Bitcoin

Bitcoin (BTC) Price Prediction 2024 2025 2026 2027

Bitcoin Overview

- Our real-time BTC to USD price update shows the current Bitcoin price as $64,931 USD.

- Our most recent Bitcoin price forecast indicates that its value will increase by 14.21% and reach $74,156 by June 20, 2024.

- Our technical indicators signal about the Bearish Bullish 39% market sentiment on Bitcoin, while the Fear & Greed Index is displaying a score of 74 (Greed).

- Over the last 30 days, Bitcoin has had 15/30 (50%) green days and 1.99% price volatility.

Bitcoin (BTC) Technical Overview

When discussing future trading opportunities of digital assets, it is essential to pay attention to market sentiments.

Bitcoin Profit Calculator

Profit calculation please wait…

Bitcoin (BTC) Price Prediction For Today, Tomorrow and Next 30 Days

| June 19, 2024 | $66,364 | 2.21% |

| June 20, 2024 | $70,392 | 8.41% |

| June 21, 2024 | $74,156 | 14.21% |

| June 22, 2024 | $74,697 | 15.04% |

| June 23, 2024 | $75,281 | 15.94% |

| June 24, 2024 | $76,109 | 17.22% |

| June 25, 2024 | $76,894 | 18.42% |

| June 26, 2024 | $77,532 | 19.41% |

| June 27, 2024 | $78,163 | 20.38% |

| June 28, 2024 | $78,778 | 21.33% |

| June 29, 2024 | $79,121 | 21.85% |

| June 30, 2024 | $79,020 | 21.7% |

| July 01, 2024 | $78,274 | 20.55% |

| July 02, 2024 | $76,760 | 18.22% |

| July 03, 2024 | $75,729 | 16.63% |

| July 04, 2024 | $75,127 | 15.7% |

| July 05, 2024 | $75,117 | 15.69% |

| July 06, 2024 | $75,488 | 16.26% |

| July 07, 2024 | $78,305 | 20.6% |

| July 08, 2024 | $82,259 | 26.69% |

| July 09, 2024 | $84,327 | 29.87% |

| July 10, 2024 | $85,796 | 32.13% |

| July 11, 2024 | $86,176 | 32.72% |

| July 12, 2024 | $86,342 | 32.98% |

| July 13, 2024 | $86,022 | 32.48% |

| July 14, 2024 | $85,656 | 31.92% |

| July 15, 2024 | $85,539 | 31.74% |

| July 16, 2024 | $85,457 | 31.61% |

| July 17, 2024 | $85,840 | 32.2% |

| July 18, 2024 | $86,179 | 32.72% |

Bitcoin Prediction Table

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2040

2050

| June | $66,364 | $72,742.50 | $79,121 | |

| July | $71,968.93 | $79,155.47 | $86,342 | |

| August | $62,879.90 | $66,918.61 | $70,957.31 | |

| September | $62,640.71 | $65,988.98 | $69,337.25 | |

| October | $59,939.33 | $74,472.02 | $89,004.71 | |

| November | $82,667.91 | $85,996.41 | $89,324.91 | |

| December | $50,216.66 | $68,290.26 | $86,363.86 | |

| January | $48,920.75 | $60,255.63 | $71,590.51 | |

| February | $53,600.62 | $56,106.70 | $58,612.77 | |

| All Time | $62,133.20 | $69,991.84 | $77,850.48 |

| January | $55,928.19 | $92,063.25 | $75,797.06 | |

| February | $61,639.72 | $94,801.59 | $81,823.33 | |

| March | $67,351.25 | $97,539.93 | $87,849.59 | |

| April | $73,062.77 | $100,278.27 | $93,875.86 | |

| May | $78,774.30 | $103,016.61 | $99,902.13 | |

| June | $84,485.83 | $105,754.96 | $105,928.40 | |

| July | $90,197.36 | $108,493.30 | $111,954.66 | |

| August | $95,908.89 | $111,231.64 | $117,980.93 | |

| September | $101,620.42 | $113,969.98 | $124,007.20 | |

| October | $107,331.94 | $116,708.32 | $130,033.47 | |

| November | $113,043.47 | $119,446.66 | $136,059.73 | |

| December | $118,755 | $122,185 | $142,086 | |

| All Time | $87,341.59 | $107,124.13 | $108,941.53 |

| January | $123,390.08 | $126,941.42 | $147,152.17 | |

| February | $128,025.17 | $131,697.83 | $152,218.33 | |

| March | $132,660.25 | $136,454.25 | $157,284.50 | |

| April | $137,295.33 | $141,210.67 | $162,350.67 | |

| May | $141,930.42 | $145,967.08 | $167,416.83 | |

| June | $146,565.50 | $150,723.50 | $172,483 | |

| July | $151,200.58 | $155,479.92 | $177,549.17 | |

| August | $155,835.67 | $160,236.33 | $182,615.33 | |

| September | $160,470.75 | $164,992.75 | $187,681.50 | |

| October | $165,105.83 | $169,749.17 | $192,747.67 | |

| November | $169,740.92 | $174,505.58 | $197,813.83 | |

| December | $174,376 | $179,262 | $202,880 | |

| All Time | $148,883.04 | $153,101.71 | $175,016.08 |

| January | $180,535.92 | $185,612.25 | $210,877.50 | |

| February | $186,695.83 | $191,962.50 | $218,875 | |

| March | $192,855.75 | $198,312.75 | $226,872.50 | |

| April | $199,015.67 | $204,663 | $234,870 | |

| May | $205,175.58 | $211,013.25 | $242,867.50 | |

| June | $211,335.50 | $217,363.50 | $250,865 | |

| July | $217,495.42 | $223,713.75 | $258,862.50 | |

| August | $223,655.33 | $230,064 | $266,860 | |

| September | $229,815.25 | $236,414.25 | $274,857.50 | |

| October | $235,975.17 | $242,764.50 | $282,855 | |

| November | $242,135.08 | $249,114.75 | $290,852.50 | |

| December | $248,295 | $255,465 | $298,850 | |

| All Time | $214,415.46 | $220,538.63 | $254,863.75 |

| January | $257,688.50 | $265,112.50 | $309,834.50 | |

| February | $267,082 | $274,760 | $320,819 | |

| March | $276,475.50 | $284,407.50 | $331,803.50 | |

| April | $285,869 | $294,055 | $342,788 | |

| May | $295,262.50 | $303,702.50 | $353,772.50 | |

| June | $304,656 | $313,350 | $364,757 | |

| July | $314,049.50 | $322,997.50 | $375,741.50 | |

| August | $323,443 | $332,645 | $386,726 | |

| September | $332,836.50 | $342,292.50 | $397,710.50 | |

| October | $342,230 | $351,940 | $408,695 | |

| November | $351,623.50 | $361,587.50 | $419,679.50 | |

| December | $361,017 | $371,235 | $430,664 | |

| All Time | $309,352.75 | $318,173.75 | $370,249.25 |

| January | $375,527.67 | $386,131.67 | $446,985.83 | |

| February | $390,038.33 | $401,028.33 | $463,307.67 | |

| March | $404,549 | $415,925 | $479,629.50 | |

| April | $419,059.67 | $430,821.67 | $495,951.33 | |

| May | $433,570.33 | $445,718.33 | $512,273.17 | |

| June | $448,081 | $460,615 | $528,595 | |

| July | $462,591.67 | $475,511.67 | $544,916.83 | |

| August | $477,102.33 | $490,408.33 | $561,238.67 | |

| September | $491,613 | $505,305 | $577,560.50 | |

| October | $506,123.67 | $520,201.67 | $593,882.33 | |

| November | $520,634.33 | $535,098.33 | $610,204.17 | |

| December | $535,145 | $549,995 | $626,526 | |

| All Time | $455,336.33 | $468,063.33 | $536,755.92 |

| January | $553,392.08 | $568,837.83 | $650,326.08 | |

| February | $571,639.17 | $587,680.67 | $674,126.17 | |

| March | $589,886.25 | $606,523.50 | $697,926.25 | |

| April | $608,133.33 | $625,366.33 | $721,726.33 | |

| May | $626,380.42 | $644,209.17 | $745,526.42 | |

| June | $644,627.50 | $663,052 | $769,326.50 | |

| July | $662,874.58 | $681,894.83 | $793,126.58 | |

| August | $681,121.67 | $700,737.67 | $816,926.67 | |

| September | $699,368.75 | $719,580.50 | $840,726.75 | |

| October | $717,615.83 | $738,423.33 | $864,526.83 | |

| November | $735,862.92 | $757,266.17 | $888,326.92 | |

| December | $754,110 | $776,109 | $912,127 | |

| All Time | $653,751.04 | $672,473.42 | $781,226.54 |

| January | $782,638.92 | $805,391.75 | $946,457.17 | |

| February | $811,167.83 | $834,674.50 | $980,787.33 | |

| March | $839,696.75 | $863,957.25 | $1,015,117.50 | |

| April | $868,225.67 | $893,240 | $1,049,447.67 | |

| May | $896,754.58 | $922,522.75 | $1,083,777.83 | |

| June | $925,283.50 | $951,805.50 | $1,118,108 | |

| July | $953,812.42 | $981,088.25 | $1,152,438.17 | |

| August | $982,341.33 | $1,010,371 | $1,186,768.33 | |

| September | $1,010,870.25 | $1,039,653.75 | $1,221,098.50 | |

| October | $1,039,399.17 | $1,068,936.50 | $1,255,428.67 | |

| November | $1,067,928.08 | $1,098,219.25 | $1,289,758.83 | |

| December | $1,096,457 | $1,127,502 | $1,324,089 | |

| All Time | $939,547.96 | $966,446.88 | $1,135,273.08 |

| January | $1,136,539.42 | $1,168,755.75 | $1,372,594 | |

| February | $1,176,621.83 | $1,210,009.50 | $1,421,099 | |

| March | $1,216,704.25 | $1,251,263.25 | $1,469,604 | |

| April | $1,256,786.67 | $1,292,517 | $1,518,109 | |

| May | $1,296,869.08 | $1,333,770.75 | $1,566,614 | |

| June | $1,336,951.50 | $1,375,024.50 | $1,615,119 | |

| July | $1,377,033.92 | $1,416,278.25 | $1,663,624 | |

| August | $1,417,116.33 | $1,457,532 | $1,712,129 | |

| September | $1,457,198.75 | $1,498,785.75 | $1,760,634 | |

| October | $1,497,281.17 | $1,540,039.50 | $1,809,139 | |

| November | $1,537,363.58 | $1,581,293.25 | $1,857,644 | |

| December | $1,577,446 | $1,622,547 | $1,906,149 | |

| All Time | $1,356,992.71 | $1,395,651.38 | $1,639,371.50 |

| January | $1,647,464.92 | $1,695,568.17 | $1,979,564.58 | |

| February | $1,717,483.83 | $1,768,589.33 | $2,052,980.17 | |

| March | $1,787,502.75 | $1,841,610.50 | $2,126,395.75 | |

| April | $1,857,521.67 | $1,914,631.67 | $2,199,811.33 | |

| May | $1,927,540.58 | $1,987,652.83 | $2,273,226.92 | |

| June | $1,997,559.50 | $2,060,674 | $2,346,642.50 | |

| July | $2,067,578.42 | $2,133,695.17 | $2,420,058.08 | |

| August | $2,137,597.33 | $2,206,716.33 | $2,493,473.67 | |

| September | $2,207,616.25 | $2,279,737.50 | $2,566,889.25 | |

| October | $2,277,635.17 | $2,352,758.67 | $2,640,304.83 | |

| November | $2,347,654.08 | $2,425,779.83 | $2,713,720.42 | |

| December | $2,417,673 | $2,498,801 | $2,787,136 | |

| All Time | $2,032,568.96 | $2,097,184.58 | $2,383,350.29 |

| January | $2,530,632.67 | $2,615,411.67 | $2,898,459.83 | |

| February | $2,643,592.33 | $2,732,022.33 | $3,009,783.67 | |

| March | $2,756,552 | $2,848,633 | $3,121,107.50 | |

| April | $2,869,511.67 | $2,965,243.67 | $3,232,431.33 | |

| May | $2,982,471.33 | $3,081,854.33 | $3,343,755.17 | |

| June | $3,095,431 | $3,198,465 | $3,455,079 | |

| July | $3,208,390.67 | $3,315,075.67 | $3,566,402.83 | |

| August | $3,321,350.33 | $3,431,686.33 | $3,677,726.67 | |

| September | $3,434,310 | $3,548,297 | $3,789,050.50 | |

| October | $3,547,269.67 | $3,664,907.67 | $3,900,374.33 | |

| November | $3,660,229.33 | $3,781,518.33 | $4,011,698.17 | |

| December | $3,773,189 | $3,898,129 | $4,123,022 | |

| All Time | $3,151,910.83 | $3,256,770.33 | $3,510,740.92 |

| January | $3,864,811.75 | $3,991,834.08 | $4,214,644.67 | |

| February | $3,956,434.50 | $4,085,539.17 | $4,306,267.33 | |

| March | $4,048,057.25 | $4,179,244.25 | $4,397,890 | |

| April | $4,139,680 | $4,272,949.33 | $4,489,512.67 | |

| May | $4,231,302.75 | $4,366,654.42 | $4,581,135.33 | |

| June | $4,322,925.50 | $4,460,359.50 | $4,672,758 | |

| July | $4,414,548.25 | $4,554,064.58 | $4,764,380.67 | |

| August | $4,506,171 | $4,647,769.67 | $4,856,003.33 | |

| September | $4,597,793.75 | $4,741,474.75 | $4,947,626 | |

| October | $4,689,416.50 | $4,835,179.83 | $5,039,248.67 | |

| November | $4,781,039.25 | $4,928,884.92 | $5,130,871.33 | |

| December | $4,872,662 | $5,022,590 | $5,222,494 | |

| All Time | $4,368,736.88 | $4,507,212.04 | $4,718,569.33 |

Choose a year

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2040

2050

Bitcoin Historical

According to the latest data gathered, the current price of Bitcoin is $$69,824.68, and BTC is presently ranked No. 1 in the entire crypto ecosystem. The circulation supply of Bitcoin is $1,375,660,239,109.04, with a market cap of 19,701,634 BTC.

In the past 24 hours, the crypto has increased by $1,277.79 in its current value.

For the last 7 days, BTC has been in a good upward trend, thus increasing by 12.82%. Bitcoin has shown very strong potential lately, and this could be a good opportunity to dig right in and invest.

During the last month, the price of BTC has increased by 5.49%, adding a colossal average amount of $3,833.37 to its current value. This sudden growth means that the coin can become a solid asset now if it continues to grow.

Bitcoin Price Prediction 2024

According to the technical analysis of Bitcoin prices expected in 2024, the minimum cost of Bitcoin will be $50,216.66. The maximum level that the BTC price can reach is $69,770.79. The average trading price is expected around $89,324.91.

BTC Price Forecast for June 2024

Based on the price fluctuations of Bitcoin at the beginning of 2024, crypto experts expect the average BTC rate of $72,742.50 in June 2024. Its minimum and maximum prices can be expected at $66,364 and at $79,121, respectively.

July 2024: Bitcoin Price Forecast

Cryptocurrency experts are ready to announce their forecast for the BTC price in July 2024. The minimum trading cost might be $71,968.93, while the maximum might reach $86,342 during this month. On average, it is expected that the value of Bitcoin might be around $79,155.47.

BTC Price Forecast for August 2024

Crypto analysts have checked the price fluctuations of Bitcoin in 2024 and in previous years, so the average BTC rate they predict might be around $66,918.61 in August 2024. It can drop to $62,879.90 as a minimum. The maximum value might be $70,957.31.

September 2024: Bitcoin Price Forecast

In the middle of the year 2023, the BTC price will be traded at $65,988.98 on average. September 2024 might also witness an increase in the Bitcoin value to $69,337.25. It is assumed that the price will not drop lower than $62,640.71 in September 2024.

BTC Price Forecast for October 2024

Crypto experts have analyzed Bitcoin prices in 2024, so they are ready to provide their estimated trading average for October 2024 — $74,472.02. The lowest and peak BTC rates might be $59,939.33 and $89,004.71.

November 2024: Bitcoin Price Forecast

Crypto analysts expect that at the end of summer 2024, the BTC price will be around $85,996.41. In November 2024, the Bitcoin cost may drop to a minimum of $82,667.91. The expected peak value might be $89,324.91 in November 2024.

BTC Price Forecast for December 2024

Having analyzed Bitcoin prices, cryptocurrency experts expect that the BTC rate might reach a maximum of $86,363.86 in December 2024. It might, however, drop to $50,216.66. For December 2024, the forecasted average of Bitcoin is nearly $68,290.26.

January 2025: Bitcoin Price Forecast

In the middle of autumn 2024, the Bitcoin cost will be traded at the average level of $60,255.63. Crypto analysts expect that in January 2025, the BTC price might fluctuate between $48,920.75 and $71,590.51.

BTC Price Forecast for February 2025

Market experts expect that in February 2025, the Bitcoin value will not drop below a minimum of $53,600.62. The maximum peak expected this month is $58,612.77. The estimated average trading value will be at the level of $56,106.70.

Bitcoin Price Prediction 2025

After the analysis of the prices of Bitcoin in previous years, it is assumed that in 2025, the minimum price of Bitcoin will be around $118,755. The maximum expected BTC price may be around $142,086. On average, the trading price might be $122,185 in 2025.

| January 2025 | $55,928.19 | $92,063.25 | $75,797.06 |

| February 2025 | $61,639.72 | $94,801.59 | $81,823.33 |

| March 2025 | $67,351.25 | $97,539.93 | $87,849.59 |

| April 2025 | $73,062.77 | $100,278.27 | $93,875.86 |

| May 2025 | $78,774.30 | $103,016.61 | $99,902.13 |

| June 2025 | $84,485.83 | $105,754.96 | $105,928.40 |

| July 2025 | $90,197.36 | $108,493.30 | $111,954.66 |

| August 2025 | $95,908.89 | $111,231.64 | $117,980.93 |

| September 2025 | $101,620.42 | $113,969.98 | $124,007.20 |

| October 2025 | $107,331.94 | $116,708.32 | $130,033.47 |

| November 2025 | $113,043.47 | $119,446.66 | $136,059.73 |

| December 2025 | $118,755 | $122,185 | $142,086 |

Bitcoin Price Prediction 2026

Based on the technical analysis by cryptocurrency experts regarding the prices of Bitcoin, in 2026, BTC is expected to have the following minimum and maximum prices: about $174,376 and $202,880, respectively. The average expected trading cost is $179,262.

| January 2026 | $123,390.08 | $126,941.42 | $147,152.17 |

| February 2026 | $128,025.17 | $131,697.83 | $152,218.33 |

| March 2026 | $132,660.25 | $136,454.25 | $157,284.50 |

| April 2026 | $137,295.33 | $141,210.67 | $162,350.67 |

| May 2026 | $141,930.42 | $145,967.08 | $167,416.83 |

| June 2026 | $146,565.50 | $150,723.50 | $172,483 |

| July 2026 | $151,200.58 | $155,479.92 | $177,549.17 |

| August 2026 | $155,835.67 | $160,236.33 | $182,615.33 |

| September 2026 | $160,470.75 | $164,992.75 | $187,681.50 |

| October 2026 | $165,105.83 | $169,749.17 | $192,747.67 |

| November 2026 | $169,740.92 | $174,505.58 | $197,813.83 |

| December 2026 | $174,376 | $179,262 | $202,880 |

Bitcoin Price Prediction 2027

The experts in the field of cryptocurrency have analyzed the prices of Bitcoin and their fluctuations during the previous years. It is assumed that in 2027, the minimum BTC price might drop to $248,295, while its maximum can reach $298,850. On average, the trading cost will be around $255,465.

| January 2027 | $180,535.92 | $185,612.25 | $210,877.50 |

| February 2027 | $186,695.83 | $191,962.50 | $218,875 |

| March 2027 | $192,855.75 | $198,312.75 | $226,872.50 |

| April 2027 | $199,015.67 | $204,663 | $234,870 |

| May 2027 | $205,175.58 | $211,013.25 | $242,867.50 |

| June 2027 | $211,335.50 | $217,363.50 | $250,865 |

| July 2027 | $217,495.42 | $223,713.75 | $258,862.50 |

| August 2027 | $223,655.33 | $230,064 | $266,860 |

| September 2027 | $229,815.25 | $236,414.25 | $274,857.50 |

| October 2027 | $235,975.17 | $242,764.50 | $282,855 |

| November 2027 | $242,135.08 | $249,114.75 | $290,852.50 |

| December 2027 | $248,295 | $255,465 | $298,850 |

Bitcoin Price Prediction 2028

Based on the analysis of the costs of Bitcoin by crypto experts, the following maximum and minimum BTC prices are expected in 2028: $430,664 and $361,017. On average, it will be traded at $371,235.

| January 2028 | $257,688.50 | $265,112.50 | $309,834.50 |

| February 2028 | $267,082 | $274,760 | $320,819 |

| March 2028 | $276,475.50 | $284,407.50 | $331,803.50 |

| April 2028 | $285,869 | $294,055 | $342,788 |

| May 2028 | $295,262.50 | $303,702.50 | $353,772.50 |

| June 2028 | $304,656 | $313,350 | $364,757 |

| July 2028 | $314,049.50 | $322,997.50 | $375,741.50 |

| August 2028 | $323,443 | $332,645 | $386,726 |

| September 2028 | $332,836.50 | $342,292.50 | $397,710.50 |

| October 2028 | $342,230 | $351,940 | $408,695 |

| November 2028 | $351,623.50 | $361,587.50 | $419,679.50 |

| December 2028 | $361,017 | $371,235 | $430,664 |

Bitcoin Price Prediction 2029

Crypto experts are constantly analyzing the fluctuations of Bitcoin. Based on their predictions, the estimated average BTC price will be around $549,995. It might drop to a minimum of $535,145, but it still might reach $626,526 throughout 2029.

| January 2029 | $375,527.67 | $386,131.67 | $446,985.83 |

| February 2029 | $390,038.33 | $401,028.33 | $463,307.67 |

| March 2029 | $404,549 | $415,925 | $479,629.50 |

| April 2029 | $419,059.67 | $430,821.67 | $495,951.33 |

| May 2029 | $433,570.33 | $445,718.33 | $512,273.17 |

| June 2029 | $448,081 | $460,615 | $528,595 |

| July 2029 | $462,591.67 | $475,511.67 | $544,916.83 |

| August 2029 | $477,102.33 | $490,408.33 | $561,238.67 |

| September 2029 | $491,613 | $505,305 | $577,560.50 |

| October 2029 | $506,123.67 | $520,201.67 | $593,882.33 |

| November 2029 | $520,634.33 | $535,098.33 | $610,204.17 |

| December 2029 | $535,145 | $549,995 | $626,526 |

Bitcoin Price Prediction 2030

Every year, cryptocurrency experts prepare forecasts for the price of Bitcoin. It is estimated that BTC will be traded between $754,110 and $912,127 in 2030. Its average cost is expected at around $776,109 during the year.

| January 2030 | $553,392.08 | $568,837.83 | $650,326.08 |

| February 2030 | $571,639.17 | $587,680.67 | $674,126.17 |

| March 2030 | $589,886.25 | $606,523.50 | $697,926.25 |

| April 2030 | $608,133.33 | $625,366.33 | $721,726.33 |

| May 2030 | $626,380.42 | $644,209.17 | $745,526.42 |

| June 2030 | $644,627.50 | $663,052 | $769,326.50 |

| July 2030 | $662,874.58 | $681,894.83 | $793,126.58 |

| August 2030 | $681,121.67 | $700,737.67 | $816,926.67 |

| September 2030 | $699,368.75 | $719,580.50 | $840,726.75 |

| October 2030 | $717,615.83 | $738,423.33 | $864,526.83 |

| November 2030 | $735,862.92 | $757,266.17 | $888,326.92 |

| December 2030 | $754,110 | $776,109 | $912,127 |

Bitcoin Price Prediction 2031

Cryptocurrency analysts are ready to announce their estimations of the Bitcoin’s price. The year 2031 will be determined by the maximum BTC price of $1,324,089. However, its rate might drop to around $1,096,457. So, the expected average trading price is $1,127,502.

| January 2031 | $782,638.92 | $805,391.75 | $946,457.17 |

| February 2031 | $811,167.83 | $834,674.50 | $980,787.33 |

| March 2031 | $839,696.75 | $863,957.25 | $1,015,117.50 |

| April 2031 | $868,225.67 | $893,240 | $1,049,447.67 |

| May 2031 | $896,754.58 | $922,522.75 | $1,083,777.83 |

| June 2031 | $925,283.50 | $951,805.50 | $1,118,108 |

| July 2031 | $953,812.42 | $981,088.25 | $1,152,438.17 |

| August 2031 | $982,341.33 | $1,010,371 | $1,186,768.33 |

| September 2031 | $1,010,870.25 | $1,039,653.75 | $1,221,098.50 |

| October 2031 | $1,039,399.17 | $1,068,936.50 | $1,255,428.67 |

| November 2031 | $1,067,928.08 | $1,098,219.25 | $1,289,758.83 |

| December 2031 | $1,096,457 | $1,127,502 | $1,324,089 |

Bitcoin Price Prediction 2032

After years of analysis of the Bitcoin price, crypto experts are ready to provide their BTC cost estimation for 2032. It will be traded for at least $1,577,446, with the possible maximum peaks at $1,906,149. Therefore, on average, you can expect the BTC price to be around $1,622,547 in 2032.

| January 2032 | $1,136,539.42 | $1,168,755.75 | $1,372,594 |

| February 2032 | $1,176,621.83 | $1,210,009.50 | $1,421,099 |

| March 2032 | $1,216,704.25 | $1,251,263.25 | $1,469,604 |

| April 2032 | $1,256,786.67 | $1,292,517 | $1,518,109 |

| May 2032 | $1,296,869.08 | $1,333,770.75 | $1,566,614 |

| June 2032 | $1,336,951.50 | $1,375,024.50 | $1,615,119 |

| July 2032 | $1,377,033.92 | $1,416,278.25 | $1,663,624 |

| August 2032 | $1,417,116.33 | $1,457,532 | $1,712,129 |

| September 2032 | $1,457,198.75 | $1,498,785.75 | $1,760,634 |

| October 2032 | $1,497,281.17 | $1,540,039.50 | $1,809,139 |

| November 2032 | $1,537,363.58 | $1,581,293.25 | $1,857,644 |

| December 2032 | $1,577,446 | $1,622,547 | $1,906,149 |

Bitcoin Price Prediction 2033

Cryptocurrency analysts are ready to announce their estimations of the Bitcoin’s price. The year 2033 will be determined by the maximum BTC price of $2,787,136. However, its rate might drop to around $2,417,673. So, the expected average trading price is $2,498,801.

| January 2033 | $1,647,464.92 | $1,695,568.17 | $1,979,564.58 |

| February 2033 | $1,717,483.83 | $1,768,589.33 | $2,052,980.17 |

| March 2033 | $1,787,502.75 | $1,841,610.50 | $2,126,395.75 |

| April 2033 | $1,857,521.67 | $1,914,631.67 | $2,199,811.33 |

| May 2033 | $1,927,540.58 | $1,987,652.83 | $2,273,226.92 |

| June 2033 | $1,997,559.50 | $2,060,674 | $2,346,642.50 |

| July 2033 | $2,067,578.42 | $2,133,695.17 | $2,420,058.08 |

| August 2033 | $2,137,597.33 | $2,206,716.33 | $2,493,473.67 |

| September 2033 | $2,207,616.25 | $2,279,737.50 | $2,566,889.25 |

| October 2033 | $2,277,635.17 | $2,352,758.67 | $2,640,304.83 |

| November 2033 | $2,347,654.08 | $2,425,779.83 | $2,713,720.42 |

| December 2033 | $2,417,673 | $2,498,801 | $2,787,136 |

Bitcoin Price Prediction 2040

According to the technical analysis of Bitcoin prices expected in 2040, the minimum cost of Bitcoin will be $3,773,189. The maximum level that the BTC price can reach is $4,123,022. The average trading price is expected around $3,898,129.

| January 2040 | $2,530,632.67 | $2,615,411.67 | $2,898,459.83 |

| February 2040 | $2,643,592.33 | $2,732,022.33 | $3,009,783.67 |

| March 2040 | $2,756,552 | $2,848,633 | $3,121,107.50 |

| April 2040 | $2,869,511.67 | $2,965,243.67 | $3,232,431.33 |

| May 2040 | $2,982,471.33 | $3,081,854.33 | $3,343,755.17 |

| June 2040 | $3,095,431 | $3,198,465 | $3,455,079 |

| July 2040 | $3,208,390.67 | $3,315,075.67 | $3,566,402.83 |

| August 2040 | $3,321,350.33 | $3,431,686.33 | $3,677,726.67 |

| September 2040 | $3,434,310 | $3,548,297 | $3,789,050.50 |

| October 2040 | $3,547,269.67 | $3,664,907.67 | $3,900,374.33 |

| November 2040 | $3,660,229.33 | $3,781,518.33 | $4,011,698.17 |

| December 2040 | $3,773,189 | $3,898,129 | $4,123,022 |

Bitcoin Price Prediction 2050

After the analysis of the prices of Bitcoin in previous years, it is assumed that in 2050, the minimum price of Bitcoin will be around $4,872,662. The maximum expected BTC price may be around $5,222,494. On average, the trading price might be $5,022,590 in 2050.

| January 2050 | $3,864,811.75 | $3,991,834.08 | $4,214,644.67 |

| February 2050 | $3,956,434.50 | $4,085,539.17 | $4,306,267.33 |

| March 2050 | $4,048,057.25 | $4,179,244.25 | $4,397,890 |

| April 2050 | $4,139,680 | $4,272,949.33 | $4,489,512.67 |

| May 2050 | $4,231,302.75 | $4,366,654.42 | $4,581,135.33 |

| June 2050 | $4,322,925.50 | $4,460,359.50 | $4,672,758 |

| July 2050 | $4,414,548.25 | $4,554,064.58 | $4,764,380.67 |

| August 2050 | $4,506,171 | $4,647,769.67 | $4,856,003.33 |

| September 2050 | $4,597,793.75 | $4,741,474.75 | $4,947,626 |

| October 2050 | $4,689,416.50 | $4,835,179.83 | $5,039,248.67 |

| November 2050 | $4,781,039.25 | $4,928,884.92 | $5,130,871.33 |

| December 2050 | $4,872,662 | $5,022,590 | $5,222,494 |

| 2024 | $84,475.55 | $87,676.23 | $96,546.34 |

| 2025 | $121,440.85 | $124,947.50 | $145,871.41 |

| 2026 | $166,264.37 | $171,262.87 | $208,801.12 |

| 2027 | $251,829.81 | $258,680.13 | $292,272.77 |

| 2028 | $369,174.08 | $379,521.04 | $449,416.05 |

| 2029 | $525,671.43 | $540,852.91 | $640,702.92 |

| 2030 | $764,391.55 | $786,025.39 | $907,823.21 |

| 2031 | $1,077,841.21 | $1,109,283.06 | $1,309,556.03 |

| 2032 | $1,556,210.36 | $1,611,674.82 | $1,890,559.93 |

| 2033 | $2,330,561.92 | $2,411,145.86 | $2,724,386.53 |

| 2040 | $3,255,046.46 | $3,568,496.11 | $3,906,056.36 |

| 2050 | $4,557,065.25 | $4,725,845.37 | $4,918,737.08 |

What Is Bitcoin (BTC)?

Bitcoin, Bitcoin… Is there anything new to say about this cryptocurrency at this point? Even people who have zero interest in the industry have heard its name. As the number one cryptocurrency, it enjoys unimaginably high prices (up to $73K), a lot of attention, and, of course, much scrutiny.

Bitcoin is the first cryptocurrency that was created back in 2009. It is a decentralized digital currency that uses blockchain technology to facilitate trustless peer-to-peer transactions. BTC utilizes a proof-of-work consensus mechanism, which means it relies on Bitcoin miners to secure its network.

In recent years, Bitcoin has been one of the most popular assets for investment: not only can it be extremely profitable due to the high volatility of the cryptocurrency market, but it is also very easy to invest in. All one needs to get Bitcoin is an Internet connection.

Bitcoin, alongside the rest of the cryptocurrency market, is known for its ability to overcome any challenges and have strong comebacks despite everyone writing it off. Various financial experts have been predicting that the Bitcoin bubble will pop “in the near future” every month without fail for the past eight or so years. And yet, the coin remains on top, and BTC investors enjoy high profits, patiently waiting for yet another meteoric BTC price rise.However, as the crypto industry evolves, introduces new coins, and expands its reach, some crypto enthusiasts are starting to doubt whether Bitcoin is still worth investing in.

What Affects the Value of Bitcoin?

Numerous factors can influence Bitcoin’s price movements. Unlike many altcoins, Bitcoin often sets the trend for the cryptocurrency market, showing less dependency on the performance of other digital currencies. Nonetheless, Bitcoin remains sensitive to universal market influences such as shifts in interest rates or significant developments in the crypto sector, particularly those affecting major players like Ethereum or Shiba Inu. For example, when Ethereum announced The Merge phase of its transition to a proof-of-stake model, it also influenced the perception and value of Bitcoin.

Bitcoin, like any asset, is susceptible to news specifically about itself, the broader crypto exchanges, or blockchain advancements. For instance, crypto valuations generally surge with announcements of widespread adoption or innovative technological advancements. A prime example is when major corporations like Tesla, Microsoft, Starbucks, etc. announced they would start accepting Bitcoin as payment, leading to a sharp increase in its value. Conversely, any hint of uncertainty, like rumors of regulatory crackdowns, can influence the Bitcoin market, too, and swiftly reduce its value.

Main factors influencing BTC price: demand & supply, regulatory and global economic news, etc.

External, non-crypto news can also play a crucial role in shaping Bitcoin’s price. A notable example was observed in the spring of 2020, when the global economic uncertainty due to the pandemic heated up interest in Bitcoin as a potential safe haven, boosting its price significantly. Therefore, keeping an eye on stock market trends can provide deeper insights into the current state of Bitcoin.

Additionally, environmental news, such as intense scrutiny over the energy consumption of mining operations, is another area that prospective or current Bitcoin investors should monitor closely, as it increasingly influences market dynamics.

History of Bitcoin

Bitcoin’s price history is known to most crypto enthusiasts. From being ultimately nearly worthless, this coin has grown to become one of the biggest assets in the world. At its height, Bitcoin’s market cap was even higher than that of several established businesses.

Let’s take a brief look at the Bitcoin price chart.

Upon looking at this chart, one thing that immediately becomes apparent is that Bitcoin’s price cycles keep on shortening. Additionally, despite the coin regularly losing value, the average value of Bitcoin keeps increasing. This shows a positive trend for the future.

“Will Bitcoin go back up?” is an evergreen question in the crypto market. The truth is, no matter how hard we study BTC price history and trends, we would not be able to predict this accurately. However, we can still consider these factors as well as today’s Bitcoin news to make a tentative prediction.

Bitcoin’s crypto market cap is still the highest in the industry, and it still has the most recognition. Its circulating supply is slowly approaching its total supply but there’s still a long way to go till we reach a point where there will be no new Bitcoins released.

Overall, Bitcoin price history shows us that there’s still room for this asset to grow even if there is a bear market.

Please note that this does not constitute investment advice.

Will Bitcoin Go Back Up?

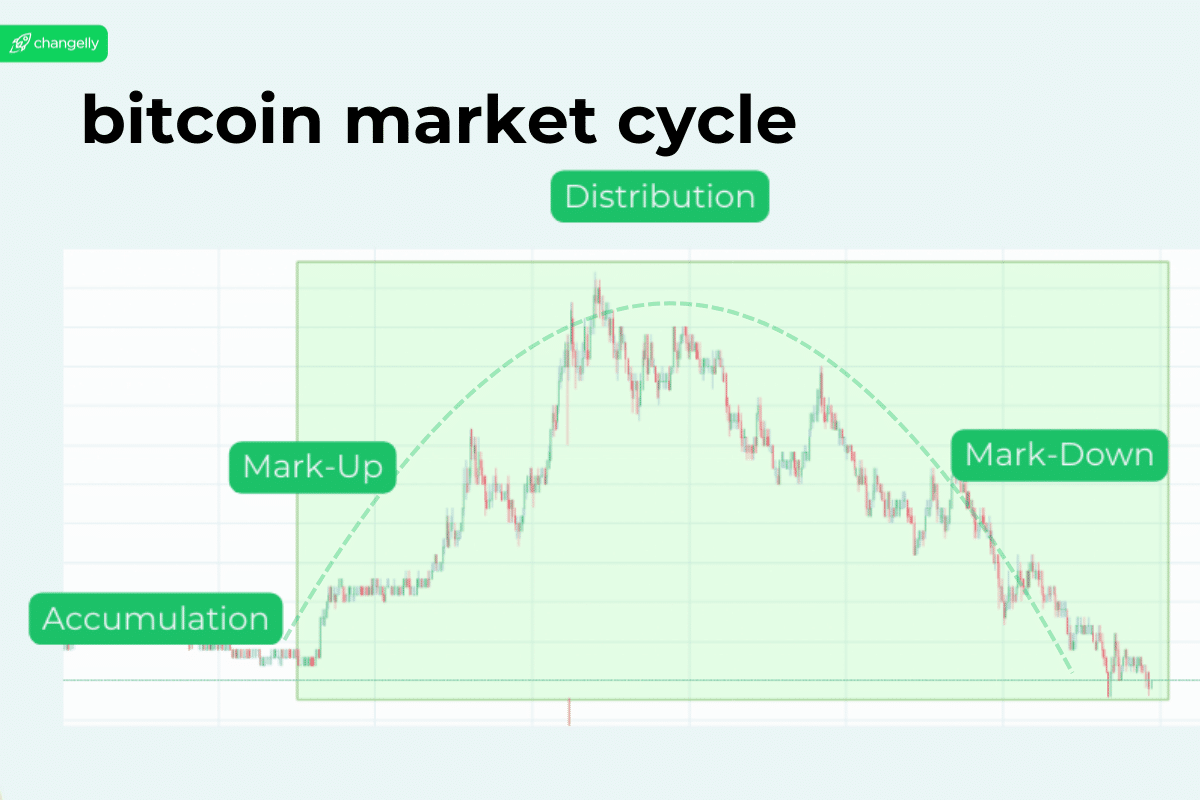

The future trajectory of Bitcoin’s price is constantly under scrutiny, influenced by various macroeconomic factors and significant events within the cryptocurrency sector.

In 2024, Bitcoin has already experienced a notable surge, updating its all-time high to over $73,700.

This March also earned its place in the history books. The SEC’s green light for these spot Bitcoin ETFs represents a huge milestone for the crypto community, potentially broadening investor access and confidence.

Another key event was the Bitcoin block reward halving that occurred in April 2024. This event, often associated with previous price surges, suggests a bullish momentum could be underway.

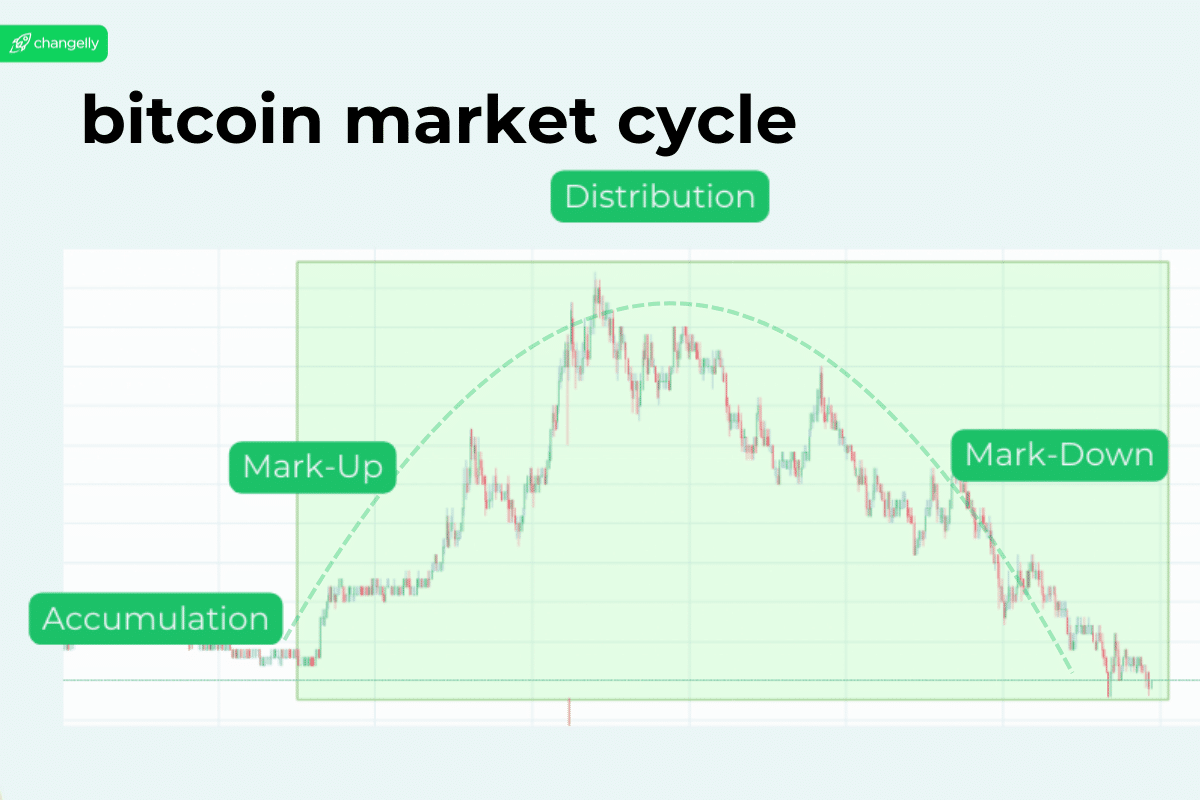

Experts within the industry are forecasting a new growth cycle in the crypto market, potentially peaking between 2024 and 2025. This expectation aligns with the four-year market cycle theory, which coincides with the last bull run in 2021.

Bitcoin’s 4 year market cycle and it’s 4 phases: accumulation, mark-up, distribution, mark-down.

However, external factors such as global news and events could impact Bitcoin’s price trajectory.

An important forthcoming event is the 2024 presidential election, where Donald Trump’s potential re-election is viewed by some as a positive catalyst for Bitcoin’s value. The Trump administration could foster a favorable environment for Bitcoin and other digital assets through more relaxed regulations.

Yet, despite these optimistic developments, the long-term prospects of the cryptocurrency market remain under examination. The growing introduction of crypto-related products contrasts with expert skepticism, often due to strict global regulations and public hesitance towards new technologies, largely stemming from misunderstandings or fears.

Bitcoin remains a straightforward digital currency by design; all the same its slow adaptation and reliance on the environmentally taxing proof-of-work (PoW) consensus algorithm might hinder its appeal compared to more versatile cryptocurrency ecosystems.

Given these dynamics, the question persists: Can Bitcoin recover and surpass its previous highs? Its historical resilience indicates the potential for a rebound, with analysts remaining optimistic about its future price action. Observing Bitcoin’s performance, it’s evident that this cryptocurrency represents a significant financial technology with the capacity to influence the global economy. It promises considerable projected growth and continues to affirm its role as a pivotal global currency.

How High Will Bitcoin Go? Bitcoin Price Predictions by Experts

Despite Bitcoin dropping below $70,000 after reaching a new all-time high, the current sentiment among investors remains generally bullish, indicating an optimistic outlook for future price increases.

- Anthony Scaramucci of SkyBridge Capital sees Bitcoin peaking at $170,000 within the next year, marking a significant uptick in the current cycle.

- Technopedia has adjusted its outlook for Bitcoin in 2024, predicting a new all-time high (ATH) of $85,000, with potential lows around $38,000. They expect the average price to hover around $60,000, revising earlier predictions of a peak at $98,000 to a more conservative estimate.

- MicroStrategy’s Michael Saylor anticipates a “supply shock” from the Bitcoin halving, which he believes will drastically reduce the amount of Bitcoin available from miners and trigger a substantial price increase. Citing historical performance post-halving, he suggests a similar bullish trend could follow this recent event.

- Tim Draper of Draper Associates projects a rise to $250,000 by July, sharing a highly optimistic view.

- Similarly, Marshall Beard, CEO of Gemini exchange, predicts a rally to $150,000 by the end of the year.

- Tom Lee of Fundstrat Global Advisors also foresees a potential rise to $150,000 in the short term and even speculates that Bitcoin could escalate to $500,000 within 5 years.

- Ark Invest’s Cathie Wood envisions Bitcoin reaching $1 million within the next five years, an ambitious projection that underscores her confidence in Bitcoin’s long-term growth potential.

- Digital Coin Price suggests an average price of $130,185.47 for 2024, with peaks potentially reaching $136,867.90, and anticipates a new high of $160,457.56 in 2025.

- Conversely, more conservative views from sources like Wallet Investor anticipate a possible rise to $75,867.21 in 5 years.

These bullish predictions are underpinned by Bitcoin’s finite supply and independence from external economic factors. Its growing acceptance and technological advancements, despite the evolving regulatory landscapes, bolster its investment appeal.

The Bearish Scenario

At the time of writing, the cryptocurrency industry largely maintains a positive view on Bitcoin, making it challenging to find notable bearish projections. However, two primary concerns could negatively influence Bitcoin’s price.

Firstly, Bitcoin’s substantial energy consumption continues to draw criticism, posing a potential threat to its market value. Secondly, the evolving regulatory landscape, particularly concerning anti-money laundering (AML) and Know Your Customer (KYC) laws, presents significant challenges that trouble investors.

If Bitcoin’s price crashes, then the values of other cryptocurrencies are likely to follow suit.

Is Bitcoin a Good Investment?

Read also: What if I Invest $100 in Bitcoin Today?

No matter if it’s in a down- or uptrend, Bitcoin is almost always predicted to keep rising in the future. So, it can be a good investment. However, please DYOR and carefully consider the risks before investing in BTC or any other cryptocurrency.

Our Bitcoin price prediction is rather conservative and does not take into account any random media hype or unexpected regulations that may happen in the near future — these factors are too unpredictable. However, if you’re considering investing in Bitcoin, you need to make sure you’re ready for its price to fluctuate wildly.

Bitcoin is less risky than other cryptocurrencies, but it is still fairly unstable and unpredictable in comparison to traditional investment avenues like the stock market.

Is Bitcoin still safe to invest in?

Investing in Bitcoin carries serious risks due to its high volatility. It’s advisable only for those with a high risk tolerance, a stable financial foundation, and the capacity to absorb potential losses. Before investing, ensure you fully understand what you’re getting into and conduct thorough research.If you’re new to cryptocurrency, consider checking out our comprehensive guide on crypto investments for beginners.

Is it too late to buy Bitcoin?

History shows that it’s never too late to buy Bitcoin. The Bitcoin price today is still lower than its ATH, which means it may rise and go for a full-scale bull run again in the future.

FAQ

Why is Bitcoin going down?

Bitcoin’s recent decline can be linked to several factors at the heart of uncertainty in the crypto market.

Lower trading volumes have magnified the impact of large trades, leading to heightened volatility.

Additionally, economic concerns, such as those in China’s property sector, have reinforced the perception of Bitcoin as a risk-on asset, susceptible to broader economic downturns.

Specific events like the shutdown of Binance Connect and notable departures from crypto firms have also shaken investor confidence, further influencing market sentiment and contributing to price drops.

What will $100 of Bitcoin be worth in 2030?

Right now, $100 would buy approximately 0.00153846 Bitcoin ($100 / $65,000). If the price of Bitcoin rises to $500,000 by 2030, your 0.00153846 Bitcoin would be worth $769.23 (0.00153846 x $500,000).

How much was 1 Bitcoin in 2010?

In 2010, Bitcoin was still in its infancy and experienced significant price fluctuations. Bitcoin’s price started the year 2010 at around a fraction of a cent. The exact price is hard to pinpoint because Bitcoin was not traded on any exchanges until later in the year. However, it was valued below $0.01 for the first few months.

The price of Bitcoin saw its first significant increase in 2010, reaching around $0.08 in July. The maximum price of the year was conquered on November 6, 2010, when Bitcoin hit approximately $0.50.

Will Bitcoin reach 1 million?

There are some prominent figures in the financial and investment world who believe that Bitcoin could reach $1 million. Notably, Cathie Wood of ARK Invest has predicted that Bitcoin’s price could exceed $1 million by 2030. Her predictions hinge on various factors, including the increased adoption of Bitcoin as a store of value and the impact of technological and financial developments on its valuation.

These optimistic forecasts reflect a belief in Bitcoin’s long-term growth potential, driven by its broadening and deepening integration into the financial systems and the broader acceptance of cryptocurrencies as legitimate investment vehicles. However, as with any investment, there’s an inherent risk, and such high targets are based on very bullish market conditions and assumptions.

Is Bitcoin a good investment?

The forecast for Bitcoin price is quite positive. It is expected that BTC price might meet a bull trend in the nearest future. We kindly remind you to always do your own research before investing in any asset.

To maximize investment potential, one should regularly monitor their wallet Bitcoin balance and transaction history for accuracy and signs of unauthorized activity.

How much will Bitcoin be worth in 2025?

The Bitcoin network is evolving at a swift pace. The forecast for Bitcoin in 2025 is largely optimistic. Analysts expect the average price of Bitcoin to fluctuate between a maximum of $121,440.85 and a minimum of $45,871.41.

How much will Bitcoin be worth in 2030?

With a conducive environment for growth, Bitcoin’s future looks promising. Predictions for 2030 are highly positive, with business analysts anticipating that Bitcoin could soar to a maximum price of $500,000.

Will Bitcoin ever hit $100K?

In March 2024, Bitcoin’s price soared to a new all-time high of $73,800, a milestone that many view as the end of the crypto winter and the beginning of a promising new market cycle. With this resurgence, a wave of optimism has swept through analysts and investors alike, many of whom are now anticipating a powerful bull run by the end of 2024 and into early 2025. They predict that this momentum could propel Bitcoin’s price to even greater heights, potentially breaching the elusive $100,000 mark.For a deeper analysis of the factors influencing Bitcoin’s trajectory towards this milestone, as well as expert insights, refer to our detailed exploration in the article: When Will Bitcoin Hit $100,000?

Will Bitcoin go back down to $10K?

It is possible. After all, the cryptocurrency market is incredibly volatile, and the question of crypto regulation remains uncertain.

How high can Bitcoin go in 10 years?

In 10 years, Bitcoin may reach $1,000,000 or even higher. As long as there are no threats to it in terms of competition and regulation, its finite supply and growing popularity should ensure that it keeps conquering new price highs.

Why can there only ever be 21 million Bitcoins?

The simple answer to this question is “because it was designed that way.” Well, but why can’t this limit be extended? Among other things, BTC’s finite supply acts as a deflationary measure and is one of the reasons why Bitcoin’s price is as high as it is. As for why this exact figure was chosen, there are a few theories about it. One states that it’s because the total value of all physical money in the world when BTC was developed was equal to $21 trillion. As a result, if Bitcoin had been then to completely replace fiat, 1 BTC would have been worth $1M, and one satoshi — $0.01.

Is Bitcoin a safe long-term investment?

Bitcoin is a relatively safe investment compared to other cryptocurrencies. However, it is still a high-risk, high-reward type of asset and should not be seen as a reliable long-term store of value.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

Bitcoin

RIOT, MARA and CLSK shares at risk

Bitcoin (BTC) Mining stocks like Riot Platforms (RIOT), Marathon Digital (MARA) and CleanSpark (CLSK) retreated in pre-market trading as BTC retreated.

RIOT, MARA and CLSK all fell more than 2%, while other crypto-related stocks such as MicroStrategy (MSTR) and Coinbase (COIN) fell 1.5%.

Bitcoin sell-off continues

Crypto-linked stocks retreated as Bitcoin resumed its downtrend on Wednesday. After rising to $63,750 on Monday, BTC is hovering at $60,0000 and it is unclear whether it will recover.

More importantly, Bitcoin is dangerously close to the crucial support at $58,273, which is the 200-day Exponential Moving Average (EMA). The next support level for Bitcoin is $56,426, representing its lowest level in May.

Bitcoin Price Chart

If Bitcoin drops below this price, it will be a sign that the bears have prevailed, which could take it to the $50,000 level, if not below.

This decline happened after a whale deposited nearly 2,000 Bitcoins to Binance in two separate transactions. While this isn’t always the case, deposits to exchanges often happen when holders are exiting their positions.

The whales’ action coincided with a period in which the German government continues to sell off its Bitcoin holdings. It transferred $52 million worth of coins to exchanges on Tuesday.

As a result, data from CoinGlass shows that the volume of Bitcoin balances on exchanges has started to increase. The volume rose to 2.49 million on Tuesday, from last month’s low of 2.47 million.

Bitcoin balances on exchanges

Bitcoin Mining Companies at Risk

If the Bitcoin sell-off continues, it will put Bitcoin mining companies like Marathon, CleanSpark, and Riot Platforms at risk. These companies have tended to have a close correlation with Bitcoin in the past.

This drop is happening a few months after the halving event, reducing the amount of Bitcoins that miners receive.

To compensate for this drop, most of these companies have added their mining equipment. CleanSpark has reached a hash rate of 20 EH/swhich helped her mine 445 coins in June after mining 417 coins the previous month. She did this after purchasing 5 mining sites in Georgia.

Digital Marathon mined 590 coins in June, down 40% from the same month in 2023 and flat from May.

Riot Platforms, on the other hand, focused on acquiring Bitfarms, a company that mined 189 coins in June.

Bitcoin

Michael Saylor Issues Statement on Bitcoin Amid Crypto Market Sell-Off by U.Today

U.Today – Amid an ongoing sell-off in the cryptocurrency market, Michael Saylor, a prominent advocate and president of MicroStrategy, made a statement on X (Twitter) that reverberated across the crypto space: “Just Bitcoin.”

This two-word tweet comes as the cryptocurrency market faces significant sell-offs as the price of Bitcoin plummets.

Bitcoin, the largest cryptocurrency by market value, began its decline in Tuesday’s trading session, hitting $63,223 at one point before falling further.

Losses deepened on Wednesday as investors considered remarks from Fed Chair Jerome Powell, with Bitcoin hitting intraday lows of $59,509. At the time of writing, BTC is down 2.85% over the past 24 hours to $60,274.

According to data from CoinGlass, the sell-off has resulted in a significant amount of cryptocurrencies being liquidated in the past 24 hours, totaling over $166 million. However, this has not deterred Saylor’s confidence in Bitcoin, as he reiterates his longing for the crypto asset in his tweet.

Cryptocurrency market crashes

Cryptocurrencies fell on Tuesday after Fed Chairman Jerome Powell said the central bank needs to see more progress on inflation before cutting interest rates, which are now at 5.25%-5.50%. Powell revealed at a monetary symposium in Sintra, Portugal, that the United States is moving closer to a disinflationary path.

“We want to be more confident that inflation is moving sustainably downward toward 2% before we begin the process of tapering or easing policy,” Powell said.

Market losses deepened after Wednesday’s economic releases that indicated the labor market is cooling. Recent data showed weaker-than-expected private payroll growth in June, but weekly jobless claims were higher than economists had forecast. The latest figures come ahead of the highly anticipated June nonfarm payrolls report on Friday.

As the cryptocurrency market goes through a period of uncertainty, the coming days and weeks will be crucial in determining the direction of BTC’s price.

Bitcoin

Bitcoin and Ethereum in GTA 6? Still rumors — for now

Rumors that the long-awaited Grand Theft Auto 6 will use cryptocurrency that has been circulating for more than a year now—and they’re spinning again.

On Wednesday, a pseudonymous Crypto Twitter influencer named Gordon — apparently named after Gordon Gekko from the iconic 1987 film “Wall Street” —shared to his nearly 500,000 followers that “GTA 6 will allow cryptocurrency payments” and that “so far only Bitcoin, EthereumIt is USDT [are] confirmed.”

But in reality, no cryptocurrency has been confirmed for Grand Theft Auto 6, despite ongoing chatter about the rumors. Rockstar Games and parent company Take-Two have made no such announcements this week on the subject, nor have they made any prior announcements, and official trailers and announcements have made no mention of cryptocurrency being included.

However, the tweet — which also included a fake trailer for the game — quickly went viral, with over 500,000 views as of this writing in a matter of hours. When Twitter users asked Gordon for his sources, he would jokingly respond that his “uncle works there” or say that previous reports on the matter were “old” at this point.

But really, nothing has changed since then. DecipherGG’s reported in previous rumors in May 2023, not even since the first official trailer — which initially leaked with “BUY BTC” stamped on itApparently by the leaker in question—premiered last December.

DecipherGG reached out to Rockstar Games for comment but did not receive an immediate response.

Could Grand Theft Auto 6 implement a crypto element when it releases in 2025? It’s certainly possible, and if so, it would be a transformative moment for cryptocurrency adoption by the traditional gaming industry.

Take-Two Interactive has explored the space before, acquiring casual gaming giant Zynga in early 2022, when Take-Two founder and CEO Strauss Zelnick suggested there were “Web3 opportunities” that they could explore better as a team. Zynga has launched its first blockchain game on Ethereum, called Sugartownbut Take-Two has yet to get involved with other brands.

Rockstar Games, on the other hand, prohibited the use of cryptocurrency or NFTs on player-run Grand Theft Auto 5 servers in late 2022, following a rise in the use of NFTs to represent unique player-owned assets on modded game servers.

And given Grand Theft Auto’s satirical tone, the game may be more likely to criticize cryptocurrency and poke fun at caricatures of crypto fans and NFTs, for example, rather than trying to launch its own on-chain currency. But that’s all speculation at this point, as there are relatively few official details about GTA 6.

For now, at least, don’t believe the hype. While Rockstar Games hasn’t officially closed the door on cryptocurrency usage in Grand Theft Auto 6, it hasn’t confirmed anything about it either. However, it’s sure to remain a hot topic in the long run leading up to release, which is currently scheduled for fall 2025.

Edited by Ryan Ozawa.

Bitcoin

Crypto President Trump’s ‘Lesser’ Regulation Will Bless Coinbase’s Bitcoin Leverage, Expert Says – Coinbase Glb (NASDAQ:COIN)

Chris SenyekChief Investment Strategist at Wolfe Researchrecently expressed his opinion on the potential impact of a Donald Trump win the 2024 elections in the cryptocurrency market.

What happened: Senyek suggested that a Trump presidency could ease cryptocurrency regulations, benefiting companies like Coinbase Global Inc. COIN due to its importance Bitcoin BTC/USD Leverage.

“Trump would be less harsh on crypto regulation, and Coinbase would be a big beneficiary of that given its influence on bitcoin,” Senyek said during CNBC’s “Last Call” on Tuesday.

See too: Enhance Your Retirement Portfolio: The Benefits of Adding Cryptocurrency

Why does this matter?:Senyek’s comments come in the context of the former president Donald Trump‘s reported plans to participate at the Bitcoin 2024 convention, which could reinforce his image as a “Crypto President”.

Trump’s potential participation in the Bitcoin 2024 convention, a major event on the cryptocurrency calendar, could have significant implications for the industry.

Pratik KalaHead of Research in DigitalX Limitedhe has predicted a Trump victory in the upcoming elections, but warns that immediate cryptocurrency-friendly regulations may not be a priority.

A recent report by 10x Search explore the recent rise in Bitcoin price and its potential connection to Trump’s strong position in the 2024 election race. The report, titled “Is the Bitcoin Trump Pump Sustainable?”, highlights a 4% spike in Bitcoin’s price following the news that the president Joe Biden will remain in the race despite a poor performance in the presidential debate.

Price Action: At the time of writing, Bitcoin was trading 2.10% lower at $60,860.66, according to Benzinga Pro.

Read next:

Image created using photos from Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

News and market data brought to you by Benzinga’s APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

-

Videos6 months ago

Videos6 months agoJapan just triggered PANIC IN THE GLOBAL MARKET! [CRYPTO DUMP]

-

News9 months ago

News9 months agoNew Crypto Wallet Collects Over 350 Billion PEPE Tokens: Can This Make Memecoin Soar? ⋆ ZyCrypto

-

Memecoins8 months ago

Memecoins8 months agoOver 1 million new tokens launched since April

-

News7 months ago

News7 months agoGolem Project Joins ETH Staking Frenzy, Locks Up 40,000 Tokens

-

News7 months ago

News7 months agoa new era for DEX tokens

-

Memecoins7 months ago

Memecoins7 months agoSolana Sets New Records With Its Memecoins

-

Bitcoin8 months ago

Bitcoin8 months agoCrypto Analyst Predicts Record Bitcoin Gains Before October Amid Global Liquidity Shifts ⋆ ZyCrypto

-

Bitcoin7 months ago

Bitcoin7 months agoCrypto President Trump’s ‘Lesser’ Regulation Will Bless Coinbase’s Bitcoin Leverage, Expert Says – Coinbase Glb (NASDAQ:COIN)

-

News7 months ago

News7 months agoPepe Investors Seek New Rewards From Rival Token Mpeppe (MPEPE) at $0.0007

-

Memecoins9 months ago

Memecoins9 months agoSolana co-founder strongly supports meme coins; highlights memecoin migration from ETH to Solana ⋆ ZyCrypto

-

Videos9 months ago

Videos9 months agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

Memecoins9 months ago

Memecoins9 months agoAI Tokens Take the Baton from Memecoins to Drive a Market Rebirth ⋆ ZyCrypto