Bitcoin

Bitcoin Price Will Maintain $65K Support Despite Fed Rate Pause

Bitcoin price fell to $66,865 on Wednesday, June 13, as the US Federal Reserve dashed investor hopes for a rate cut in the first half of 2024; On-chain data trends explain how BTC managed to remain above the critical $65,000 support level.

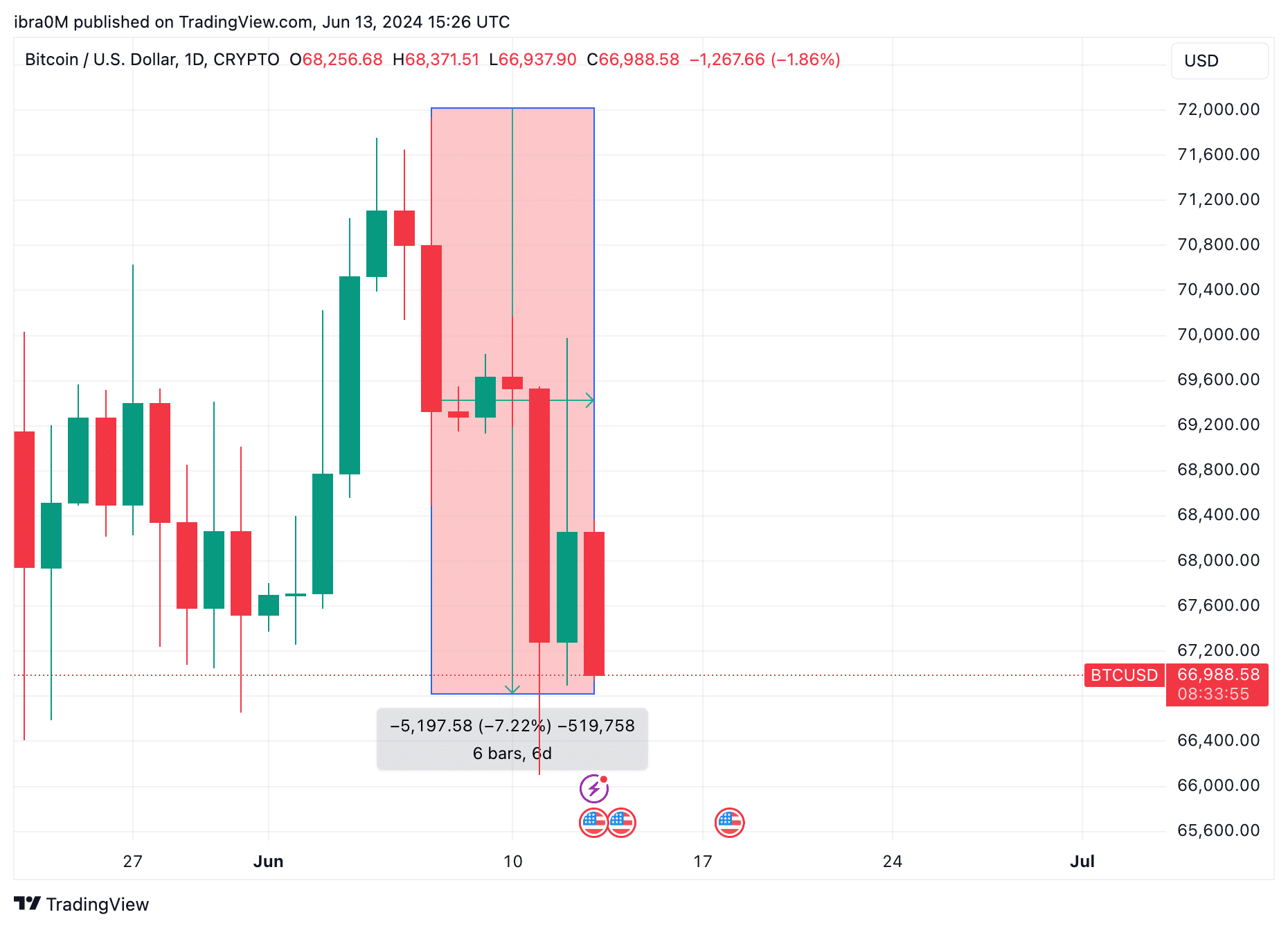

Bitcoin Price Drops 7% After US Fed Rate Pause Decision

The crypto market has further entered its ongoing consolidation phase as bulls failed to capitalize on the positive start to June 2024 amid aggressive shifts in US macroeconomic indices.

Despite the slowdown Inflation measured by CPI Signaling an imminent soft economic landing, the US Federal Reserve chose to keep interest rates at elevated levels following the last FOMC meeting on June 12.

As expected, risk asset markets, including the cryptocurrency sector, reacted negatively to the Fed’s rate pause decision.

As seen above, the price of Bitcoin quickly fell to a daily low of $66,896 after the US Fed’s rate decision hit the news on Wednesday, June 12. This marks a 7.22% decline in BTC prices over the 7-day period.

But what’s interesting is that despite short-term negative market sentiment, Bitcoin bulls managed to avoid a reversal below the critical psychological resistance of $65,000.

Long-term investors don’t want to sell Bitcoin

After nearly a week of increasing market volatility, Bitcoin sellers are now showing early signs of fatigue. If it persists, this movement could trigger a slight recovery phase in the BTC price in the coming weeks.

The Santiment Consumed Age chart below monitors the level of selling pressure among long-term investors. Essentially, it is derived by multiplying the number of BTC coins traded on a given day by the number of days since they have been stationary.

Whenever several long-term BTC investors are in liquidation mode, a significant increase appears on the Age Consumed chart and vice versa.

The Bitcoin Era only consumed a monthly spike of 45.35 million on June 11 as traders went into a rapid selling frenzy following the US Federal Reserve’s latest rate pause decision.

But looking closely at the snapshot above, BTC Age Consumed’s latest peak is 91% lower than last month’s peak seen on May 28. This indicates that most long-term Bitcoin investors are not willing to undertake another large-scale sell-off. within the current market dynamics.

In combination with rising Bitcoin ETF flows, this decline in selling trends among long-term holders largely explains why BTC price avoided a reversal below $65,000, consolidating above the trading territory. $68,000 on Thursday, June 13th.

Bitcoin Price Prediction: $65,600 Support for Ransom

Drawing conclusions from the above on-chain data analysis, Bitcoin price looks set to consolidate above the $65,000 level despite the current negative market sentiment. IntoTheBlock’s IOMAP data further confirms this bullish Bitcoin price prediction.

As can be seen below, there is a large cluster of 1 million addresses, which purchased 573,740 BTC at the average price of $65,591.

To avoid falling into a net loss position, most of these holders could opt to make hedging purchases if the BTC price falls close to $65,600 in the near term, thus triggering a recovery.

Likewise, in the event of another bullish price breakout, the Bitcoin bull will face daunting resistance in the $69,000 territory.

Indeed, without any outlier catalysts, the price of BTC now appears likely to consolidate within the $66,000-$70,000 channel as the week comes to a close.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinion of The Crypto Basic. Readers are encouraged to do thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Announcement-