Solana

BNB Price Hits All-Time High of $715, Beats Solana at $100 Billion Valuation

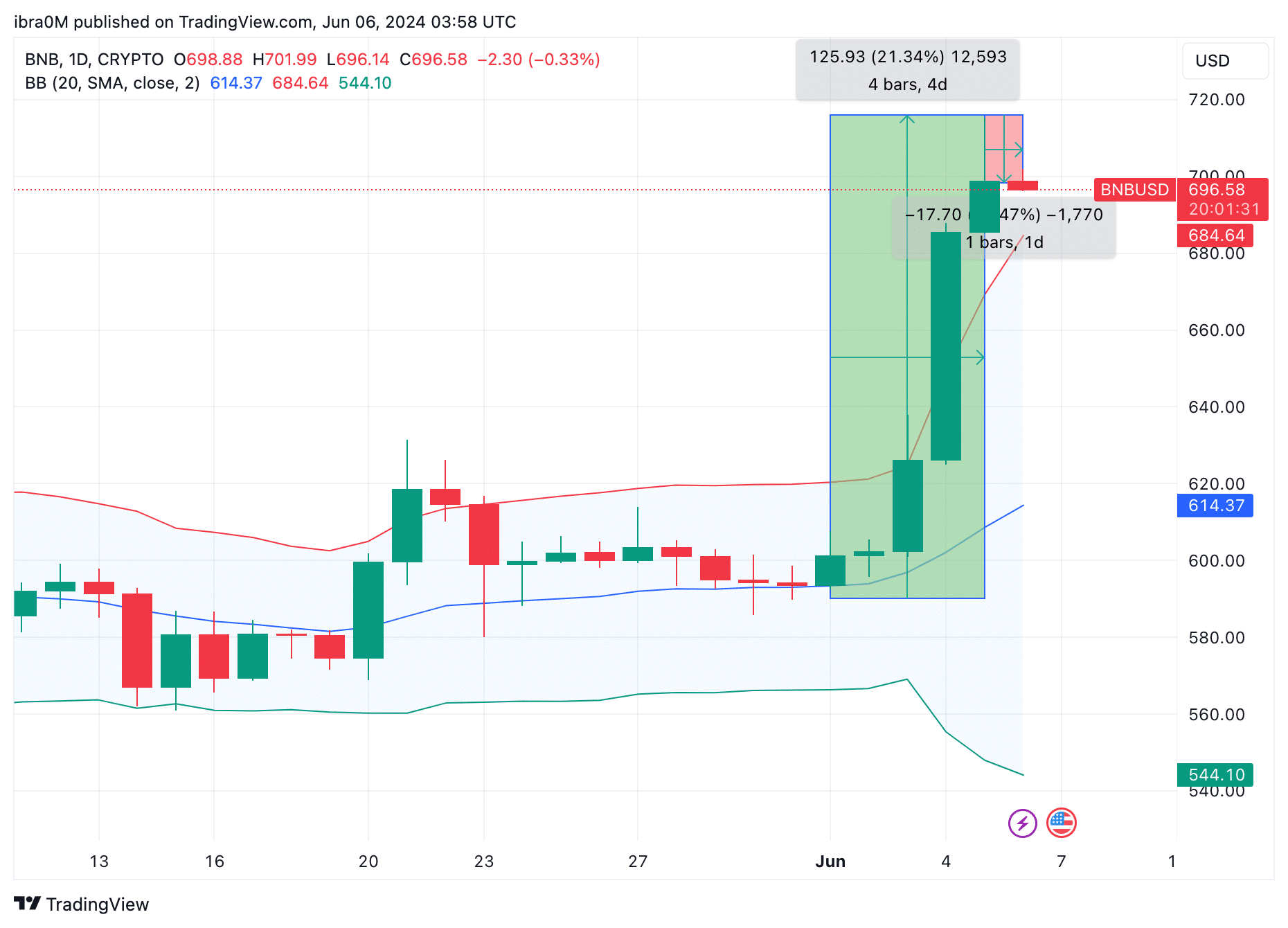

BNB price broke the $700 barrier on Wednesday, June 5, 2024, reaching a new all-time high for the first time since November 2021; As bulls prepare to take profits, BNB appears to be at risk of a major correction phase.

BNB price records all-time high of $715

Binance, the world’s largest cryptocurrency exchange, has been under significant regulatory pressure over the past two years. While battling bans in countries like China, Nigeria, and the Philippines, Binance has also been embroiled in a $4.6 billion settlement lawsuit with US authorities.

Binance has negatively affected its entire ecosystem. Daily trading volumes on the exchange have fallen, allowing Coinbase, BitGet and other competitors to encroach on their market share, while the growth of Binance’s native BNB chain and BNB coin has also slowed.

However, there has been a resurgence of bullish momentum within the Binance ecosystem as the protracted case with the US SEC finally came to fruition.

Former Binance CEO Changpeng Zhao has begun a 4-month prison sentence in California, much more lenient than the 3-year prison sentence requested by prosecutors.

CZ’s conviction effectively marks the end of a long legal battle and, curiously, it has triggered bullish reactions in the BNB markets.

As clearly illustrated above, the price of BNB increased by 21% between June 1 and June 5, reaching an all-time high of $715 on June 5 before retracing 2% towards the $697 area. at the time of writing this report, June 6.

– Advertisement –

This historic achievement means that BNB has now surpassed Solana (SOL) to become only the 4th crypto asset to cross the coveted $100 billion mark, behind Bitcoin, Ethereum and USDT.

Interestingly, this close convergence between BNB’s price rise and Zhao’s prison sentence suggests that the resolution of the case catalyzed a considerable influx of LONG positions into derivatives markets.

The Coinglass Futures Open Interest chart above, which monitors total capital invested in speculative contracts, BNB’s open interest was $594 million as of May 31.

Interestingly, since Zhao’s prison sentence began, speculative traders have significantly increased their capital inflows. By June 5, BNB’s open interest had reached $1.01 billion, a substantial increase of $405 million. Although BNB price increased by 21.28% over five days, open interest surged by 68%.

When there is a faster rise in open interest relative to the uptrend in price, strategic traders often interpret this as an early indication that the market trend is nearing its peak.

This rapid increase in open interest could mean that this week’s BNB price rise was primarily driven by the activities of speculative traders. Therefore, BNB’s open stake of $1.01 billion poses a risk of large liquidations and sharp declines if traders start taking short-term profits.

BNB Price Forecast: Bears Eye $650 Setback

BNB is currently trading at an all-time high of around $700 as of June 6. However, speculative contracts that rose by $400 million indicate that a potential wave of profit-taking could trigger a sharp short-term decline towards the $600 level.

In terms of a near-term support area to watch, the Upper Bollinger Band technical indicator currently marks the $670 price level as a potential trend reversal point.

But if profit-taking triggers widespread LONG liquidations as expected, BNB price could quickly fall back to the 20-day SMA price level at $608.

Conversely, if the bullish momentum continues, bulls could attempt to push the rally towards the $750 level, especially if the upcoming Nonfarm Payrolls report on Friday, June 7, 2024 provides a positive result for assets at risk.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-