Solana

What the data actually shows

Few platforms have faced as much skepticism as Solana. Critics often describe it as a centralized network plagued by frequent outages. However, such a narrative does not match the actual data and progress seen within the Solana ecosystem. This article seeks to debunk these misconceptions by taking an in-depth look at Solana’s key metrics.

Contrary to the prevailing negative perception, Solana is demonstrating remarkable growth and innovation on several fronts. The growing volumes of stablecoins traded on its network and higher decentralized exchange (DEX) volumes compared to Ethereum highlight Solana’s growing utility. Additionally, the platform’s higher data throughput highlights its technical capabilities and resilience. Additionally, the increase in new addresses and daily active users further reflects the growing trust and adoption within the broader crypto community.

By examining these metrics, this article aims to provide a balanced, data-driven perspective on why Solana represents an undervalued asset in the cryptocurrency market in June 2024.

Centralization

The decentralization of a blockchain network is complex and cannot be evaluated simply on a single metric. An in-depth analysis of the truly decentralized network, based on every detail, could fill an entire article. We will therefore focus on the Nakamoto coefficient. The Nakamoto coefficient measures the minimum number of entities in a network needed to agree to disrupt the system. For proof-of-stake networks like Solana and Ethereum, 33% stake is important, while for proof-of-work networks like Bitcoin, 51% control is crucial.

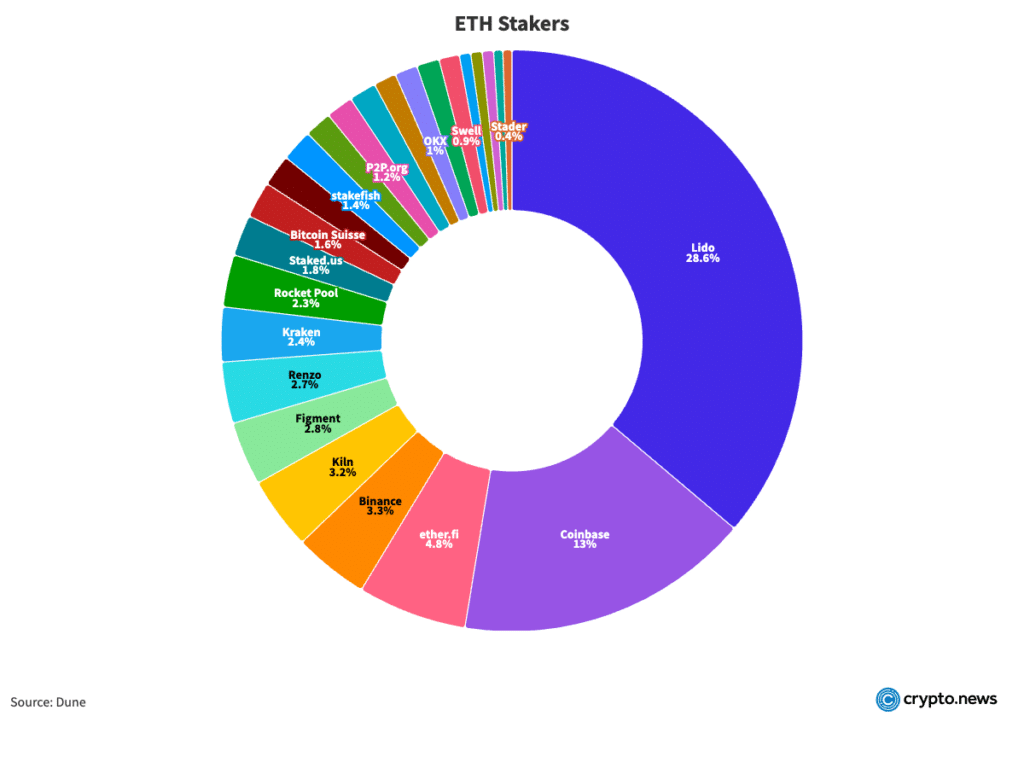

As of June 20, 2024, Solana had 1,525 active validators, of which 20 held more than 33% of the shares. On the other hand, Ethereum has 1,024,619 active validators, with only two entities controlling more than 33% of the share. A validator must stake 32 ETH to become a node on the Ethereum network. The problem here is that one entity can control multiple validators, thus obscuring the true level of decentralization.

Active validators and Nakamoto coefficient, June 20, 2024

According to Dune, Lido and Coinbase hold more than 33% of Ethereum shares. If each node holds 32 ETH, then out of the 1,024,629 active nodes, these two entities potentially control 432,389 unique validators. This concentration of control under two entities compromises the philosophy of decentralization.

ETH Stakers Pie Chart, June 20, 2024

For Bitcoin, the network has 17,692 full nodes that have not been pruned, of which 7,516 are capable of disrupting the network. Unfortunately, no information exists on the individual hashrate of each node. The calculation of this number used the Peer Index (PIX). The PIX value, ranging from 0.0 to 10.0, is updated every 24 hours based on a node’s properties and network metrics, with 10.0 being the most desirable value. Nodes with a PIX value of 5 or more were considered.

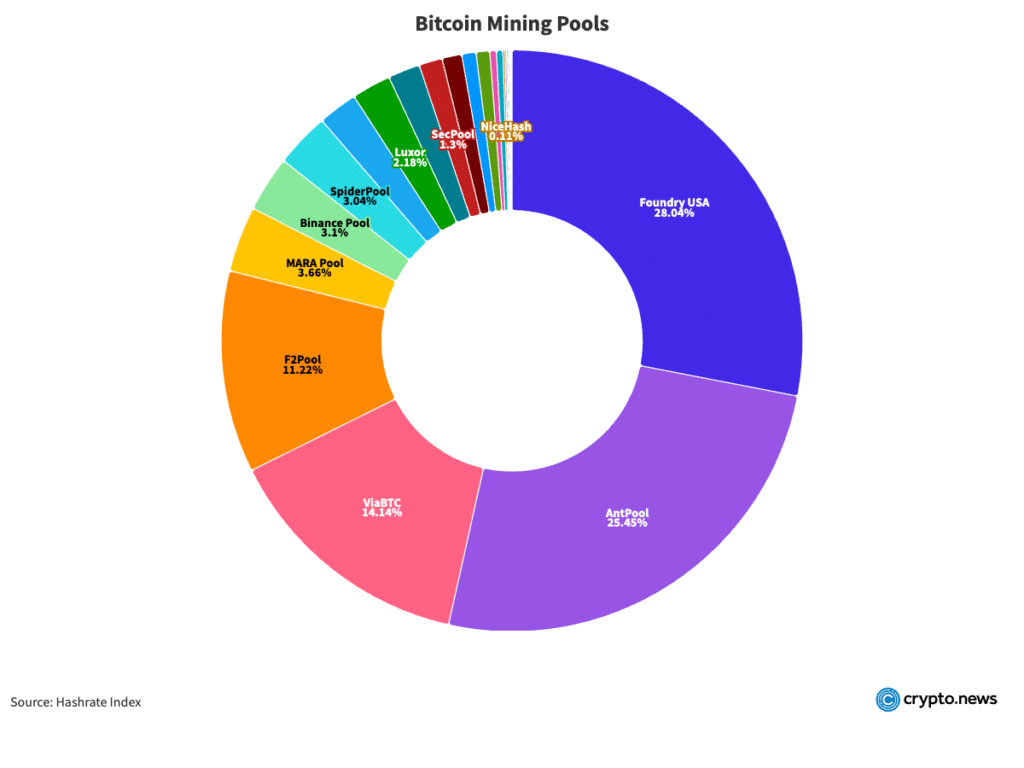

Some may argue that Bitcoin’s decentralization should be assessed through hashrate distribution. Currently, two mining poolsFoundry USA and Antpool control over 51% of the network’s hashrate.

Bitcoin Mining Pools Pie Chart, June 20, 2024

However, it is incorrect to consider these pools as the controllers of the network because they are pools of individual miners. Mining pools allow miners to combine their computing resources to increase their chances of solving blocks and earning rewards. If a pool starts acting maliciously, individual miners can simply move to another pool, thus maintaining network decentralization.

Although the decentralization of blockchain networks is multifaceted and cannot be accurately assessed by a single metric, the Nakamoto coefficient provides a useful perspective for comparison. Solana’s position is not as worrying as it might seem at first glance. With a Nakamoto coefficient indicating that 20 validators hold more than 33% of the stake, Solana appears more decentralized than Ethereum, where only two entities hold more than 33% of the stake. Additionally, even though Solana is not as decentralized as Bitcoin, it still maintains a robust level of decentralization, contributing to its security and reliability.

Stability

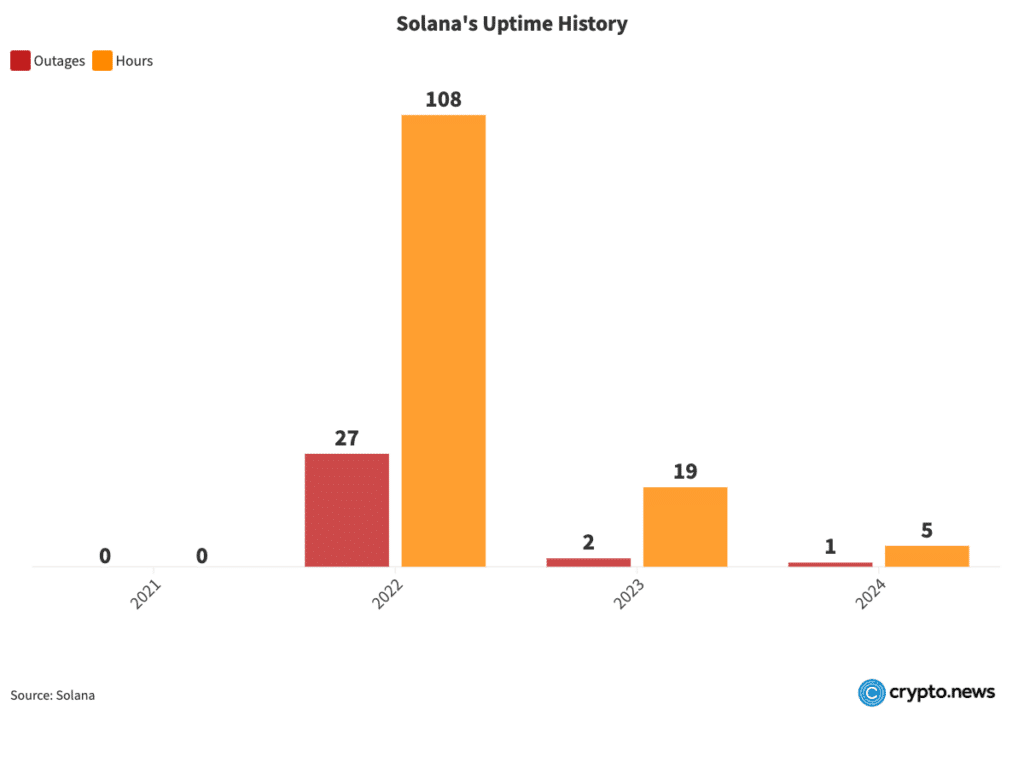

Solana, known for its high-speed transactions and low fees, has faced scrutiny over the stability of its network due to several outages it has experienced in recent years. However, a closer look reveals that the situation might be exaggerated. The stability of the network becomes evident despite occasional hiccups when examining Solana data. availability history.

In 2021, Solana experienced no outages and demonstrated a full year of uninterrupted service. The year 2022, however, saw a significant increase, with 27 outages totaling 108 hours. 2023 saw considerable improvement, with only two outages totaling 19 hours. In 2024, until June 19, the network experienced only one five-hour outage. These numbers, while remarkable, only tell part of the story.

Solana Availability History, 2021-2024

When considering availability, these outages represent a tiny fraction of total operating hours. For example, in 2022, despite 27 outages, the network maintained functionality for 99.47% of the year. Likewise, the 19 hours of downtime in 2023 and the 5 hours in 2024 through mid-June represent negligible interruptions in an otherwise stable performance.

The main culprit for these outages is Solana’s design. The network prioritizes speed and low costs, which attract heavy usage. This high traffic can lead to traffic jams and instability. For example, Solana produces a block every 400 ms, much faster than other blockchains. Due to the fast pace of production, when block creation stops for an hour or two, it looks more serious. However, other blockchains, even Bitcoin, also face downtime. For example, it took more than two hours to extract the block 689301 next block 689300.

Solana’s strategy of pushing its performance limits allows it to encounter and solve real-world challenges that theoretical models and simulations cannot predict. This approach resembles SpaceX’s iterative process of learning from failures to achieve rapid innovation. Although some critics view Solana’s historic downtime as a liability, this rigorous testing and problem-solving phase ultimately provides a significant competitive advantage.

Solana in numbers

Daily Active Portfolios

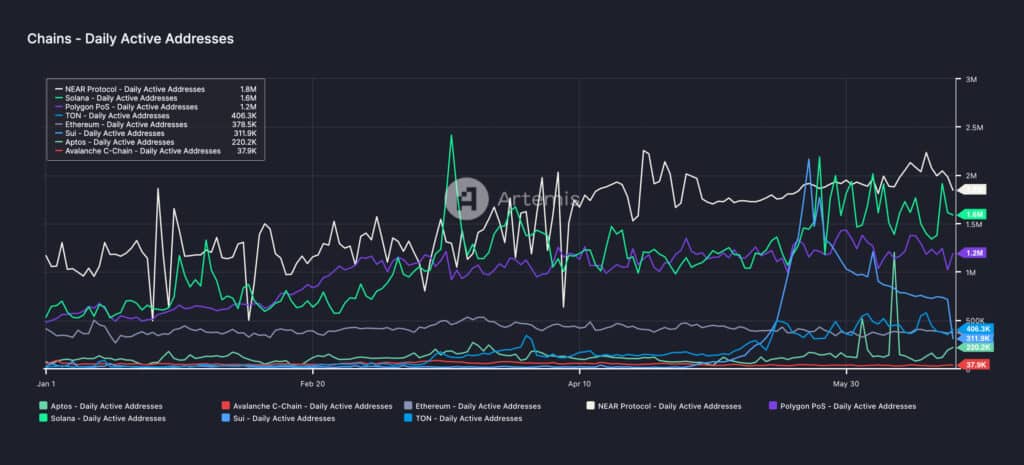

Solana currently has 1,600,000 daily active wallets, which is significantly higher than Ethereum’s 367,000 daily active wallets.

Daily active addresses, January 2024 – June 2024

Entrances and exits

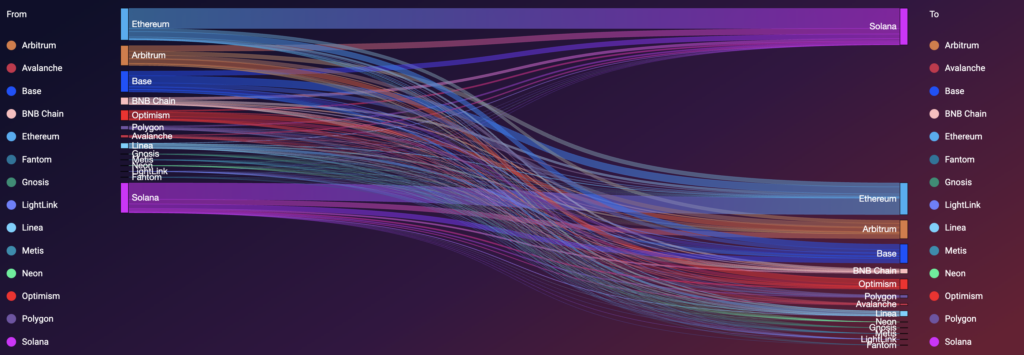

In addition, between April 2023 and June 2024, Solana recorded $801.73 million in inflows and $654.21 million in outflows. In contrast, Ethereum saw $694.17 million in inflows and $694.1 million in outflows. This translates to a net inflow of around $150 million for Solana, compared to Ethereum’s net inflow of around $70,000.

Total amount transferred between bridges, April 2023 – June 2024

Total amount transferred between bridges, April 2023 – June 2024

DEX Volumes

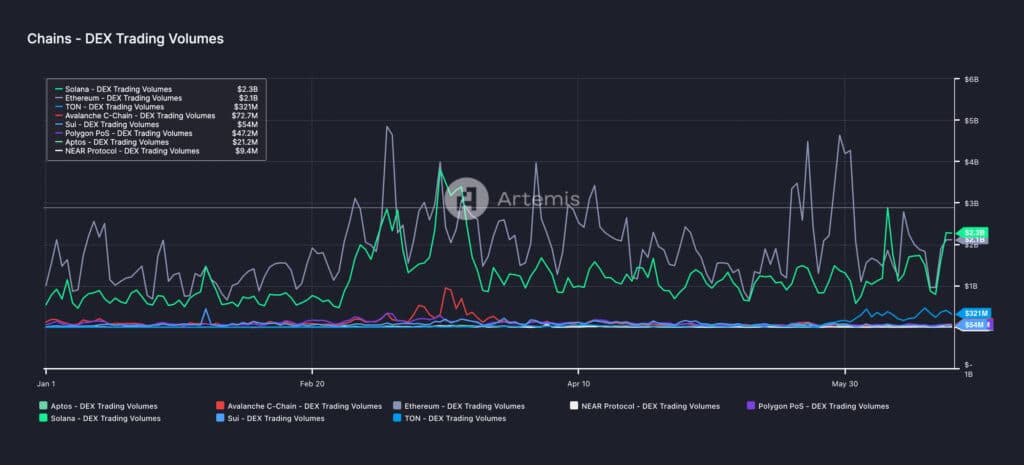

In terms of DEX volumes, Solana also performed excellently. It began to match or exceed Ethereum’s transaction volumes on several occasions. This is important because Solana’s market cap is around $63 billion, much lower than Ethereum’s $430 billion. Additionally, Solana’s token was launched only four years ago, compared to Ethereum’s nine years on the market. Although it is newer and smaller, Solana’s ability to compete with Ethereum in DEX volumes shows its potential.

DEX trading volumes, January 2024 – June 2024

Stablecoin transfer volumes

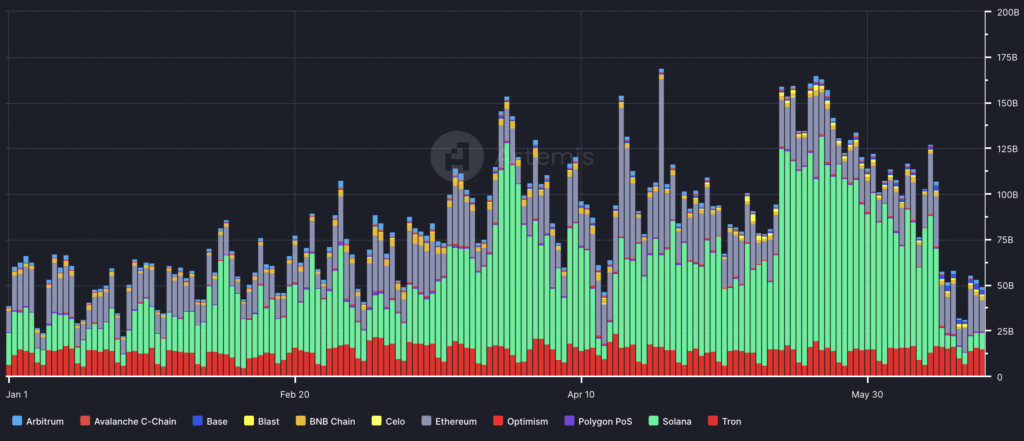

Solana’s high stablecoin transfer volumes come from its fast transaction speeds and low fees, making it attractive to users. The network’s ability to efficiently process many transactions supports a high volume of activity. Additionally, Solana’s focus on scalability and user-friendly experience further solidifies its dominance in stablecoin transfers.

Stablecoin transfer volumes, January 2024 – June 2024

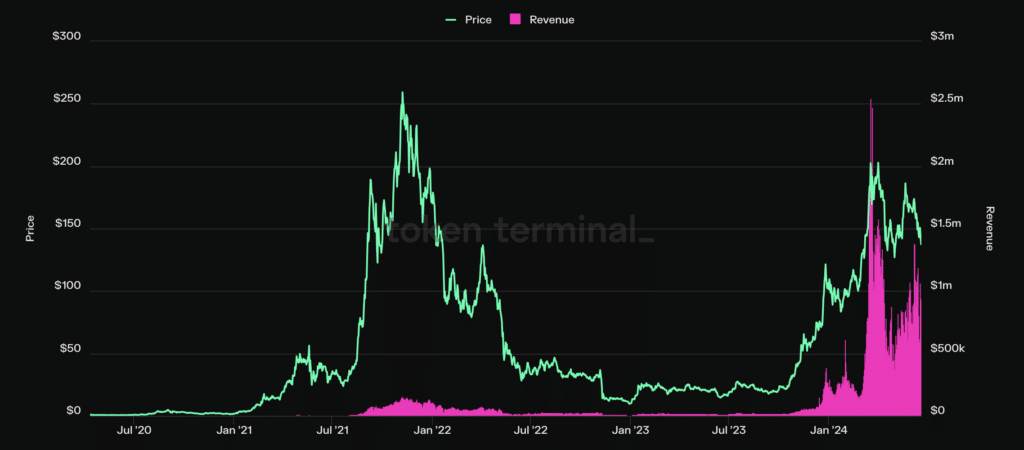

Income

Solana’s revenues soared to 50% of Ethereum’s by mid-2024, an all-time high. Historically, during the peak activity periods of 2021 and 2022, Solana’s revenue was less than 1% of Ethereum’s. At the start of 2024, this figure was around 10%. This dramatic increase in revenue ratio indicates the growing usage and economic activity of Solana on the network.

Solana revenue, April 2020 – June 2024

Conclusion

The narrative of Solana as a centralized and unreliable network does not hold up in real-world data. With its strong technical capabilities and growing adoption, Solana is demonstrating significant progress and resilience. The Nakamoto coefficient shows that Solana’s decentralization is more favorable than that of Ethereum, with fewer entities needed to collude to disrupt the network. Although not as decentralized as Bitcoin, Solana nevertheless maintains a substantial level of decentralization, which contributes to its security and reliability.

Network stability, often criticized due to past outages, is showing marked improvement, with substantial availability and continued improvements. Solana’s strategic focus on high performance and scalability results in occasional instability, but also rapid innovation and resilience, similar to the iterative development seen in other cutting-edge technology areas.

Metrics such as daily active wallets, inflows and outflows, decentralized exchange volumes, and revenue indicate Solana’s growing importance in the cryptocurrency ecosystem. Despite its smaller market capitalization and young age, the network’s ability to handle high transaction volumes at low costs positions it as a formidable competitor to Ethereum.

Overall, Solana’s performance and growth reflect a platform that is not only maturing, but also setting new standards in the industry, challenging prevailing negative perceptions and establishing itself as a valuable asset in the market .

Disclosure: This article does not represent investment advice. The content and materials presented on this page are intended for educational purposes only.

Solana

Portfolio Booster Mpeppe (MPEPE) Predicts 300x Surge Solana Investors Share Bag With MPEPE

Strategic diversification is a key tactic to maximize returns and minimize risk. Recently, a growing number of Solana (SOL) investors have split their investments to include Mpeppe (MPEPE)a promising token that is expected to see a remarkable 300x increase. This strategic move aims to capitalize on the high growth potential of Mpeppe (MPEPE) while leveraging the stability and steady growth of Solana (SOL).

Solana’s strength and investor confidence

Steady growth

Solana (SOL) Solana (SOL) has consistently demonstrated strong performance in the cryptocurrency market, earning a reputation for its fast transaction speeds, low fees, and scalable blockchain infrastructure. This consistent growth has instilled a strong sense of confidence among investors, making it a popular choice for both long-term holdings and short-term gains. Solana’s (SOL) technological advancements and the expansion of its decentralized application (dApp) ecosystem have further solidified its position as a leading cryptocurrency.

Recent Benefits

A lot Solana (SOL) Solana (SOL) investors have reaped significant profits from the token’s recent price gains. These gains have prompted a strategic approach to reinvestment, with a focus on diversification to maximize returns and protect against market volatility. By reinvesting their profits, Solana (SOL) investors aim to enrich their portfolios with high-potential assets like Mpeppe (MPEPE)which offers the promise of substantial future gains.

Benefits of Diversification

Investment diversification is a well-established strategy in financial markets, and it is especially important in the volatile cryptocurrency landscape. Including high-potential tokens like Mpeppe (MPEPE) in a portfolio can provide a balance between stability and growth. This approach mitigates the risks associated with market fluctuations and maximizes the opportunity for significant returns, making it an attractive option for savvy investors.

Mpeppe (MPEPE): the next big wave

Mpeppe (MPEPE) stands out in the cryptocurrency market by uniquely integrating sports enthusiasm with blockchain technology. This innovative fusion creates a compelling value proposition that appeals to a broad audience, including sports fans and tech enthusiasts. By leveraging the popularity of sports, Mpeppe (MPEPE) improves user engagement and drives adoption, paving the way for substantial growth.

Surge potential 300x

The 300x surge prediction for Mpeppe (MPEPE) is based on several key factors, including its innovative features, strong community support, and strategic market positioning. The integration of decentralized finance (DeFi) elements such as yield farming, liquidity mining, and decentralized governance mechanisms adds substantial utility and value to Mpeppe (MPEPE). These features, combined with the token’s unique appeal, create a powerful combination for explosive growth.

Why Solana Investors Are Splitting Their Investments

Growth and stability

Combining the stability of Solana (SOL) with Mpeppe’s (MPEPE) Mpeppe’s growth potential offers a winning combination for investors. Solana (SOL) offers a solid foundation of consistent performance, while Mpeppe (MPEPE) offers attractive opportunities for exponential gains. This balanced approach ensures investors benefit from both safety and high returns, making it a strategic choice for long-term growth.

Strategic positioning

Holding both Solana (SOL) and Mpeppe (MPEPE) in an investment portfolio offers strategic benefits, including exposure to different market segments and innovative technologies. This diversified positioning allows investors to capitalize on various trends and developments in the cryptocurrency space, thereby enhancing their overall investment strategy.

Conclusion: a winning combination

In summary, the trend of Solana (SOL) investors splitting their investments to include Mpeppe (MPEPE) reflects a strategic approach to optimizing returns and managing risk. With the consistent growth and stability of Solana (SOL) combined with the 300x potential of Mpeppe (MPEPE), this combination offers a powerful portfolio booster. As investors continue to seek new opportunities in the dynamic cryptocurrency market, Mpeppe (MPEPE) stands out as a promising addition that can generate substantial gains and improve overall portfolio performance.

For more information on the Mpeppe presale (MPEPE):

Visit Mpeppe (MPEPE)

Join us and become a member of the community:

Solana

Paysage de jalonnement liquide de Solana | Bankless

Le secteur du jalonnement de Solana continue d’être l’un des secteurs les plus dynamiques du réseau.

Le staking, qui consiste à bloquer du capital pour la sécurité du réseau en échange d’un rendement, est un élément essentiel de la DeFi et l’un des secteurs les plus forts de l’économie onchain. Les exigences de staking varient selon la chaîne ; Ethereum nécessite 32 ETH pour un staking natif sur un nœud personnel, ou les utilisateurs peuvent opter pour des fournisseurs de staking liquide comme Lido ou Rocketpool. Sur Solana, tout le monde peut staker de manière native via son système de preuve d’enjeu délégué en déléguant à des validateurs au lieu de gérer son propre nœud.

Cette facilité de jalonnement peut expliquer le grand écart entre Solana et Ethereum en termes de total des actifs jalonnés par rapport aux actifs liquides jalonnés. Solana a 61 milliards de dollars de capital investisurpassant Ethereum, mais à la traîne en matière de jalonnement liquide. Ethereum a 65 % de son ETH jalonné sous forme liquide, alors que seulement 6,5% des SOL jalonnés de Solana sont des jetons de staking liquides (LST), indiquant une opportunité de croissance significative pour Solana.

Dans cet article, nous explorerons l’arène actuelle du staking liquide SOL, en examinant les principaux acteurs ainsi que les protocoles innovants et s’attaquant à cette opportunité. Commençons ! 👇

💦 Les meilleurs LST de Solana

Jito, Marinade Finance et Jupiter dominent le staking liquide de Solana, détenant 80 % de tous les SOL dans les LST. Voyons ce qui rend chaque protocole unique et comment ils visent à augmenter leur part du gâteau du staking.

◼️ JitoSOL de Jito

JitoSOL n’est pas seulement le plus grand holding LST 48% de SOL liquide jalonné, évalué à 1,7 milliard de dollars – mais Jito est le plus grand protocole sur Solana.

Jito, bien connu pour son airdrop massif, permet aux utilisateurs de miser du SOL et de recevoir du JitoSOL à utiliser sur le réseau dans DeFi.

La particularité de Jito réside dans son approche unique du MEV, qui offre aux utilisateurs de meilleurs rendements tout en préservant la santé du réseau. Jito prend en charge des validateurs spéciaux qui optimisent l’espace de bloc et incluent les transactions de manière équitable, évitant ainsi les tactiques nuisibles telles que les attaques sandwich ou le front-running. En conséquence, cela aide MEV à se comporter plus positivementpermettant aux détenteurs de JitoSOL de gagner environ 15 % de plus.

En tant que plus grand LST du réseau, JitoSOL est profondément ancré dans la DeFi. C’est un actif populaire pour les prêts et les emprunts sur des protocoles comme Solend, Drift et Marginfi et peut être exploité sur Kamino pour des rendements plus élevés. Ces intégrations ont créé un volant d’inertie de liquidité positionnant JitoSOL comme le LST le plus productif et le plus efficace, augmentant la demande pour l’actif. Enfin, l’impact de Jito sur le réseau Solana ne se limite pas à augmenter les récompenses de jalonnement. Grâce à StakeNet, un système décentralisé d’optimisation des validateurs, Jito améliore les performances et distribue équitablement les récompenses, rendant le réseau plus efficace et plus sûr pour tous les participants.

Jito est un mastodonte absolu. De véritables flux de trésorerie en chaîne.

63 000 $/semaine * 52 semaines/an * 170 $ SOL = 600 M$ de revenus de pourboires annuels

« Mais il n’y a pas de cas d’utilisation ! »

>Où suis-je et où es-tu https://t.co/fwTXg2deZC

— Vance Spencer (@pythianism) 7 juin 2024

🟩 Le mSOL de Marinade Finance

Marinade Finance occupe la deuxième place avec 22% de la part de marché totale du LST.

Lancé en août 2021, le mSOL de Marinade fonctionne comme JitoSOL, s’appréciant au fil du temps avec des récompenses de jalonnement. En juillet 2023, Marinade a lancé Marinade Native, permettant le jalonnement SOL direct avec des récompenses à chaque époque, évitant ainsi le risque de contrat intelligent tout en gardant le contrôle du SOL. De plus, les récompenses de jalonnement protégées de Marinade garantissent que les stakers ne perdent pas de récompenses en raison de problèmes de performance des validateurs en exigeant que les validateurs fournissent une caution.

Marinade, qui était autrefois le plus grand LST, a perdu sa position au profit de Jito, mais reste néanmoins le deuxième plus grand protocole sur Solana dans son ensemble. Sa TVL continue cependant de saigner, car il perd des parts non pas au profit de Jito mais de Sanctum, un protocole permettant de créer, de lancer et d’unifier la liquidité des LST.

Il est intéressant de constater que la part de marché des marinades dans les LST est passée de 60 % l’année dernière à 22 % aujourd’hui.

Jito a continué à connaître une croissance régulière pour maintenir une part de marché de 50 %, bien que la majeure partie de la nouvelle liquidité soit allée aux LST à validateur unique (à savoir jupSOL). https://t.co/sr34XcDhiA pic.twitter.com/evsMqt2Sl1

— ilemi (@andrewhong5297) 1er juillet 2024

🟩 JupSOL de Jupiter

En troisième place se trouve JupSOL, avec dix% de tous les SOL mis en jeu dans les LST, lancés par Jupiter et Sanctum.

Sortie en avrilJupSOL a rapidement conquis des parts de marché, offrant une version instantanément liquide de SOL jalonnée avec le validateur de Jupiter. En plus des récompenses de staking et des pots-de-vin MEV, JupSOL offre des rendements élevés, boostés par 100 000 SOL délégués par l’équipe Jupiter. JupSOL augmente également le taux d’inclusion de Jupiter en augmentant la participation de son validateur. Les validateurs avec plus de participation ont une priorité de traitement des transactions plus élevée sur Solana. Par conséquent, le validateur de Jupiter peut traiter plus de transactions, même pendant les périodes de pointe. Ainsi, les transactions sur des plateformes comme Jupiter et Sanctum, utilisant le validateur de Jupiter, ont plus de chances d’être réalisées rapidement et avec succès. La détention de JupSOL rend le validateur de Jupiter plus influent, améliorant l’efficacité des transactions et les taux de réussite sur ces plateformes.

Annonce de JupSOL – le LST au rendement le plus élevé sur Solana, avec une délégation sans confiance au validateur de Jupiter.

Ce validateur a des frais de 0 % et un retour MEV de 100 % et dispose actuellement de 100 000 SOL supplémentaires délégués pour augmenter le rendement de JupSOL.Cela fera probablement de JupSOL le plus haut… pic.twitter.com/vsEYqG5bxh

— Jupiter 🪐 (@JupiterExchange) 16 avril 2024

Qu’est-ce que Sanctum ?

Initialement lancé en février 2021Sanctum permet aux validateurs inscrits sur liste blanche de créer et de lancer leurs propres jetons de jalonnement liquides tout en unifiant la liquidité de ces produits dérivés.

Les LST personnalisés de Sanctum servent à diverses fins, allant de l’augmentation des rendements à l’activation des listes blanches NFT ou des services d’abonnement. Sanctum répond aux principaux problèmes de jalonnement liquide, en unifiant la liquidité fragmentée et en élargissant les options LST limitées grâce à trois fonctions principales. Le routeur Sanctum permet des conversions LST transparentes, et la réserve Sanctum offre une liquidité instantanée pour le déblocage. La piscine à débordement de Sanctumun pool de liquidité multi-LST, prend en charge un nombre illimité de LST de manière native, contrairement aux pools traditionnels ne prenant en charge que quelques actifs. Il garantit des prix LST équitables et ajuste les frais de swap de manière dynamique pour optimiser les rendements et maintenir le bon équilibre de chaque LST dans le pool. Dépôt de LST ou SOL dans le Infinity Pool donne le LST de SanctumINF, utilisable dans les protocoles DeFi comme Chemin et Météores.

nous n’aurions pas pu faire cela sans tous nos partenaires. encore une tonne de LST à venir – ensemble, nous réinventerons le jalonnement liquide 💧💧🚀🚀 pic.twitter.com/HUJo9cd6gl

— FP Lee (@soleconomist) 12 juillet 2024

La vision de Sanctum s’étend au-delà du simple jalonnement liquide. Avant le lancement de son jeton ce jeudi, FP Lee de Sanctum a présenté une vision centrée sur trois produits de base.

# Trois choses que je veux construire après TGE

1. Rampe de lancement de Sanctum

Sanctum Launchpad est le moyen par lequel la communauté Sanctum va lancer l’économie onchain. Nous utiliserons les LST pour soutenir les nouveaux projets et les produits réels que nous souhaitons voir.Les projets peuvent utiliser les LST comme moyen d’obtenir un fonds de roulement, donc… pic.twitter.com/yXzWfgjyHd

— FP Lee (@soleconomist) 15 juillet 2024

Dans l’ensemble, l’approche de Sanctum améliore la liquidité, étend les cas d’utilisation de LST et prend en charge l’économie onchain la plus fondamentale via Launchpad, Profiles V2 et Pay. Ces développements pourraient avoir un impact significatif sur l’écosystème Solana en améliorant la liquidité, en créant de nouveaux chemins de lancement LST et en offrant de nouveaux cas d’utilisation LST.

♻️ Re-staking sur Solana

Au-delà du jalonnement liquide, Solana constate un développement accru des protocoles de rejalonnement, tirant parti de l’activité de la chaîne principale de ce cycle pour étendre ses cas d’utilisation.

Les protocoles de démarrage Cambrian, Picasso et Solayer visent à ajouter le retaking à l’extension modulaire de Solana.

- Coucheur de sol : Le fournisseur de restaking Solayer vise à créer un réseau d’appchains sécurisé par la sécurité économique de Solana. En utilisant l’architecture de Solana pour le multitâche et les transactions rapides, Solayer peut améliorer la répartition de la charge de travail et la personnalisation des services. Cela étend les capacités de Solana, offrant un meilleur consensus et une meilleure personnalisation de l’espace de blocs pour les développeurs, ce qui est particulièrement utile compte tenu de l’élan récent des L2 de Solana. Lancement en douceur de Solayer en maih a atteint un plafond de dépôt de 20 millions de dollars pour les SOL et les LST en 45 minutes, montrant une forte demande qui s’est poursuivie et a augmenté TVL à environ 127 millions de dollars.

- Cambrien:Cambrian développe une couche de repositionnement modulaire pour Solana afin de réduire les coûts et d’améliorer l’allocation des ressources, bénéficiant aux oracles décentralisés et aux processeurs IA. Leur modèle permet aux protocoles de louer la sécurité de Solana, réduisant ainsi les coûts des solutions natives et la positionnant comme une alternative en chaîne aux fournisseurs de cloud comme AWS. Son testnet est attendu cet été.

Cambrian propose une approche complètement nouvelle de la modularité : les développeurs pourront combiner des piles techniques et des implémentations AVS très différentes pour des dApps individuelles sous leur contrôle.

L’idée sous-jacente du resttaking et de l’AVS est que les développeurs peuvent créer des AVS séparés… pic.twitter.com/J2DHNX08X5

— Cambrien (@cambrianone) 17 mai 2024

- Picasso : Initialement axé sur le rapprochement entre Solana et Cosmos, Picasso est devenu un pôle de re-staking soutenant d’autres projets Solana comme Mantis, un prochain L2 re-stadé. En utilisant le framework Cosmos SDK, Picasso connecte les chaînes compatibles IBCaméliorant leur utilité et leur sécurité. La couche de jalonnement généralisée de Picasso et l’IBC sécurisent les applications nécessitant une sécurité temporaire ou permanente. Cela permet de re-staker SOL et ses LST, offrant de nouvelles options de jalonnement et facilitant les échanges de liquidités.

1/ 🎨🔗 @Solana @IBCprotocol les transferts sont en direct sur https://t.co/iOhfXgpCIe

Nous sommes ravis d’annoncer que les utilisateurs peuvent désormais découvrir une implémentation d’IBC sur Solana. Cela marque le lancement de la première connexion à confiance minimale entre @Solana, @Cosmos, @Ethereumet… pic.twitter.com/ksf6XLaOHk

— Picasso $PICA 🎨 (@Picasso_Network) 22 mai 2024

🌱 Prêt pour la croissance

Solana est susceptible de bénéficier énormément de l’expansion de son économie de jalonnement.

Avec un faible pourcentage de SOL mis en jeu dans les LST par rapport au SOL mis en jeu dans son ensemble, des protocoles comme Jito, Marinade Finance et Jupiter continueront de prospérer à mesure que l’écosystème évolue. Sanctum joue un rôle crucial dans cette évolution, en s’attaquant à la fragmentation de la liquidité. De plus, bien que le développement du resttaking sur Solana puisse être prématuré compte tenu de l’état du resttaking sur Ethereum, il s’inscrit dans la dynamique autour du développement modulaire que nous observons avec les SVM L2 et les appchains, ce qui signifie que des protocoles tels que Cambrian, Solayer et Picasso pourraient étendre les fonctions principales de la chaîne et alimenter davantage la croissance du LST.

Dans l’ensemble, l’économie de jalonnement de Solana semble prête pour une croissance significative, tirée par des protocoles innovants, des rendements compétitifs et l’expansion potentielle du rôle que les LST peuvent jouer sur la chaîne dans le développement et l’activation de nouvelles économies.

Solana

Solana (SOL) Price Hits $150: Market Dips Look Tempting

Aayush Jindal is a leading authority in the world of financial markets, with expertise spanning over 15 illustrious years in the fields of Forex and Cryptocurrency trading. Renowned for his unmatched proficiency in technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the complex landscapes of modern finance with his sharp insights and astute chart analysis.

From a young age, Aayush displayed a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush has honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions to navigate the volatile waters of financial markets. His background in software engineering has given him a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-changing landscape.

In addition to his roles in finance and technology, Aayush is a Director at a prestigious IT company, where he leads initiatives to drive digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its leadership position in the technology sector and pioneering revolutionary advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush strongly believes in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures and creating lasting memories along the way. Whether it’s trekking in the Himalayas, diving into the azure waters of the Maldives or experiencing the vibrant energy of bustling metropolises, Aayush seizes every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and an unwavering commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his Software Engineering with honors and excelling in all departments.

Aayush is driven by a deep passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he is studying price charts, identifying key support and resistance levels, or providing in-depth analysis to his clients and subscribers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and an inspiration to aspiring traders everywhere.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a beacon, lighting the path to financial success with his unmatched expertise, unwavering integrity, and boundless enthusiasm for the markets.

-

Videos6 months ago

Videos6 months agoJapan just triggered PANIC IN THE GLOBAL MARKET! [CRYPTO DUMP]

-

News9 months ago

News9 months agoNew Crypto Wallet Collects Over 350 Billion PEPE Tokens: Can This Make Memecoin Soar? ⋆ ZyCrypto

-

Memecoins8 months ago

Memecoins8 months agoOver 1 million new tokens launched since April

-

News7 months ago

News7 months agoGolem Project Joins ETH Staking Frenzy, Locks Up 40,000 Tokens

-

News7 months ago

News7 months agoa new era for DEX tokens

-

Memecoins7 months ago

Memecoins7 months agoSolana Sets New Records With Its Memecoins

-

Bitcoin8 months ago

Bitcoin8 months agoCrypto Analyst Predicts Record Bitcoin Gains Before October Amid Global Liquidity Shifts ⋆ ZyCrypto

-

Bitcoin7 months ago

Bitcoin7 months agoCrypto President Trump’s ‘Lesser’ Regulation Will Bless Coinbase’s Bitcoin Leverage, Expert Says – Coinbase Glb (NASDAQ:COIN)

-

News7 months ago

News7 months agoPepe Investors Seek New Rewards From Rival Token Mpeppe (MPEPE) at $0.0007

-

Memecoins9 months ago

Memecoins9 months agoSolana co-founder strongly supports meme coins; highlights memecoin migration from ETH to Solana ⋆ ZyCrypto

-

Videos9 months ago

Videos9 months agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

Memecoins9 months ago

Memecoins9 months agoAI Tokens Take the Baton from Memecoins to Drive a Market Rebirth ⋆ ZyCrypto