Solana

How Solana Bulls Fuel the “Ethereum Killer” Narrative

- Solana dominated Ethereum in terms of network activity.

- SOL’s weekly chart remained green, but the trend may change soon.

Solana [SOL] has gained a lot of traction in the recent past due to the multiple launches of memecoin on the blockchain. But there was a lot more going on with blockchain, as one key metric was trending upward, which seemed pretty optimistic.

Solana grows up

AMBCrypto reported earlier how Solana volume was increasing, which can be attributed to several memecoin launches such as Dogewihat [WIF]BONK, etc.

Additionally, blockchain’s performance in the DeFi space was commendable. This was the case as Solana’s TVL recently reached an all-time high.

In addition to this, Token Terminal recently released a Tweeter this highlighted another realization. According to the tweet, SOL fees have increased.

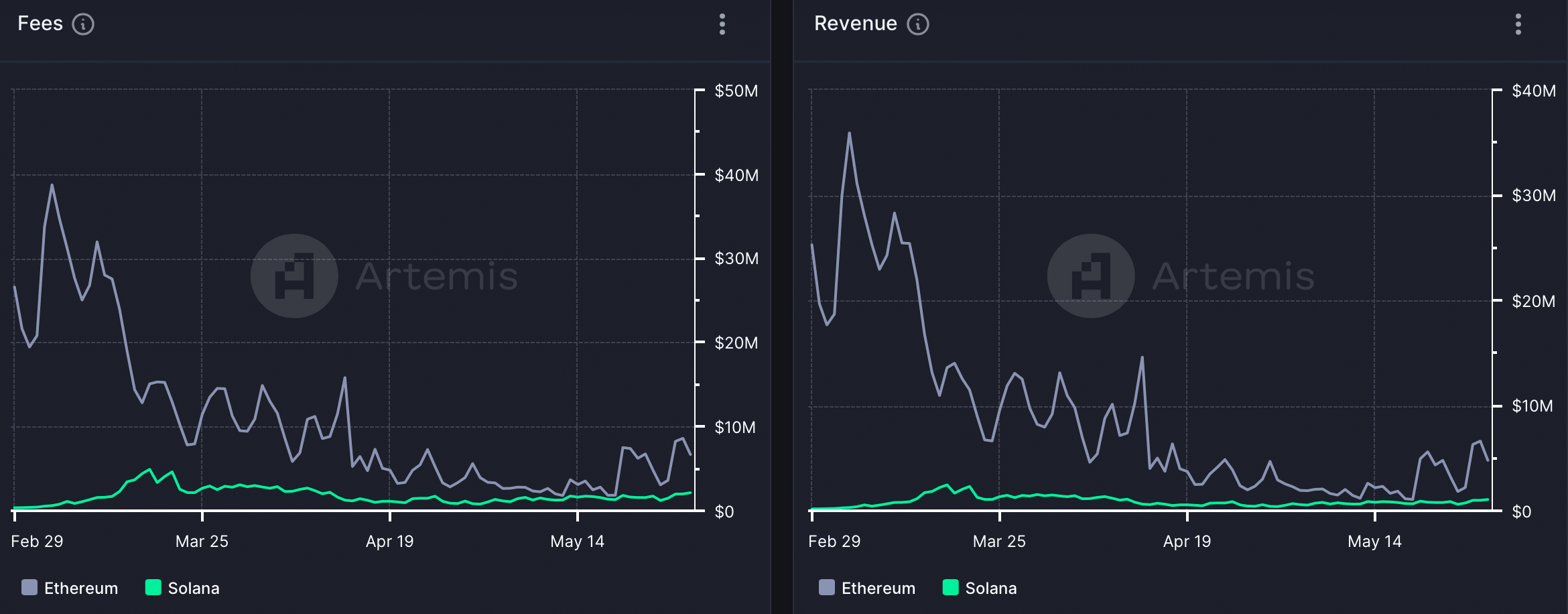

In fact, looking at the latest data, SOL’s fees were quite close to those of Ethereum. [ETH]. Analysis of Artemis by AMBCrypto data revealed that a similar trend was also seen in terms of revenue from both blockchains.

Source: Artemis

As Solana’s fees and revenues approached those of Ethereum, SOL already dominated ETH by a substantial margin in terms of network activity.

Solana’s daily active addresses and daily transactions were significantly higher than those of Ethereum, reflecting the popularity and high adoption of SOL.

Nonetheless, Ethereum continued to dominate the DeFi space, as its TVL was much higher than that of SOL.

Source: Artemis

SOL bulls don’t let go

Amidst all this, SOL bulls rejected the decision to pull out as the token’s weekly price action remained positive in a somewhat bearish market.

According to CoinMarketCapAt the time of writing, the token was trading at $167.45 with a market cap of over $76.9 billion.

Thanks to the bullish price action, Solana’s weighted sentiment has remained elevated. This meant that bullish sentiment around the token was dominant in the market.

Additionally, its social volume has also remained high, reflecting its popularity in the crypto space.

Source: Santiment

AMBCrypto then analyzed the daily chart of the token to better understand if this bullish price action would continue. According to our analysis, the positive price action may not last as its relative strength index (RSI) has been on a sideways trajectory.

Read by Solana [SOL] Price prediction 2024-25

Additionally, the token’s Money Flow Index (MFI) recorded a sharp decline, suggesting a decline in prices.

Nonetheless, SOL stood just above its 20-day simple moving average (SMA), which typically serves as support.

Source: TradingView