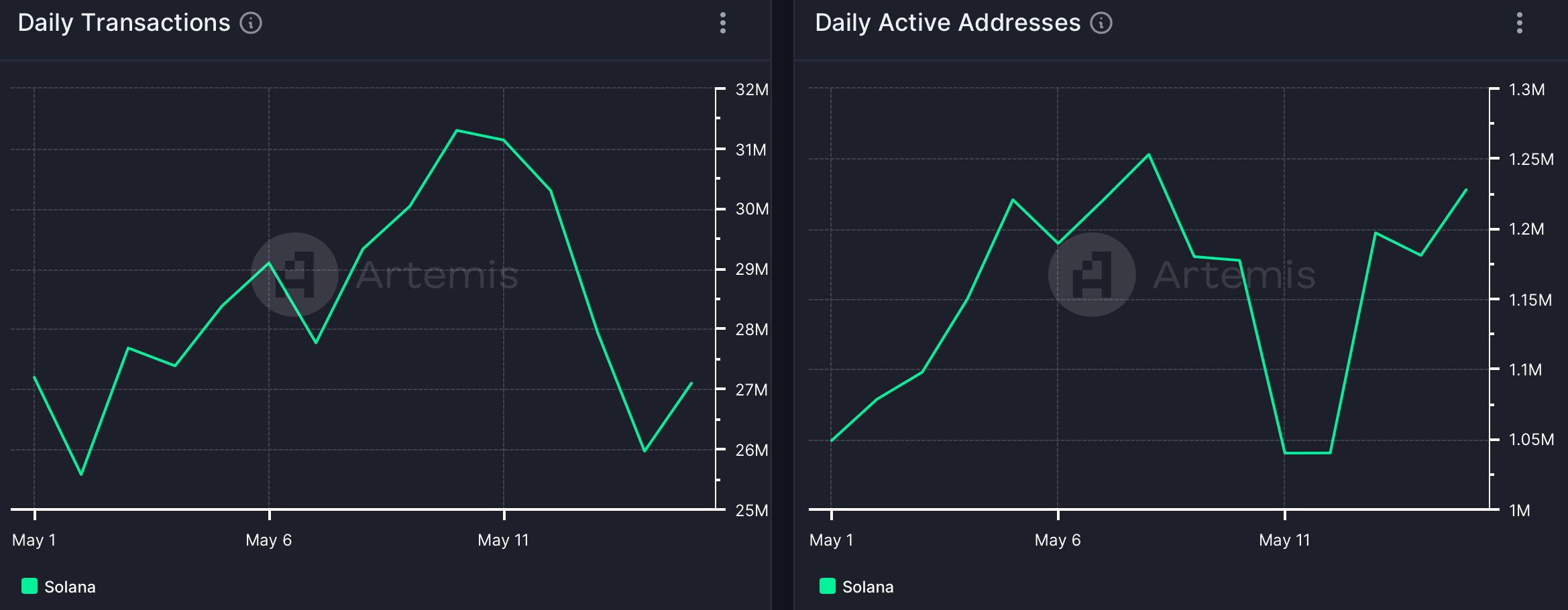

Analysis of Artemis by AMBCrypto data revealed that SOL network activity remained high in May. Not only did its daily active addresses increase sharply, but SOL’s daily transactions also increased on May 10. Here it is worth noting that the same thing fell soon after.

Source: Artemis

The increase in network activity has helped blockchain generate more revenue. We have seen that SOL’s fees have increased sharply since the beginning of May, allowing its revenue to grow as well.

Everything in the DeFi space also looked rather bullish as its TVL increased. Additionally, SOL heavily dominated BTC in terms of network activity.

SOL’s daily transactions and addresses have remained significantly higher than those of BTC. In fact, SOL fees have remained higher than BTC, with the latter seeing a significant drop on May 7.

Source: Artemis

Apart from this, SOL has also performed well in the NFT ecosystem. AMBCrypto had reported Previously, there was a slight increase in Solana NFT volumes over the past seven days, mainly due to top collections.

SOL remains optimistic

Meanwhile, Solana bulls remained strong in the market as its weekly chart remained green. According to CoinMarketCap, SOL has appreciated by more than 5% in the last seven days. At the time of writing, the token was trading at $163.26 with a market cap of over $73.27 billion.

Thanks to the price increase, Solana’s social volume has increased in recent days. However, it was surprising to see a decline in SOL’s weighted sentiment.

Source: Santiment

Is your wallet green? Check Solana Profit Calculator

AMBCrypto then checked the daily chart of SOL to see if this uptrend would continue. According to our analysis, SOL’s Relative Strength Index (RSI) has seen a slight rise and appears to be moving further away from neutral 50 – a sign of a sustained uptrend.

However, the token’s price has touched the upper limit of the Bollinger Bands – a sign of potential selling pressure.

Source: TradingView