Bitcoin

Can BTC reach $70K by July 2024?

Bitcoin price had a positive start to the week, rising 5% on the daily timeframe to hit the $63,700 mark on July 1. Growing accumulation among bullish traders could propel BTC even higher in the coming days.

Bitcoin price starts July with a 5% increase

The global cryptocurrency market was subject to intense volatility in June 2024. Although buyers remained active, several bearish events, including the US Fed’s decision against an interest rate cut in the first half of 2024 and delays surrounding the launch of Ethereum ETFs, prevented the market from maintaining upward momentum throughout the month.

Bitcoin closed June 2024 with losses of over 16%, falling from $67,800 on June 1 to drop to $60,600 on June 30. But since the beginning of July, BTC has been flashing promising signs of an extended bullish phase.

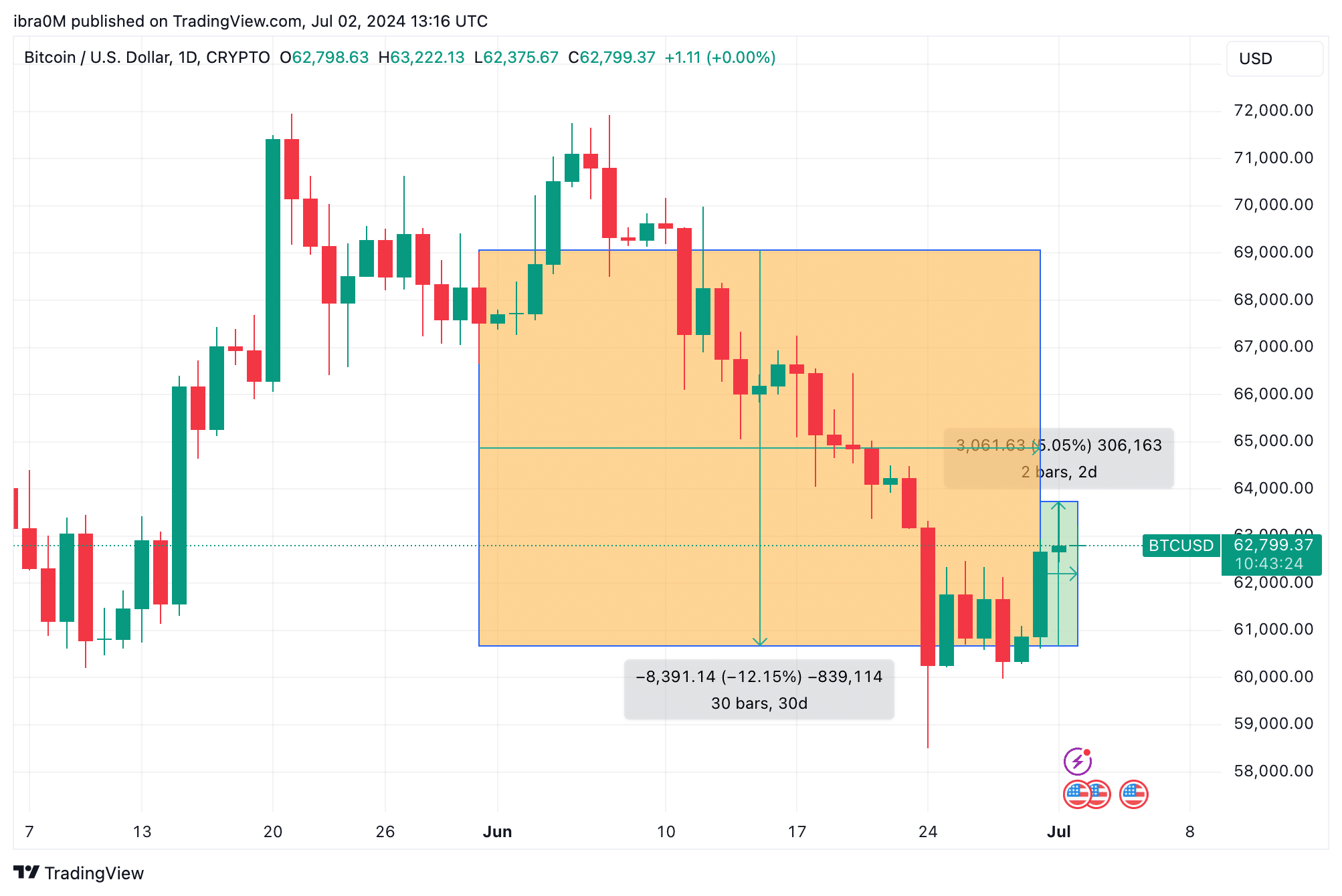

The chart above shows how BTC price closed June 2024 with a negative growth performance of 12.15%. But in the last 48 hours, Bitcoin bulls stepped in, turning the tide and rocketing to a strong start to July.

Since June 30, Bitcoin’s price has surged by 5% and reached the $62,800 level at the time of writing on Tuesday, June 2. With 3 consecutive green candles, Bitcoin’s pullbacks now appear to have taken control of the short-term BTC market momentum.

However, looking beyond the price action, on-chain data suggests that Bitcoin’s current rally is being supported by persistent bullish activity among institutional investors.

Bitcoin Price Prediction: BTC Could Retest $70,000 in July

Since June 30, Bitcoin’s price has seen a 5% increase, reaching approximately $62,800 on Tuesday, July 2. This recent upward momentum is captured on the Fibonacci retracement chart, which provides critical insights into potential future price movements. Fibonacci levels indicate key resistance and support zones that traders should keep a close eye on.

Immediate resistance for Bitcoin is identified between the $64,000 and $65,000 range, as highlighted by Fibonacci extension levels. This area represents a significant hurdle that Bitcoin needs to overcome to continue its upward trajectory.

A successful break above this level could set the stage for a retest of the next major resistance zone, around $68,000 to $70,000. This upper resistance is not only a key Fibonacci level but also a psychological barrier, marking a potential target for bullish investors in July.

On the support side, Bitcoin finds strong support near the $60,000 level. This support level has historically acted as a crucial pivot point, preventing deeper declines during bearish phases.

The Fibonacci chart reinforces the importance of this support, indicating that if Bitcoin were to face selling pressure, the $60,000 level would likely serve as a critical floor. Further down, additional support is found around the $58,000 mark, providing another layer of defense against potential declines.

Given the current market dynamics and the support from institutional investors, Bitcoin looks well-positioned to maintain its bullish momentum. If the price can break the $64,000 to $65,000 resistance, it has a strong chance of retesting the $70,000 level in July.

Disclaimer: This content is informative and should not be considered financial advice. The views expressed in this article may include the personal views of the author and do not reflect the views of The Crypto Basic. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Announcement-