Solana

SOL Reclaims $160 After Crypto Crash, What Next?

Solana (SOL) price recovered to the $160 level on Monday, June 9, up 6% over the weekend; SOL’s open interest trends suggest a major breakout phase ahead.

Solana price bounces 6% over the weekend

The crypto market experienced intense downward volatility on Friday (June 7) as investors reacted to the latest US Nonfarm Payrolls (NFP) data.

Solana emerged as one of the worst-hit assets in the top 10 crypto rankings, after struggling to attract new demand since the last week of May 2024 as the Ethereum ETF The approval saw investors overlooking rival proof-of-stake networks.

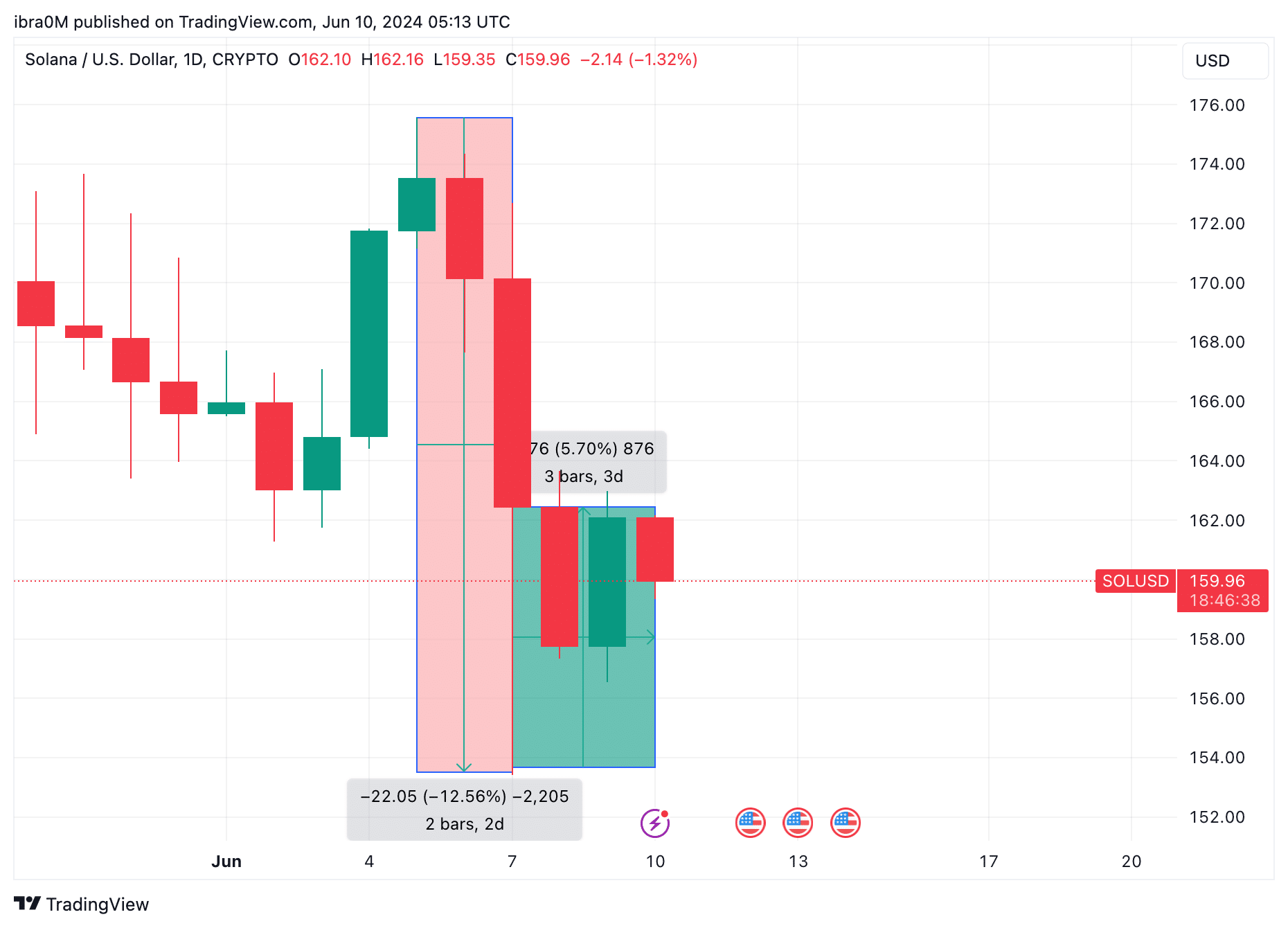

Following the NFP data, SOL price quickly succumbed to a 12.6% correction on June 7, falling to its 20-day low at $153, according to data obtained from TradingView.

However, Solana price saw a significant 6% rebound back to the $160 level in the early hours of June 10, erasing almost half of the losses recorded during Friday’s stock market crash.

There appears to have been a significant increase in demand in the Solana markets over the weekend, as bulls rushed to avoid further losses.

Solana Open Interest Holds $2 Billion Despite Price Drop

Solana’s price drop in late May following the approval of the ETH ETF caught the attention of eagle-eyed bullish traders looking to buy at a local low. The stock market crash of June 7 came prematurely for this group of new entrants, who were then forced to defend their positions to avoid early losses.

– Advertisement –

Solana Open Interest Trends show how investors had taken a new position by the end of May 2024.

The chart above shows how the bulls jumped right into action in early June, propelling SOL futures’ open interest to a 20-day high of $2.58 billion as of June 5. Interestingly, while SOL price is now down 9% from the weekly $171. up on June 5, open interest remained stable.

At the time of writing on June 10, Solana Open Interest was trading at $2.36 billion. This $220 million drop in Solana’s open interest between June 5 and 10 reflects a 9% decline in share capital.

At first glance, this seems extremely bearish. However, compared to the downward trend in SOL prices during the same period, this speaks to the resilience and optimistic conviction of short-term traders.

During a stock market crash, if an asset’s open interest declines at a slower rate than the downward trend in its price, this signals bullish rebound momentum for two main reasons:

Widespread expectation of an early rebound: When an assent’s open interest holds up better than its price, it implies that traders hold on to their long positions during the downturn and do not liquidate en masse. This often protects the asset from a deeper decline and sets the stage for a potential rebound.

Reduced panic selling: Solana’s measured decrease in open interest may suggest that fewer traders are panicking and selling their positions. This can help stabilize the market more quickly and lead to a more sustainable recovery once the initial panic subsides.

Solana Price Prediction: Will $160 Resistance Collapse?

Solana price jumped 6% over the weekend as bullish traders held onto their LONG positions, keeping SOL open interest above the $2 billion mark. This market alignment suggests that a quick price break above $180 could be on the cards in the coming week.

However, in terms of near-term resistance, Solana faces a potential hurdle around the 10-day SMA price level at $165.

If the bulls manage to make a decisive break in Solana price above the key resistance level, they could advance towards $180 as expected.

But conversely, if the bears regain a foothold in the market, Solana price could suffer a major pullback from the $165 sell wall. However, in this scenario, the bulls could establish short-term support around the $157 level.

Essentially, Solana traders can expect an extended consolidation with a narrow channel from $155 to $170 in the current market dynamics.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-