Bitcoin

Bitcoin’s low volatility will have THIS effect on BTC prices

- Volatility in the Bitcoin market has decreased significantly.

- AxelAdlerJr, in a new report, found that this has fallen to historic levels.

O Bitcoin [BTC] the market is currently witnessing low volatility, CryptoQuant pseudonymous analyst AxelAdlerJr has discovered in a new report.

AxelAdlerJr evaluated two of BTC’s main volatility markers and found that they have trended downward in recent weeks, suggesting a decline in the possibility of a near-term price swing.

The first metric observed by the analyst was BTC’s Garman-Klass Realized Volatility. This metric measures the historical volatility of the BTC price. It combines the high, low, opening and closing prices of an asset during a specific period to track its volatility during that period.

According to AxelAdlerJr, BTC’s Garman-Klass realized volatility has dropped to 20%. When this metric returns low values, it indicates a decrease in the volatility of the asset’s price.

A historical evaluation of the indicator revealed that when its value fell to this low in the last six years, the price of BTC witnessed significant changes.

Furthermore, the analyst considered the BTC Volatility Index using a 30-day small moving average (SMA). This metric measures the degree of fluctuations in the price of BTC during a specific period.

Similar to the coin’s Garman-Klass realized volatility, BTC’s volatility index has also decreased, confirming the low volatility in the leading coin’s market.

According to the CryptoQuant analyst, the value of the index has fallen to extremely low levels, “which have only been seen four times in the last six years”.

BTC price fluctuations are minimal

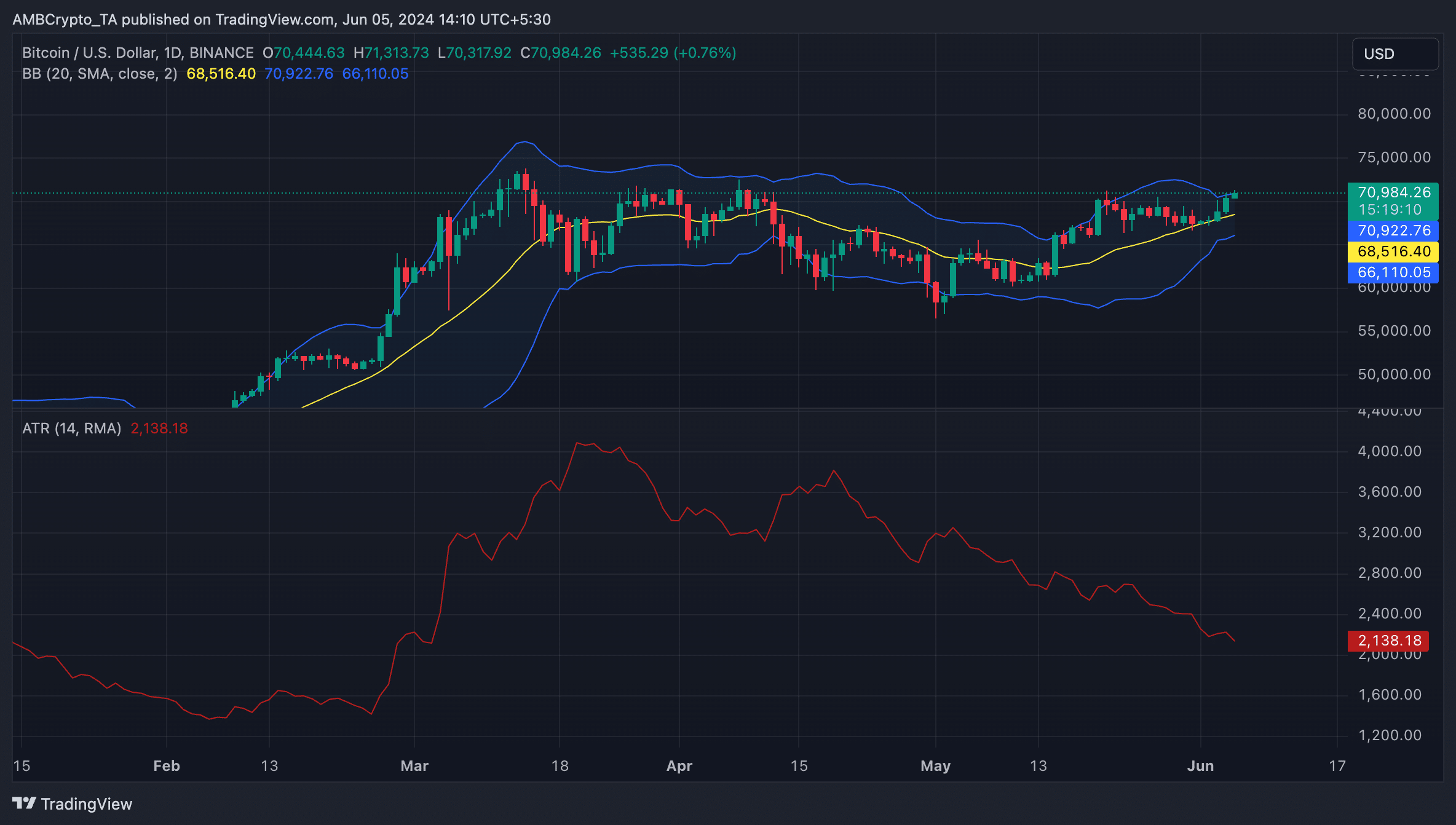

AMBCrypto’s assessment of the coin’s Bollinger Bands and Average True Range confirmed the analyst’s positions.

BTC Bollinger Bands readings showed an ever-shrinking gap between the upper and lower bands of the indicator. This happens during a period of reduced price fluctuations.

The decline in BTC’s Average True Range (ATR) confirmed this trend. This indicator measures market volatility by calculating the average interval between high and low prices over a given number of periods.

To read Bitcoins [BTC] Price prediction 2024-2025

When the indicator falls, it suggests lower market volatility and suggests that the asset’s price is trending within a range. At 2,138.35 at press time, BTC’s ATR is down 44% since April 19.

Source: BTC/USDT on TradingView

According to AxelAdlerJr, the current low volatility in the BTC market is a good sign. “

“Given that the current market structure remains bullish and that the end of the period of low volatility could be followed by a strong price movement, it can be concluded that the market is in the process of forming a new bullish trend,” added the analyst.