Bitcoin

Bitcoin and Ethereum on the “Road to Acceleration”, CryptoQuant Explains Why

On-chain analytics firm CryptoQuant explained why Bitcoin and Ethereum recently appeared to be on the path to acceleration.

Bitcoin and Ethereum look bullish on on-chain metrics

In a new wire on X, the official CryptoQuant handle discussed how some key network indicators are looking for Bitcoin and Ethereum at the moment.

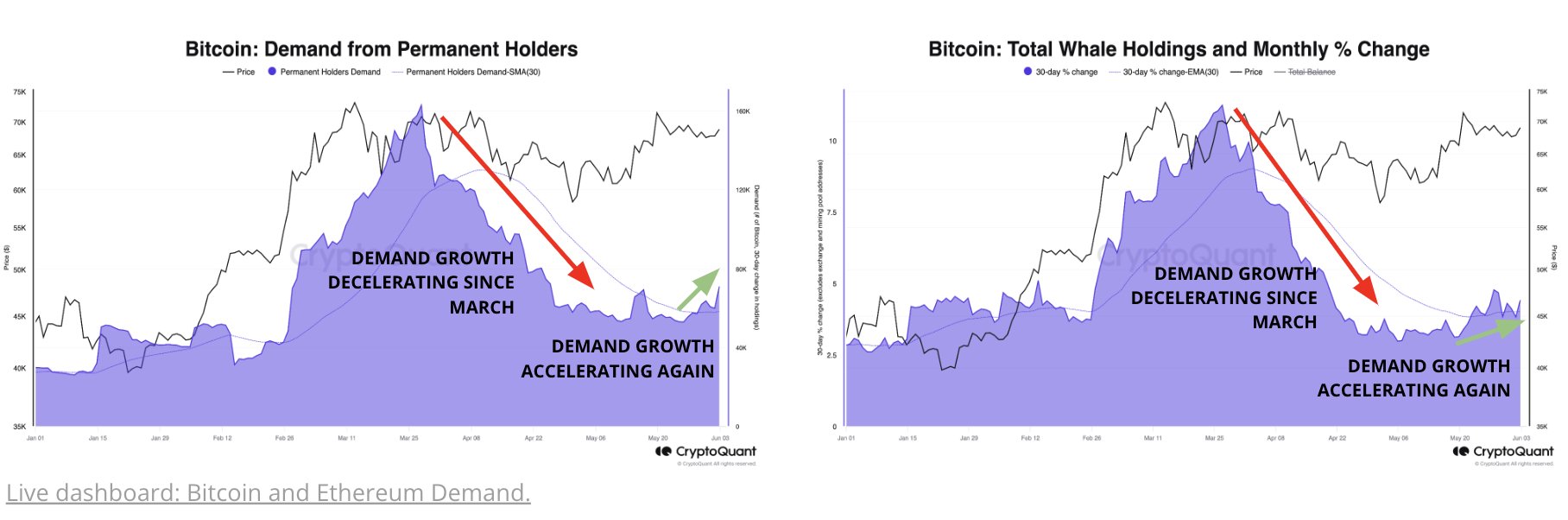

The first two metrics of interest here follow the demand from permanent holders and the whales. First, here are the relevant charts for BTC:

As seen above, demand from permanent holders, or HODLers, has been declining after peaking in March, but recently, the metric has seen a turnaround. These investors added 70,000 BTC to their portfolios last month.

A similar trend has also been witnessed in whale holdings, typically defined as addresses carrying more than 1,000 BTC. According to the analysis company, monthly demand from these large investors increased by 4.4%.

CryptoQuant also revealed that the sector is experiencing an influx of potentially new capital, such as “new whales”I saw your Realized Cap skyrocket recently.

O Limit Realized measures the amount of capital a given group of investors uses to purchase their Bitcoin. Thus, the increase in the Realized Limit of new whales, which are whale entities that entered in the last 155 days, would represent the new demand from large investors entering BTC.

As the charts above show, the pattern in this metric appeared similar this year to what was observed in 2020. Demand that year led to the 2021 bull run.

Now, here is the trend in permanent holder flows and whale balance for Ethereum:

As the charts show, demand for Ethereum from these investor groups has skyrocketed since exchange-traded fund (ETF) approvals last month.

Permanent holders are now making inflows of 40,000 ETH per day on average, while whales, investors holding 10,000 to 100,000 ETH, have increased their holdings to record highs of around 16 million ETH.

While the signs have been positive for Bitcoin and Ethereum in terms of direct demand, there is one development that could be detrimental to the cryptocurrency sector as a whole. This is the slowdown in the growth of stablecoins.

The chart shows that Tether (USDT) market capitalization grew sharply during the rally towards Bitcoin’s all-time high. While the largest stablecoin is still receiving capital injections, demand for it has slowed.

Historically, stablecoins have been one of the gateways for capital into the sector, so consistent demand for them may be needed for sustainable rallies.

BTC Price

At the time of writing, Bitcoin is trading at around $70,200, up more than 4% over the past week.

Featured image by Dall-E, CryptoQuant.com, chart by TradingView.com