Bitcoin

Short-term holder realized price approaches $64,000, signaling Bitcoin bullish trend

Quick take

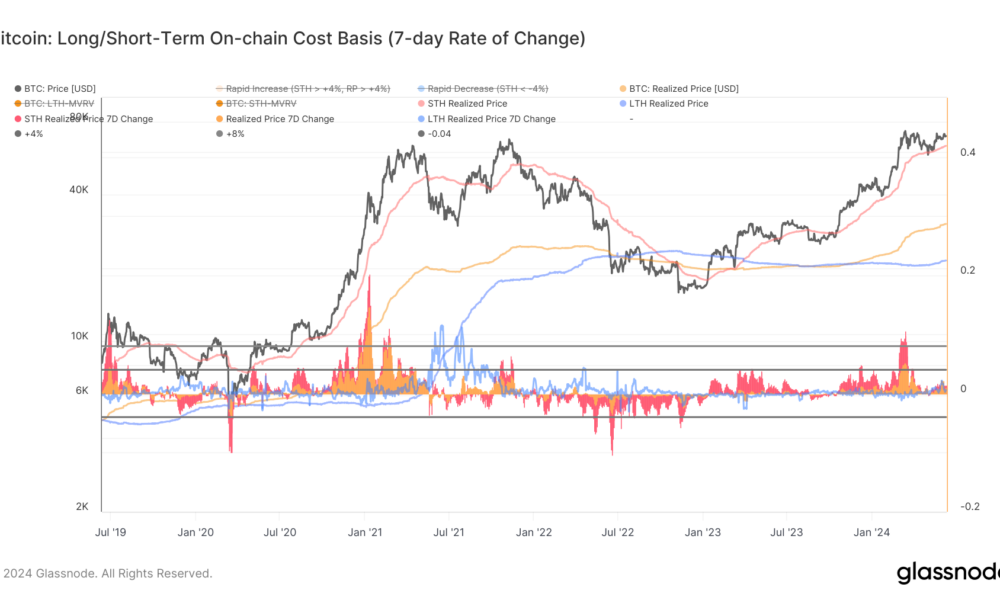

The Realized Price metric provides a comprehensive overview of the average on-chain acquisition price for the entire circulating supply of Bitcoin. By analyzing the heuristics of short-term and long-term holders, we can determine the realized price for different groups of investors.

For all coin supply, Realized Price denotes the aggregate acquisition price on the network. For Short Term Holders (STH), the Realized Price reflects the average purchase price of currencies moved in the last 155 days and kept outside of foreign exchange reserves. These coins are more likely to be spent soon. On the other hand, Long Term Holders (LTH) represent coins not moved in the last 155 days, indicating the coins least likely to be spent.

Data from Glassnode shows that STH’s realized price has been steadily increasing, approaching $64,000, indicative of Bitcoin’s continued upward trend over the past 18 months. According to CryptoSlate, this metric provides crucial support, with Bitcoin testing this level in early May. The realized price of STH rose 1.5% last week, signaling increased short-term speculation.

Notably, this metric rose 11% in March during Bitcoin all time high in seven days, the biggest since February 2021. The 1.5% increase indicates a reduction in market speculation compared to March, while Bitcoin consolidates below US$70,000.

Furthermore, CryptoSlate reported that the total realized price It recently surpassed $30,000, indicating investors exchanging Bitcoin at higher prices.

Bitcoin: Long/Short-Term On-chain Cost Basis: (Source: Glassnode)

Latest Alpha Market Report

Disclaimer: Our writers’ opinions are theirs alone and do not reflect the views of CryptoSlate. None of the information you read on CryptoSlate should be considered investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Buying and trading cryptocurrencies should be considered a high-risk activity. Please do your own due diligence before taking any action related to the content of this article. Finally, CryptoSlate is not responsible if you lose money trading cryptocurrencies.