Bitcoin

Bitcoin ‘starting to look frighteningly bullish’, $90K not far away: analyst

- Bitcoin’s recovery sparks debate among investors like Tapiero and Novogratz about future prospects.

- Uncertainty persists about Fed cuts and regulations.

After bleeding red for weeks, Bitcoin [BTC] appears to be recovering, as indicated by recent price action. At the time of writing, BTC is trading at $62,150, reflecting a slight increase of 0.39%.

Notably, on May 14, BTC also experienced a brief recovery, surpassing the $63,000 mark before pulling back slightly.

This recent movement in the price of Bitcoin has generated considerable discussion and excitement on social media platforms.

Executives differ on BTC

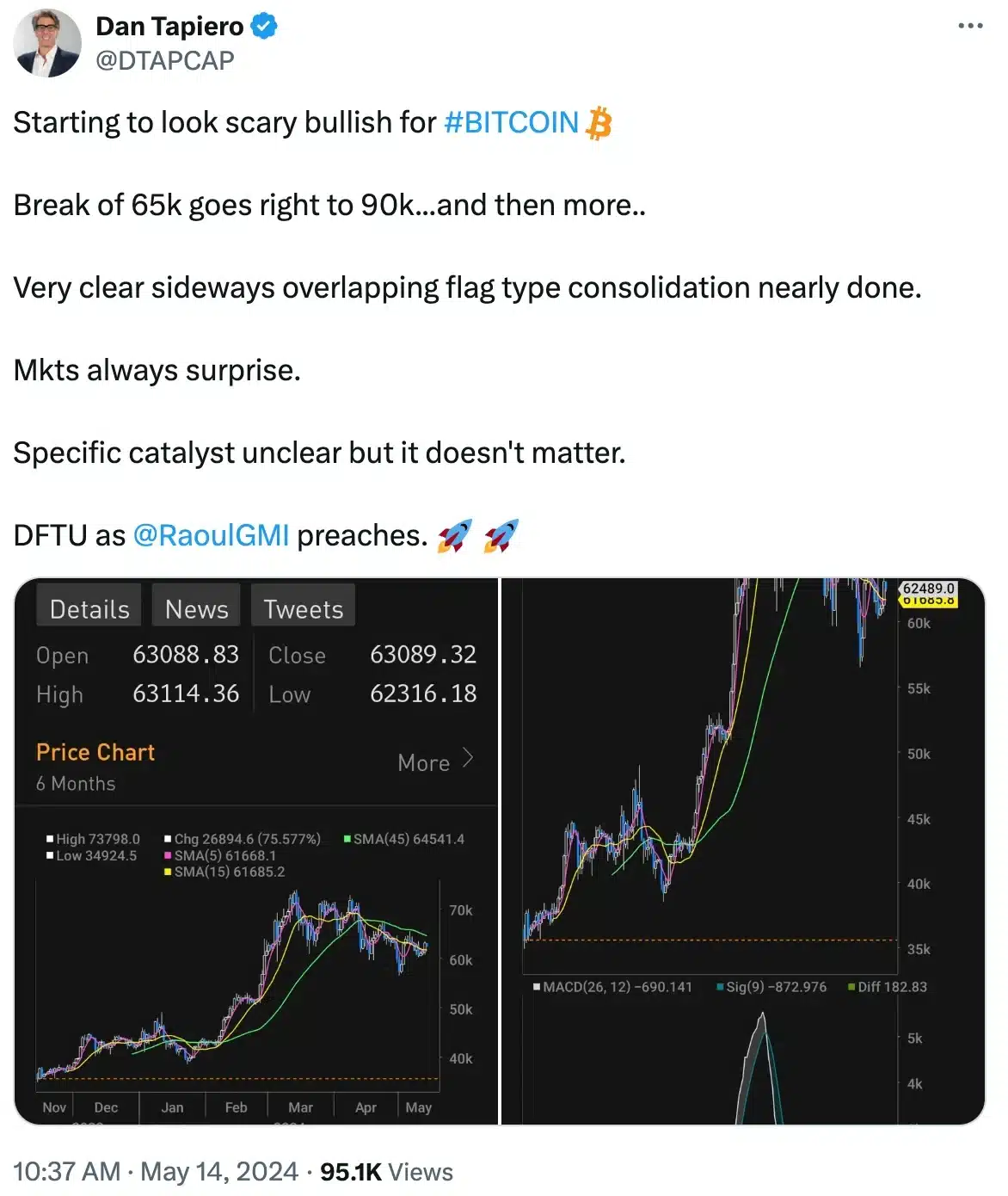

A prominent figure contributing to this discourse is Dan Tapieroa macro investor and fund manager, who believes BTC is about to reach new all-time highs (ATHs).

Taking to X (formerly Twitter), he noted,

Source: Dan Tapiero/X

However, Galaxy Digital Holdings Ltd. founder Michael Novogratz predicts that BTC will likely trade within a tight range this quarter as traditional finance continues to embrace crypto.

According to BloombergNovogratz said,

“We are in the consolidation phase in crypto. Bitcoin, Ethereum and everything else, Solana will consolidate, what does that mean?”

He added,

“That means probably somewhere between $55,000 and $75,000 until the next set of circumstances, the next set of market events takes us higher.”

Additionally, he attributed the previous record of approximately $73,000 to the launch of US spot Bitcoin exchange-traded funds (ETFs) and the Bitcoin halving event.

Looking at the current market trend, he believes the market has stagnated due to reduced optimism about potential rate cuts from the Federal Reserve despite strong economic indicators.

Bitcoin’s dominance is a milestone

Well, that seems a bit false as despite the fluctuations in BTC’s price, its market dominance has consistently remained above 50%.

According to CoinMarketCap data, Bitcoin currently represents approximately 51% of the total cryptocurrency market capitalization.

Source: CoinMarketCap

Consequently, BTC price could break out of this consolidation phase if the Federal Reserve starts cutting rates or if the upcoming elections bring clarity to the crypto regulatory landscape.

What’s next for Bitcoin?

In conclusion, while historical trends provide guidance, they do not guarantee future results. Thus, there is a high probability of market fluctuations and sideways movements in the coming days.

And if we pass Michael Saylor words,

“There are thousands of pension funds in the United States that manage around 27 billion dollars in assets. They’re all going to need some #Bitcoin.”