News

Top 9 Projects to Watch

Cryptocurrencies that have integrated artificial intelligence (AI) or plan to do so have been soaring in popularity.

The fast-paced expansion and development of AI have generated considerable interest, controversy, and fear among the public, especially tech enthusiasts, investors, and even government officials and politicians. Projects like OpenAI’s ChatGPT, as well as its numerous alternatives, have been making headlines left and right, and this has inevitably impacted the crypto industry.

This can be reminiscent of Bitcoin and the early creation of the decentralized finance (DeFi) market.

But as with the broader cryptocurrency market, AI-focused projects have also increased in their numbers and identifying the legitimate and promising ones can be a bit challenging.

That’s why, in this guide, we take a closer look at the top AI-based crypto protocols that you should have on your watch list.

Quick Navigation

What is AI Crypto?

Before proceeding, let’s briefly explain AI crypto and why this sector has blossomed in the last few years.

At the forefront of crypto, AI crypto projects appreciated substantially, especially in the first quarter of 2024. The reason is not just hype; the combination of AI and blockchain technology has opened several windows of new use cases and applications for finance, data storage, cloud computing, and much more.

In decentralized finance (DeFi), for example, we can see different types of dApps using AI. Decentralized exchanges (DEXs) can use AI to facilitate trade automation through algorithms (as many automated market makers do).

AI can also improve the screening process for smart contracts, allowing founders to spot potential threats and vulnerabilities. In another example, AI is frequently used to produce generative art NFT projects, such as Interactive Non-Fungible Tokens (iNFTs), which incorporate intelligent traits and reasoning abilities.

There are currently hundreds of AI-based crypto projects, each targeting a specific market within and outside the space.

Best AI Crypto Projects to Watch This Year

Fetch.ai (FET)

Fetch.ai is one of the top crypto AI projects boasting billions in total market capitalization.

It allows users to leverage resources and tools to build and monetize their AI-powered crypto apps and services. However, one feature that distinguishes Fetch is autonomous economic agents.

These agents, which can be devices, services, organizations, or individuals, are capable of performing various tasks such as processing and sharing data among IoT (Internet of Things) devices, executing crypto transactions for users, and facilitating trades and swaps on decentralized exchanges like Uniswap through crypto trading bots.

The protocol operates on its own blockchain, powered by its utility token, FET. A unique aspect of its blockchain is its mixed consensus: Proof-of-Work (PoW) and Proof-of-Stake (PoS), in which miners validate transaction blocks and agents earn fees for executing multiple AI-related tasks.

For developers, Fetch offers a comprehensive suite of tools, including AI, Web3, and blockchain infrastructure, resources, and extensive documentation to create decentralized AI projects.

Likewise, Fetch also features the Open Economic Framework (OEF), an AI-driven layer that stores information for agents. This layer allows agents to interact and source information while nodes (miners) are rewarded with FET for facilitating these interactions.

Founders of Fetch.ai

Fetch.ai was founded in 2017 by:

Humayun Sheikh is a tech entrepreneur and previous founding investor in DeepMind (Google DeepMind).

Toby Simpson, another co-founder, has a background in software design, previously working at DeepMind as well. Thomas Hain, the third co-founder, is an academic with expertise in machine learning and artificial intelligence.

Funding

Fetch.ai has raised approximately $115.9 million in funding, including various rounds and notable investments, such as $40 million from DWF Labs in early 2024 (Pitchbook).

Notable Milestones

- Partnered with Singularity NET and Ocean Protocol, two prominent crypto AI projects, to launch the Superintelligence Alliance, merging AGIX, OCEAN, and FET into a single token called $ASI (Artificial Superintelligence).

- Launch of DeltaV: the launch of DeltaV meant a significant milestone for Fetch.ai. This feature simplifies complex tasks and enhances user experiences through AI-powered chat interfaces. It allows users to process everyday practical tasks, such as holiday bookings and finding electric vehicle charging points. Next to Agentverse and AI Engine, the chat system is part of the v0.21 release

- Raised over $40 million in funding from high-profile investors in early 2023.

- Main sponsor of London Tech Week for 2024.

- Became the largest crypto AI token by market capitalization by early 2024.

NEAR Protocol (NEAR)

NEAR Protocol is a layer-1 blockchain designed to provide a scalable and developer-friendly platform for building decentralized applications (dApps). It aims to overcome the limitations of other blockchain networks, such as Ethereum, by offering higher transaction speeds, lower costs, and improved usability.

It uses a unique technology called sharding to enhance its scalability and performance. Sharding involves splitting the network into smaller, manageable pieces called shards, each of which processes a portion of the network’s transactions in parallel. This architecture, known as Nightshade, allows NEAR to handle a large number of transactions per second — potentially up to 100,000 transactions per second (TPS) — while maintaining security and efficiency.

Another notable aspect of NEAR is its consensus mechanism — Thresholded Proof-of-Stake (TPoS).

The TPoS algorithm is quite similar to Delegated Proof-of-Stake (DPoS) in which validators are selected to process transactions and create new blocks based on the amount of NEAR tokens they stake. This system not only secures the network but also ensures decentralization by allowing anyone to participate as a validator. However, there are notable differences that can be read here.

Founders of NEAR Protocol

Behind NEAR is Alexander Skidanov and Ilya Polosukhin, who first launched the protocol as NEAR.ai.

Prior to founding NEAR, Skidanov worked as a software engineer at Microsoft and later joined MemSQL as a Director of Engineering.

Polosukhin has a background in artificial intelligence and machine learning. He previously worked at Google, where he was involved in several significant projects, including TensorFlow.

Funding

According to Cruchbase, Near Protocol has received $1.1 billion in funding from notable VCs, including Blockchange Ventures, ParaFi Capital, Hashed, MetaWeb Ventures.

Notable Milestones

- Over $1B in funding from over 60 investors, making it one of the top-funded crypto protocols.

- As part of its roadmap for 2024, the protocol rolled out User-Owned AI, a research and development lab for decentralized AI.

Render Network (RNDR)

Render Network is an Ethereum-based blockchain platform that aims to decentralize GPU cloud rendering by connecting those who need rendering services with owners of high-performance GPUs.

It is one of the top Solana projects.

This system enables artists, individuals, and companies to carry out rendering tasks more affordably and quickly than traditional centralized options.

The platform operates as follows: creators submit rendering jobs, and node operators use their spare GPU capacity to complete these jobs and earn RNDR tokens as compensation. Render Network supports a range of tasks, from basic rendering for gaming and entertainment to complex projects involving AI and machine learning.

The protocol also implements a tiered pricing system based on the reputation of node operators. The highest-rated operators fall into tier 1 and are typically the most expensive but offer more reliable and scalable services, often used by Render’s partners.

Tier 2 provides high-quality services at a reduced cost, and Tier 3 offers the most economical options, but reliability and scalability are not the highest-rated. This pricing structure supports the democratization of GPU cloud computing, particularly for Web3 creators, by adapting to various budget needs.

Founders of Render Network

The Render Network (RNDR) was founded by Jules Urbach, who is also the founder and CEO of OTOY, Inc., a cloud graphics company. The core team includes:

- Kalin Stoyanchev — Head of Blockchain

- Joshua Bijak — Project Lead, Charlie Wallace as the Chief Technology Officer,

- Phillip Gara — Director of Strategy

- Jayson Kleinman — Head of Business Development.

Funding

Render Network completed one round of fundraising. According to CoinCarp, the protocol brought in $30 million from a Seed round on December 21, 2021, from venture capital firms like Multicoin Capital and Solana Foundation and angel investors like Vinny Lingham.

Notable Milestones

- OctaneX is the spectrally-correct GPU production renderer for iPad.

- Raised roughly $30 million in 2018.

- Became one of the most sought-after rendering solutions for intensive rendering work in 2023 and early 2024, with the Render Network experiencing a 31% increase in RNDR

The Graph (GRT)

The Graph is a decentralized, open-source indexing protocol that collects, processes, and stores information and data similarly to a web browser like Google.

It allows users to navigate and explore different blockchain ecosystems and their respective dApps. The Graph is also available in at least 14 languages.

One of the key features of The Graph is Subgraphs, which are indices designed to enhance data querying for users across several networks, including EVM-compatible blockchains and even the InterPlanetary File System (IPFS).

Subgraphs can index all public information globally, bridging the gap between Web2 and Web3. This data can be stored, organized, and shared across applications, making it accessible for anyone to query. Naturally, users pay using the protocol’s native coin, GRT.

GRT has one of the largest supplies in the AI sector, with a max supply of 10,799,004,319 tokens and approximately 9.5 billion tokens in circulation.

Founders of the Graph

The Graph (GRT) was founded in 2018 by Yaniv Tal, Brandon Ramirez, and Jannis Pohlmann.

Yaniv Tal has a background in engineering and is renowned tech entrepreneur. Along with Ramirez and Pohlmann, Tal aimed to develop the first decentralized indexing and querying protocol for blockchain data to simplify the development of dApps.

Before founding The Graph, Yaniv Tal and Brandon Ramirez worked together at MuleSoft, a company specializing in enterprise integration, which was later acquired by Salesforce.

Funding

The verified funding rounds for The Graph are a $5.2 million seed round in July 2020, a $12 million public token sale in October 2020, an undisclosed seed round in January 2019, and a $205 million ecosystem fund raise in February 2022 led by several major investors.

Notable Milestones

- The protocol recently expanded to decentralized AI, creating Agentc, a ChatGPT-like tool with open-source code.

- It released the Sunrise Upgrade Program as part of the protocol’s roadmap, allowing users to perform certain tasks and earn GRT as reward.

BitTensor (TAO)

BitTensor is an open-source infrastructure built around a blockchain called Subtensor. It utilizes a unique consensus mechanism called Proof-of-Intelligence (PoI).

This mechanism resembles Proof-of-Work (PoW) by rewarding miners for their valuable contributions across various technology and research domains within the BitTensor network.

BitTensor functions as a decentralized marketplace with multiple subnets, each designed for specific tasks. Unlike parallel chains in systems like Avalanche, these subnets are competitive marketplaces tailored for AI, machine learning, data storage, price feeds, cellular automation, and more.

A notable example of a subnet in BitTensor is Decentralized AI Detection, where miners are incentivized to share findings, solutions, products, tools, and frameworks to help the network detect content generated by large language models (LLMs) like ChatGPT.

Anyone can create a subnet by paying a registration fee in TAO, BitTensor’s native token, and establish incentive mechanisms for miners and validators. Each subnet has validators who assess the quality of miners’ work and reward them with TAO.

BitTensor aims to democratize and commoditize AI and emerging technologies through blockchain technology.

Founders of BitTensor

The founders of BitTensor are Jacob Steeves and Ala Shaabana.

- Jacob Steeves has a Mathematics and Computer Science background from Simon Fraser University and has previously worked as a Software Engineer at Google.

- Ala Shaabana holds a PhD in Computer Science from McMaster University and has served as an Assistant Professor at the University of Toronto.

Funding

BitTensor was incubated by Polychain Capital, one of the largest crypto venture firms in the industry, and has invested over $200 million into the project.

Notable Milestones

- Released the BitTensor Language Model (BTLM) in cooperation with Cerebras.

- Became one of the largest AI crypto projects by democratizing and commoditizing AI and Machine Learning models.

- Is backed by Digital Currency Group (DCG), Polychain Capital, and Firstmark.

Akash Network (AKT)

Akash Network is one of the top AI crypto coins that introduces a cloud-computing marketplace where users can buy and sell cloud resources using AKT as the payment method.

Akash Network rose to prominence as one of the largest AI crypto coins thanks to its simple business model: users needing cloud computing can purchase resources from those with extra capacity, all in a peer-to-peer manner.

The platform’s main competitive edge is its ability to provide decentralized storage and asset ownership at a lower cost than traditional centralized systems, appealing to both businesses and individuals.

Akash has formed partnerships with leading institutions in the crypto space, such as Coinbase Prime, which offers custodial services for AKT, and Solve.Care, a blockchain-based healthcare platform aimed at decentralizing patient data and integrating blockchain benefits into healthcare systems.

Akash utilizes the Interplanetary File System (IPFS) for decentralized storage due to its enhanced security and resistance to censorship.

The rise in popularity of DeCloud (decentralized cloud), AI, and ML protocols has driven increased usage and renewed investor interest in Akash and similar AI coins.

Founders of Akash Network

Akash Network was founded by Greg Osuri and Adam Bozanich. Here’s a more detailed breakdown:

- Greg Osuri: Co-founder and CEO of Akash Network. Before founding Akash, he worked as a software engineer and entrepreneur. He founded AngelHack and was a contributor to the OpenStack project.

- Adam Bozanich: Co-founder and CTO. He has experience in software development and previously worked at Symantec.

- Bassel Menzalji: Co-founder, his previous experiences include business development and management roles.

- Gregory Gopman: Co-founder with a background in marketing and community building, Gopman is known for his work with AngelHack and Twitter.

Funding

Amount Raised: Akash Network has raised approximately $26.2 million over several funding rounds, including a notable $20 million Series A round led by Andreessen Horowitz in March 2021.

Notable Milestones

2024 has been a year of notable partnerships for Akash Network, which means the protocol has been adopted by platforms from several industries, including adoption in multiple industries, not just AI.

For instance, the protocol is collaborating with Solve.Care, an advanced blockchain-based healthcare platform.

By utilizing Akash’s decentralized compute resources, Solve.Care aims to provide patients with true ownership of their data while enhancing the security, transparency, and accessibility of datasets and reducing administrative costs for companies.

Similarly, Passage, a web3 platform for content creators, leverages Akash Network to reduce hosting costs, enhance accessibility, and improve video and rendering quality.

AIOZ Network (AIOZ)

AIOZ Network, created by the tech company AIOZ, is a blockchain-based platform that aims to deliver scalable and reliable solutions in Web3 storage, AI computing, live streaming, and video on demand.

The company, founded by Erman Tjiputra, focuses on making AI development more democratic and decentralized through its two main offerings: the W3AI marketplace for AI computation and the Web3 AI Platform, which provides a variety of AI solutions for businesses, developers, and individuals.

AIOZ operates on the Cosmos network and is compatible with BEP and EVM, using a Delegated Proof-of-Stake (DPoS) consensus mechanism powered by Tendermint Core that allows for up to 1,500 transactions per second. Its Decentralized Content Delivery Network (dCDN) utilizes a global network of nodes to provide additional computing power.

The network offers a decentralized marketplace for the Decentralized Physical Infrastructure (DePIN) market, enabling contributors to monetize their AI-related assets and computing resources.

This setup offers competitive costs for cloud computing and allows for the deployment of AI applications, benefiting businesses and developers by providing cheaper alternatives to traditional infrastructures.

Founders of AIOZ

Erman Tjiputra is the founder of AIOZ Network alongside Quang D. Tran.

Before AIOZ, Tjiputra was involved in various entrepreneurial ventures and has a software development and blockchain technology background. Similarly, as a technical analyst, Tran was involved in numerous AI and Machine Learning projects.

Funding

AIOZ Network has raised a total of $1.35 million during its fundraising rounds. This includes a private sale and an initial coin offering (ICO) that took place on April 2, 2021.

Notable Milestones

Some of the most notable milestones for AIOZ Network so far in 2024:

- AIOZ Network is the first DePIN project to be listed on Nvidia’s Accelerated Applications Catalog, placing AIOZ next to industry giants such as Adobe, Epic Games, and Autodesk.

- AIOZ Network reached a milestone after the launch of the AIOZ Node V3 in Q1 2024, which enabled 160,000 network nodes to access a broader range of GPU and CPU resources.

SingularityNET (AGIX)

SingularityNET is a marketplace for AI products and services. It allows users to create their AI-powered models through the protocol’s blockchain, which offers smart contract templates for faster and easier development and deployment.

The platform allows developers to build AI models and systems or purchase existing ones to integrate into their projects, creating a decentralized AI ecosystem that benefits both projects and developers. These and other transactions on the platform are carried out using the protocol’s native token, AGIX.

SingularityNET is one of the AI crypto projects due to its extensive offerings, featuring over 70 AI-powered services. These include:

- Domain-Specific Language (DSL): a self-organizing network of AI agents that can delegate tasks to each other.

- OpenCog Hyperon: an open-source general AI system based on OpenCog, a framework for developing AI models, robotics, and virtual embodied cognition.

- Training AI models: users can train and customize AI models for various services based on specific needs.

- Other services include speech command recognition, neural image generation, multilingual speech translators, real-time voice cloning, and more.

Founders of SingularityNET

SingularityNET was founded by Dr. Ben Goertzel and Dr. David Hanson.

Dr. Goertzel is a renowned AI researcher and author. He has previously worked on various AI projects and is known for his work with OpenCog and Hanson Robotics.

Meanwhile, Dr. Hanson is a robotics scientist known for creating lifelike robots. He founded Hanson Robotics, where he developed the humanoid robot Sophia.

Funding

SingularityNET raised approximately $36 million in their initial coin offering (ICO) in December 2017. This funding has been crucial for developing their decentralized AI platform.

Notable Milestones

- It reached the top ten list of largest AI crypto coins by market capitalization, reaching over $1 billion in the first quarter of 2024.

- Its coin, AGIX, broke records after reaching an all-time high of $1.46 on March 10, 2024.

- The protocol partnered with Minswap, the largest decentralized exchange (DEX) on Cardano, to explore and develop multiple integrations that mix AI with DeFi.

Ocean Protocol (OCEAN)

Through AI-powered smart contracts, Ocean Protocol allows data suppliers to sell specific data directly to consumers. This data can be from multiple industries, including healthcare, politics, finance, e-commerce, and more.

Ocean Protocol is one of the OGs in AI-crypto. It was founded in 2017 by Bruce Pon, an entrepreneur who established BigchainDB, a blockchain database software company, and AI researcher Trent McConaghy, who holds a PhD in Creative AI.

Ocean Protocol offers other appealing features. One is the Ocean Predictoor, which allows users to run AI-powered prediction or trading bots on crypto price feeds to generate yields.

It supports Javascript and Python and provides builders with a library of resources and tools to build AI decentralized applications and APIs to monetize them. Developers can leverage many features, such as IP ownership, access licenses, payment routing, analytics for on-chain data, and more.

Founders of Ocean Protocol

The co-founders of Ocean Protocol are Bruce Pon and Trent McConaghy.

- Pon has 13 years of experience in blockchain, data, and AI. He previously co-founded BigChainDB, a blockchain database company.

- Meanwhile, McConaghy is an AI researcher and tech writer.

Funding

Ocean Protocol has raised more than $5 million over its various funding rounds. According to the sources, the total amount raised is approximately $39.19 million, which includes both public and private funding rounds. The confirmed investors include Cypher Capital (Dubai), Outlier Ventures, and Cogitent Ventures.

Notable Milestones

Below are some of the most notable milestones for Ocean Protocol in 2024:

- Part of the Superintelligence Allicance, with SingularityNET and Fetch.ai

- Partnership with NIM Network to bring AI to gaming, adding Ocean Protocol to the AI Gaming Coalition.

- Launch of Data Farming (DF) rewards for users, allowing them to earn OCEAN by making predictions via Ocean Predictoor.

How to Buy AI Crypto?

There are two main ways to buy AI crypto tokens. The first is through centralized exchanges like Binance.

As a partner of Binance, CryptoPotato readers can receive exclusively a $600 voucher. Use this link to head to Binance. Open a new account, verify it, and then complete the following tasks for up to $600 free.

That said, once you have an account registered, you will need to navigate to the top of your main menu and in the right corner, click on the “depoist” button and select “buy crypto.”

From there, you will simply need to input your preferred currency and the cryptocurrency you want to buy. You can use a regular credit or debit card for this.

Alternative, you can also use a decentralized exchange (DEX), but that’s a more complicated process and would require more technical knowledge.

Is AI Good for Crypto?

AI and blockchain technology can synergize if both are used for their best purposes. As we’ve seen with the projects listed above, AI can be used for trading automation in a blockchain-based protocol, enhancing trading functions and price automation.

For crypto institutions, AI algorithms, through machine learning, are helping exchanges provide and fulfill trading orders quicker, develop chatbots that assist users, smart trading bots that can analyze market trends and predict price movements, and more.

Regarding security and on-chain analysis, blockchain firms can use AI to spot potential threats and vulnerabilities in a smart contract. Moreover, wallets and exchanges can use AI to detect suspicious activity or flag addresses that have been poisoned or belong to a malicious actor.

Even in mining, we see AI and crypto merging, as AI marketplaces can provide or optimize computing power allocation for users.

There are certain drawbacks, however, and we can summarise them as follows:

- Centralization: There’s a growing concern in the public that leading AI companies are working on their AI models behind closed doors, leaving investors and users out of the picture and raising concerns over the lack of transparency and power centralization. Projects like BitTensor try to democratize AI developments and innovation by rewarding users for sharing their discoveries and models.

- Black Box Problem: AI algorithms can be opaque, making it difficult to understand their decision-making processes. The black box problem refers to the challenge of transparency and interpretability of AI algorithms during their time of existence and may complicate/strain operations in crypto projects.

- New risk and security challenges: introducing AI in crypto could mean new risks and vulnerabilities that malicious actors can exploit.

Best AI Crypto Projects – Conclusion

There are multiple ways in which AI and crypto can work, from fraud detection, smart contract security, and on-chain analysis to cloud-based resources, mining, and trading optimization.

The marriage between AI and crypto has opened new windows of use cases and applications for multiple industries. However, their drawbacks must be addressed and analyzed thoroughly to mitigate their negative impact on users and investors.

SPECIAL OFFER (Sponsored)

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

News

Pepe Investors Seek New Rewards From Rival Token Mpeppe (MPEPE) at $0.0007

As the cryptocurrency market continues to expand, investors are constantly looking for new opportunities to maximize their returns. Pepe (PEPE), a meme coin inspired by the iconic Internet character Pepe the Frog, has been a staple in the meme coin arena. However, recent developments have shifted some investors’ attention to a promising new competitor: MPEPE (MPEPE). Currently trading at $0.0007, Mpeppe is attracting significant interest from those looking to diversify and capitalize on the next big thing.

Pepe’s appeal (PEPE)

Pepecoin (PEPE) has carved out a significant niche for itself in the cryptocurrency market, largely due to its vibrant community and roots in internet meme culture. Drawing inspiration from the popular meme character Pepe the Frog, Pepe (PEPE) has captured the attention of cryptocurrency enthusiasts and meme enthusiasts alike. This fusion of humor and community spirit has been instrumental in its rise within the cryptocurrency space.

The continued success of Pepecoin (PEPE) can be attributed to its active and dedicated community. Holders of the coin are known for their enthusiastic promotion on social media platforms, which helps maintain its visibility and popularity. This strong community support has been instrumental in sustaining Pepe (PEPE)’s momentum and driving its market performance. Recent whale activity, such as a massive transfer of 9 trillion PEPE tokens valued at $82 million to Bybit, further highlights the coin’s potential for significant price movements driven by large-scale transactions.

Mpeppe (MPEPE): the rising star

Mpeppe (MPEPE) differentiates itself by merging the realms of sports and cryptocurrency. Drawing inspiration from soccer sensation Kylian Mbappé and leveraging the legacy of the Pepe (PEPE) meme coin, Mpeppe offers a unique appeal that resonates with both sports fans and cryptocurrency investors. This innovative fusion is attracting a diverse and engaged audience, fostering a vibrant community around the token.

A large ecosystem

Differentiating itself from typical meme coins, Mpeppe (MPEPE) features a robust ecosystem that includes gaming and sports betting platforms, NFT collectibles, and social interaction features. These utilities provide real value to users, creating multiple channels for engagement and investment. This comprehensive approach positions Mpeppe as more than just a meme coin, offering a richer and more engaging experience for its users.

Investment Potential of Mpeppe (MPEPE)

Strategic Tokenomics

Mpeppe (MPEPE) has been strategically priced at $0.0007, making it accessible to a wide range of investors. Tokenomics is designed to support long-term growth, with allocations for presales, liquidity, and sports activities. This strategic distribution ensures stability and promotes community engagement, positioning Mpeppe for substantial growth.

Analysts’ optimism

Market analysts are optimistic about the potential of Mpeppe (MPEPE). The coin’s innovative approach, strong community, and strategic partnerships are expected to drive significant price increases. Early investors stand to benefit from substantial returns as Mpeppe gains traction in the market. Analysts note that Mpeppe’s combination of utility and community engagement positions it well for future growth, especially as the cryptocurrency market continues to evolve.

The impact of similar competing businesses

Driving Innovation

Competition between similar assets such as Pepe (PEPE) and Mpeppe (MPEPE) is a catalyst for innovation. Each project strives to outdo the other, resulting in continuous improvements and new features. This dynamic competition benefits investors, offering them better and more advanced products.

Market diversification

Having multiple competing assets in the market promotes diversification. Investors have more options to choose from, which can help spread risk and potentially increase returns. The presence of strong contenders like Pepe (PEPE) and Mpeppe (MPEPE) ensures a vibrant and resilient crypto ecosystem.

Increased market interest

Competition between similar assets also generates increased market interest. As projects compete for attention, they attract more investors and media coverage, leading to increased visibility and adoption. This increased interest can drive further investment and growth in the sector.

The Future of Mpeppe (MPEPE)

Strategic development

Mpeppe (MPEPE) has a clear and ambitious roadmap for the future. Development plans include expanding its gaming and sports betting platforms, launching new NFT collections, and forming strategic partnerships. These initiatives are designed to improve user experience and drive market growth.

Community Growth

The success of Mpeppe (MPEPE) will largely depend on its ability to build and sustain a strong community. By focusing on engagement and providing valuable utility, Mpeppe aims to foster a loyal and active user base. This community-driven approach is expected to play a significant role in its long-term success.

Conclusion: A New Horizon for Meme Coin Investors

In conclusion, while Pepe (PEPE) has established itself as a significant player in the meme coin market, Mpeppe (MPEPE) offers a fresh and innovative approach that is capturing the interest of investors. With its strategic pricing, comprehensive ecosystem, and potential for high returns, Mpeppe (MPEPE) represents an exciting opportunity for those looking to diversify their cryptocurrency portfolios. As always, investors should stay informed and consider multiple factors before making investment decisions. Embrace the potential of Mpeppe (MPEPE) and join the journey to new rewards in the cryptocurrency world.

For more information on the pre-sale of Mpeppe (MPEPE):

Visit Mpeppe (MPEPE)

Join and become a member of the community:

Italian: https://t.me/mpeppecoin

Italian: https://x.com/mpeppecommunity?s=11&t=hQv3guBuxfglZI-0YOTGuQ

News

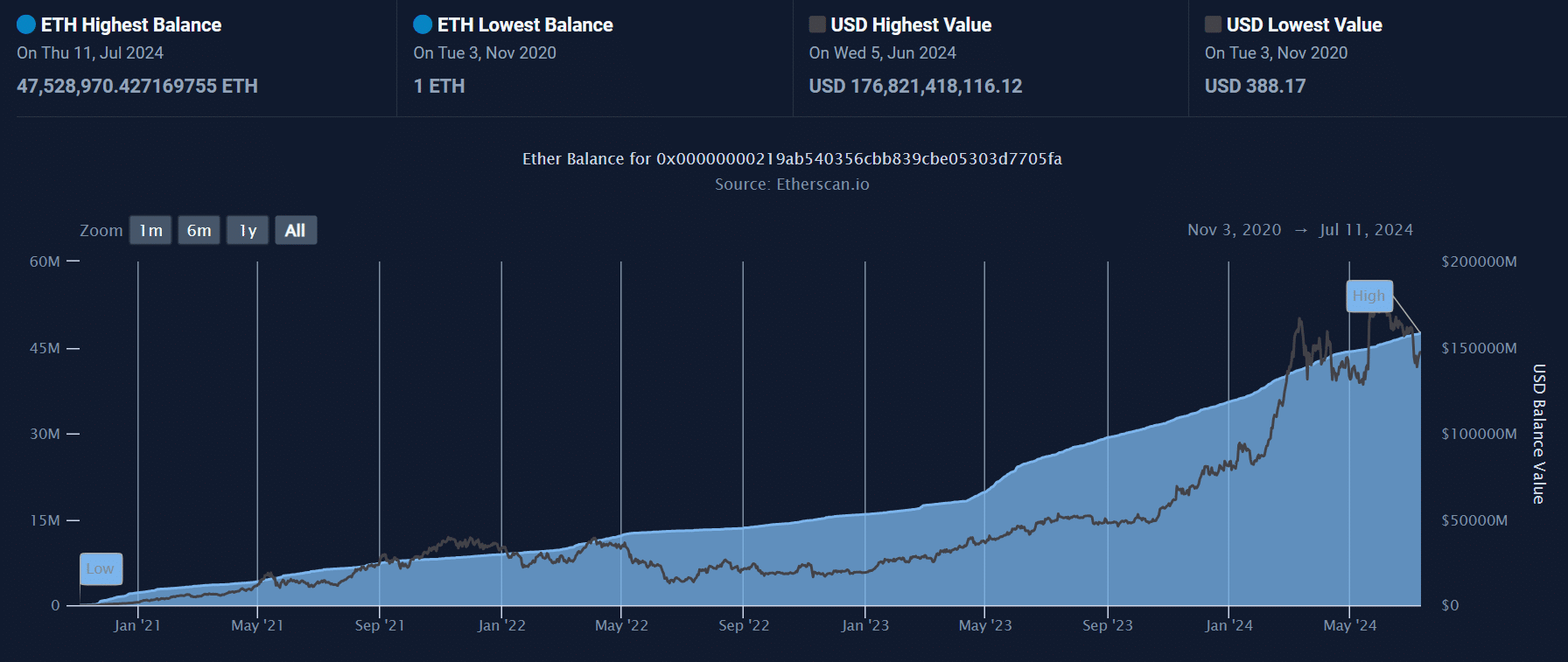

Golem Project Joins ETH Staking Frenzy, Locks Up 40,000 Tokens

- The Golem project has moved over $124 million in ETH for staking.

- Ethereum staking frenzy has increased ahead of the launch of spot ETH ETFs in the US.

Ethereal [ETH]The Project Golem-based distributed computing marketplace has joined the ETH staking frenzy.

On July 11, contrary to its recent sell-off, the company reportedly staked 40K ETH worth over $124.6 million, according to Lookonchain data.

Golem Network has confirmed its Ethereum staking initiative and said its purpose was to “create space” to help participants contribute to the network.

“The Golem Ecosystem Fund is officially launched today! We have staked 40,000 ETH from Golem’s treasury. This will create a space where developers, researchers, and entrepreneurs can bring their ideas to life and contribute to the Golem Network and its ecosystem!”

Ethereum Staking Frenzy

The staking frenzy has infected Ethereum, with just days to go until the potential launch of a spot ETH ETF in the United States. Recently, an unmarked address blocked over 6K ETH.

The Golem project’s decision to lock up 40K ETH on July 11th pushed the total ETH locked up to Chain of lights at an all-time high of 47.5 million ETH, worth over $140 billion based on market prices at press time.

Beacon Chain is Ethereum’s system that manages the validation of new blocks.

Source: Etherscan

According to a recent AMBCrypto relationshipIncreased ETH staking ahead of the debut of the ETH spot ETF in the US has underscored bullish sentiment.

More ETH has been moved from exchanges, further strengthening bullish expectations.

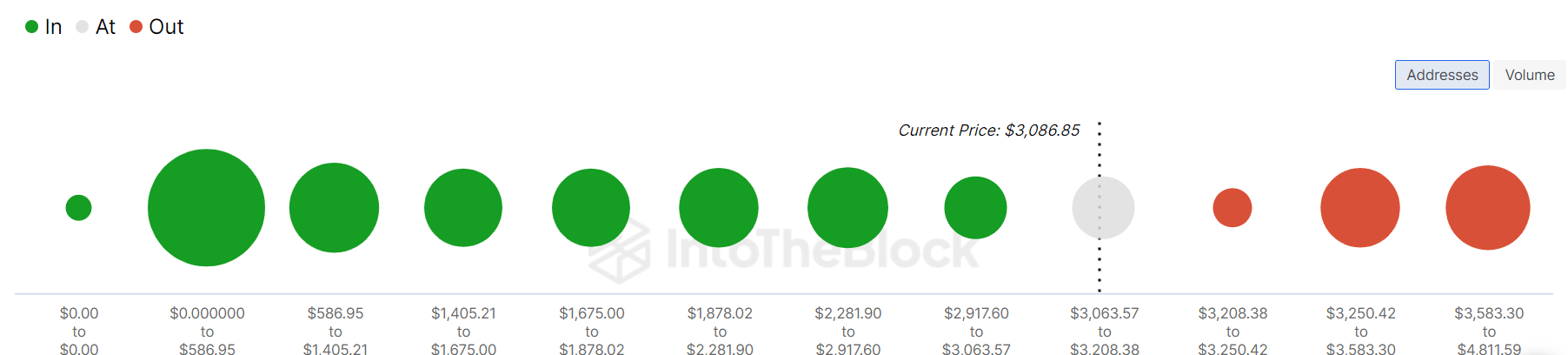

Meanwhile, from a short-term perspective, many addresses were losing at the $3.2K and $3.5K levels. Investors could try to take a profit if they break even.

These prices represent key levels to watch in the short term.

Source: IntoTheBlock

Next: Why Bitcoin Must Surpass $61K Soon, According to Analysts

News

BlockDAG Thrives While Chainlink and FTM Tokens Decline

As the cryptocurrency space turns bearish, giants like Chainlink and Fantom are facing setbacks with declining trends for LINK and FTM. Amid these changes, BlockDAG emerges as a prime target due to its promising pre-sales and long-term prospects. This Layer-1 project boasts an innovative Low Code No Code ecosystem, attracting investors with potential ROIs exceeding 30,000x. The pre-sales momentum has already accumulated over $57.6 million, driven by growing investor enthusiasm.

Impact of Chainlink’s Recent Token Release

Chainlink’s recent move to release 21 million LINK tokens, worth approximately $295 million, from its dormant supply contracts has significant market implications. This release sent 18.25 million LINK to Binance, fueling speculation that the price will drop. LINK is currently trading at $13.64, approaching its critical support at $13.5, with the potential to drop to $10 if this level breaks.

These releases, increasing the circulating supply above 600 million LINK, have previously maintained price stability, but the prevailing bearish conditions could alter this trend. With 391.5 million LINK pending release, market caution persists.

Fantom (FTM) Market Position Dynamics

Fantom experienced a strong buying spree last November, but its valuation has been challenging lately. After peaking near $1.20 in March, subsequent resistance and profit-taking pushed its price lower. FTM recently dipped below the crucial $0.600 mark but found some ground around $0.500. Fantom is currently valued at $0.559 with a market cap of $1.67 billion and daily trading volume of $257.56 million.

The Fantom Foundation’s decision to award over 55,000 FTMs quarterly to major dApps on the Opera network has invigorated user participation. Indicators such as RSI and MACD suggest a possible bounce if it surpasses the $0.600 mark. Failure to break above the 200-day EMA could prolong the bearish outlook.

BlockDAG Pre-Sale Triumph and Innovative Platform

BlockDAG’s pioneering low-code/no-code platform enables the seamless creation of utility tokens, meme tokens, and NFTs, catering to a broad user base. Its intuitive templates allow enthusiasts to quickly launch and customize projects, thereby democratizing blockchain development and accelerating market entry.

The cutting-edge features of this platform have attracted cryptocurrency investors, significantly increasing the interest in the presale. BlockDAG has successfully raised over $57.6 million, witnessing a 1300% escalation in the coin’s value from $0.001 to $0.014 in its 19th batch. This impressive rise underscores the immense return potential of BlockDAG for early backers.

Additionally, BlockDAG’s commitment to expanding its ecosystem extends to supporting the development of decentralized apps. This fosters a wide range of new projects in the blockchain domain, from digital art platforms to tokenized assets, enriching the blockchain ecosystem.

Key observations

While Chainlink and Fantom are currently navigating bearish trends due to token releases and resistance hurdles, BlockDAG’s innovative low-code/no-code framework positions it as an attractive investment option. With a presale raise of over $57.6 million and prices skyrocketing 1300% in recent batches, BlockDAG shows tremendous potential for returns of up to 30,000x. Amidst the market volatility impacting Chainlink Tokens and Fantom, BlockDAG stands out as a promising avenue for cryptocurrency traders.

Sign up for BlockDAG Pre-Sale now:

Website: https://blockdag.network

Pre-sale: https://acquisto.blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: Italian: https://discord.gg/Q7BxghMVyu

Disclaimer: The statements, views and opinions expressed in this article are solely those of the content provider and do not necessarily represent those of Crypto Reporter. Crypto Reporter is not responsible for the reliability, quality and accuracy of any material in this article. This article is provided for educational purposes only. Crypto Reporter is not responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Do your own research and invest at your own risk.

News

a new era for DEX tokens

The DEX aggregator Anger Trading is about to issue its RAGE token on the new Layer 1 blockchain Hyperliquid. The token sale is scheduled for August 7, with 20 million tokens out of a total supply of 100 million available on Fjord Foundry at a fixed price of $0.30.

Additionally, the “Rage Quit” feature has been introduced, which allows private investors to get their allocation early by accepting a 60% cut.

RAGE will be among the first tokens to be launched on Hyperliquidmarking a significant moment for this new blockchain. Let’s see all the details below.

DEX News Rage Trade: New RAGE Token Arrives on Hyperliquid

As expected, decentralized exchange (DEX) aggregator Rage Trade has announced the issuance of its new token ANGER. The launch is happening through a liquidity generation event and token sale on Fjord Foundry, scheduled for August 7th.

The token will be launched on the newly launched layer 1 blockchain Hyperliquidwhich has rapidly gained popularity due to its decentralized perpetual exchange.

Rage Trade currently aggregates platforms such as GMX, Synthetix, Dydx, Aevo and Hyperliquid, allowing traders to manage their positions across multiple blockchains and earn incentives.

During the event, 20 million RAGE tokens will be sold at a fixed price of $0.30, while another nine million will be used to inject liquidity into Hyperliquid.

Additionally, six million tokens have been reserved for future market making and product development incentives.

The token will have a total supply of 100 million, with 20% earmarked for sale and 30% for community treasury. The latter is subject to a 12-month lock-up period and a 24-month linear release.

The “Rage Quit” feature introduces a deflationary mechanismThis allows private investors and recipients of the air launch to receive their assignment after an initial three-month stalemate, accepting a 60% cut.

Rage Trade has chosen Hyperliquid as the platform for its token after the network became the preferred choice of users of the Anger Aggregatorwith over 1,300 users generating $445 million in volume.

Hyperliquid surpasses dYdX in TVL

Hyperliquid, the exchange decentralized based on Referee, recently introduced a new points program, which has catalyzed significant growth in total value locked (TVL) on the platform.

According to data from DefiLlama, Hyperliquid has reached a TVL of $530 million, surpassing dYdX’s $484 million and reaching a new all-time high.

This figure places Hyperliquid in second place among derivatives platforms, just behind GMX, which maintains a TVL of $542 million.

Rounding out the top five platforms by TVL are Solana-based Jupiter with $415 million and Drift with $365 million. Hyperliquid had a stellar year in 2024, jumping from eighth to second place in just six weeks.

This rapid increase was largely attributed to the new Hyperliquid points program, which launched on May 29.

The points program provides for the distribution of 700,000 points weekly for four months. With an additional 2 million points awarded for activity between May 1 and May 28.

Despite community criticism over the decision to extend the incentive program and delay the token launch and airdrop, the platform has continued to attract numerous traders.

From Perpetual DEX to Layer 1

Steven, founding member of Capital Yuntwhich has backed some of the largest cryptocurrency firms, including Zerion, noted that Hyperliquid has distributed approximately 51 million points in four periods.

He further stressed that the project aims to reward its early adopters and move from simply being a perpetual DEX to a true Layer 1:

“The team is clearly making an effort to communicate that Hyperliquid is an L1 and not just a DEX for derivatives.”

Furthermore, he highlighted that the token holders PURSUE were significantly rewarded, with a 23% increase in the token’s value.

PURR was the first spot token launched on Hyperliquid and looks set to continue receiving attention and incentives from the platform.

-

Videos6 months ago

Videos6 months agoJapan just triggered PANIC IN THE GLOBAL MARKET! [CRYPTO DUMP]

-

News9 months ago

News9 months agoNew Crypto Wallet Collects Over 350 Billion PEPE Tokens: Can This Make Memecoin Soar? ⋆ ZyCrypto

-

Memecoins8 months ago

Memecoins8 months agoOver 1 million new tokens launched since April

-

News7 months ago

News7 months agoGolem Project Joins ETH Staking Frenzy, Locks Up 40,000 Tokens

-

News7 months ago

News7 months agoa new era for DEX tokens

-

Memecoins7 months ago

Memecoins7 months agoSolana Sets New Records With Its Memecoins

-

Bitcoin8 months ago

Bitcoin8 months agoCrypto Analyst Predicts Record Bitcoin Gains Before October Amid Global Liquidity Shifts ⋆ ZyCrypto

-

Bitcoin7 months ago

Bitcoin7 months agoCrypto President Trump’s ‘Lesser’ Regulation Will Bless Coinbase’s Bitcoin Leverage, Expert Says – Coinbase Glb (NASDAQ:COIN)

-

News6 months ago

News6 months agoPepe Investors Seek New Rewards From Rival Token Mpeppe (MPEPE) at $0.0007

-

Memecoins9 months ago

Memecoins9 months agoSolana co-founder strongly supports meme coins; highlights memecoin migration from ETH to Solana ⋆ ZyCrypto

-

Videos9 months ago

Videos9 months agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

Memecoins9 months ago

Memecoins9 months agoAI Tokens Take the Baton from Memecoins to Drive a Market Rebirth ⋆ ZyCrypto