Memecoins

Dump UNI, buy PEPE: Memecoin more than DeFi?

- A whale sold all his UNI to buy 329.3 billion PEPE.

- PEPE holders were increasing at a faster rate than UNI holders.

According to AMBCrypto’s market analysis, it appears that traders are convinced that DeFi tokens may not replicate the kind of performance they had in the 2021 bull cycle.

Evidence of this has been shown in the past. On April 30, more evidence appeared: a whale dumped all of its Uniswap [UNI] tokens. What did he do instead? He has accumulated 329.3 billion Pepper [PEPE] and withdrew it from Binance.

However, it is important to note that the aforementioned traders made $7 million by holding UNI. But dumping tokens in the early stages, when altcoins have not yet had their expected season, indicates a decline in confidence in UNI’s potential.

No PEPE, no show

Furthermore, it is suggested to accumulate PEPE bullish belief in long-term value. However, the decisions may not surprise anyone who has “followed the money.”

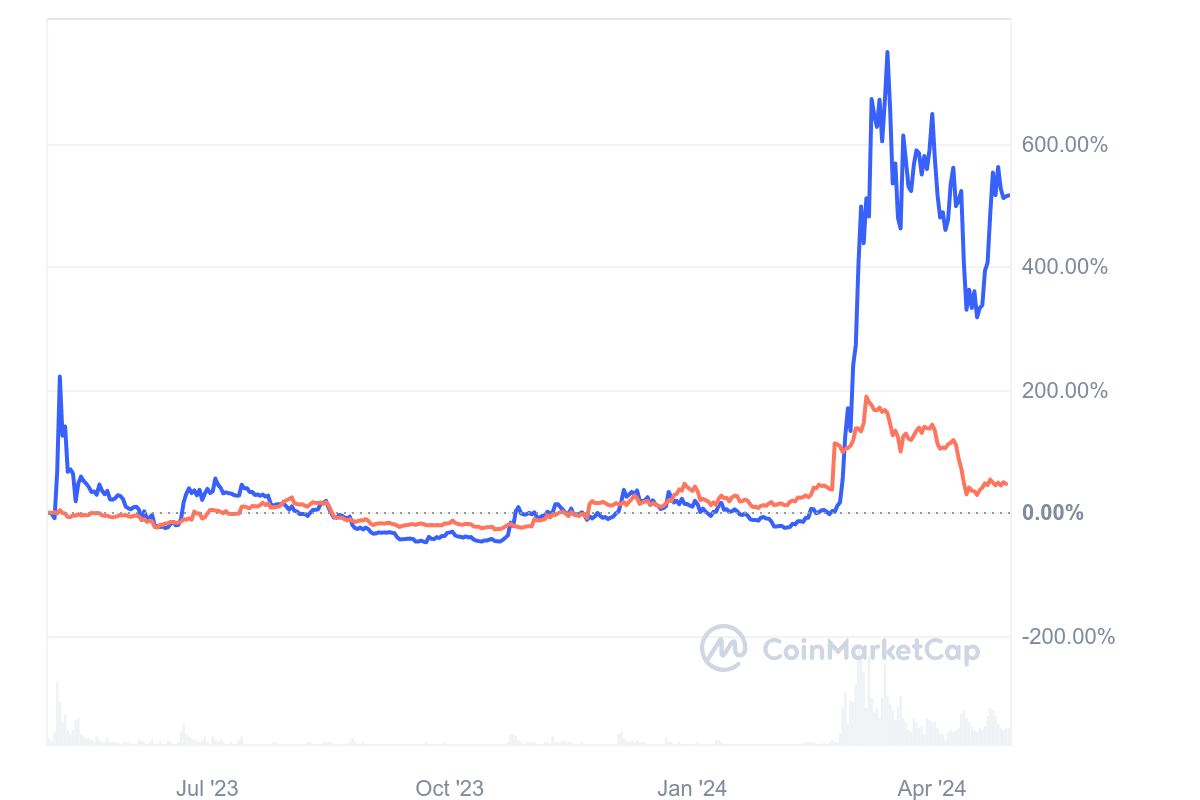

The price performance of both tokens was also proof of the dominance of memecoins in the market. As of this writing, PEPE’s Year-To-Date (YTD) performance was up 420%.

Source: CoinMarketCap

UNI, however, changed hands at almost the same price as at the beginning of the year. Despite this data, the market capitalization of DeFi tokens was $104.48 billion. For Memecoins it was $49.50 billion.

However, this difference does not show a clear picture as the latter has recorded better growth in the last year. Also, a look at the number of starters showed that UNI had more.

While PEPE holders were 211,000, UNI was 381,000. But like market capitalization, the figures don’t paint an explicit picture of the situation.

Source: Santimento

UNI may be gaining strength but not as much as…

But if you look closely, you’ll realize that PEPE’s pace in attracting more starters has been faster than UNI. A simple interpretation of this implies that the DeFi narrative may not be one of the best to follow this cycle.

However, this does not mean that the sentiment in the market will not change. According to the acumen, AMBCrypto also examined the weighted sentiment.

This metric uses social volume to measure the perception of projects in the market. At the time of this writing, both PEPE and UNI weighted sentiment were positive.

While PEPE stood at 0.45, UNI stood at 0.16, reinforcing the idea that most traders are bullish on memecoin rather than the latter.

Source: Santimento

Furthermore, the disparity of feeling It doesn’t mean that UNI won’t experience a notable recovery.

Realistic or not, that’s it Market capitalization of PEPE in UNI terms

But if we follow history, money flow and trend narratives, PEPE may continue to do so far surpass UNI.

And the significant thing is that it won’t be a small mile. In a highly bullish scenario, PEPE could outperform UNI by another 200%. While this may not happen now, it seems feasible in the months ahead.