News

Regulation of crypto-tokens: Spotlight on the DFSA’s feedback statement | Canada | Global law firm

In April we published a briefing note that reported on the Dubai Financial Services Authority’s (DFSA) consultation paper on the regulation of crypto-tokens (CP143). Despite being only 50 pages CP143 covered a wide range of issues including what a crypto-token is, how they can be marketed and the regulatory requirements applicable to them. The DFSA’s reasoning for making the consultation so wide ranging was due to the increasing use of crypto-tokens as a medium for financial transactions in the UAE and their connectivity to the mainstream financial system via trading facilities is growing.

In October the DFSA published its widely anticipated feedback statement to CP143 in which it sets out its thinking where changes have been made to its consultation proposals or where changes have not been made. The purpose of this briefing note is to highlight some of the key points arising from the feedback statement.

Taxonomy

In CP143, the DFSA opted for a broad definition of crypto-token that was taken from an earlier consultation paper published last year (CP136) and subsequently adopted in the Glossary (GLO) module. The regulator proposed that such crypto-tokens falling within this definition would include crypto currencies, hybrid utility tokens and asset referenced tokens. Certain tokens, which the DFSA called ‘Excluded Tokens, would fall outside the definition, these included non-fungible tokens (NFTs) and central bank digital currencies (CBDCs). In terms of utility tokens (UTs), these would be Excluded Tokens unless they were hybrid UTs.

Definition

In the feedback statement, the DFSA reports that it has not made any major changes to the classification or definition of crypto-tokens. However, it has provided further guidance to the market on crypto-token taxonomy by providing a chart and table that provides a deeper dive into the application of the rules. In addition, the DFSA has also produced a crypto-token decision tree intended to help market participants classify the type of crypto-token they intend to operate and whether it will be permitted in the DIFC. The DFSA also states that when the regime commences (see below) it will put on its website an initial list of crypto-tokens that are recognised and that such crypto-tokens will not need to go through the formal recognition process.

Accepted Crypto Tokens

The DFSA reports that, as expected, there were a number of comments regarding its definition of a crypto token arguing that its definition is broadly aligned with that used by the Financial Action Taskforce (FATF) albeit that the DFSA changed “used” to something that is “used or intended to be used” and added “used as a medium of exchange” to further clarify the application1.

In relation to fiat crypto-tokens, the DFSA has made changes in light of the confusion caused by the proposed use of the terms “Asset Reference Token” and “Fiat Crypto Token”. Any reference to “Asset Reference Token” has been removed. “Fiat Crypto Token” has now been defined as a crypto token whose value is determined by reference to a fiat currency or a combination of fiat currencies. Such crypto-tokens will need to undergo a recognition process and meet additional requirements set out in GEN2 3A.3.4(4). Where used by clearing houses, the fiat token will also need to meet additional governance and risk management criteria set out in AMI3 7.2.5A. Other crypto-tokens that reference their price against any asset, other than fiat currency, will not fall within the definition. Instead, they will fall within the wider definition of a crypto-token unless they are a derivative token or a security token.

Excluded tokens

The DFSA has kept in place the narrow definition of NFTs and has added further guidance to help market participants determine whether the crypto-token they wish to use is an NFT. The feedback statement also touches on “fractionalisation”, which is a process used to depart from the unique nature of the NFT where the token is distributed to multiple persons or relates to different reference assets.

In response to questions on gaming tokens the DFSA states that the key question will be whether the crypto-token will meet the narrow definition of an NFT or UFT.

In terms of UFTs, the DFSA provides further examples and guidance in GEN and in the feedback statement deals with a common market misconception where the crypto currency is labelled a UT despite the token having the characteristics of a crypto-token that is used or intended to be used for investment purposes. The DFSA warns that it will not be relying on labels and will instead adopt a “substance over form” approach when classifying tokens. Authorised firms are prohibited from providing services relating to UFTs although licensed custodians in the DIFC may safeguard and administer these tokens on behalf of their clients.

Excluded tokens also include CBDCs but in contrast to NFTs and UTs, CBDCs may be used by authorised firms and their clients if and when they are made available to the public.

Designated Non-Financial Business or Profession – NFTs and UTs

A significant policy change that the DFSA has made is to bring both NFTs and UTs within the anti-money laundering / countering the financing of terrorism (AML/CFT) regime. Originally only NFTs would be in the regime but this has changed to counter the potential money laundering risks and provide a level playing field.

The DFSA has inserted this requirement in AML 3.2.1 providing that a person who carries on the business or profession of issuing, or providing services related to, a NFT or UT must apply to the DFSA to be registered as a Designated Non-Financial Business or Profession.

The feedback statement highlights the exclusion to this requirement which applies to issuers where each issue involves a single transaction, or series of multiple interrelated transactions that are equal to or less than USD 15,000 in value; or in the case of a service provider, where the service constitutes solely technology support or technology advice to an issuer. The DFSA clarifies that such exclusion will not apply to NTF exchanges, either operating in a centralised or decentralised manner, on the basis that they will not be viewed as solely providing a technology service as they also bring together buyers and sellers who wish to transact in NFTs.

Prohibited tokens

In CP143 the DFSA proposed banning privacy tokens and devices and algorithmic tokens. The DFSA confirms in the feedback statement that it is proceeding with the ban. It also provides further clarification on whether the use of VPNs and self-custody wallets would constitute a privacy device.

Recognition

In the feedback statement the DFSA reaffirms its consultation position that, despite many respondents arguing to the contrary, no financial services or activities can be undertaken with a crypto-token unless it is first recognised. This extends to derivatives transactions relating to crypto-tokens and to funds or portfolio managers that invest directly or indirectly in crypto tokens.

In terms of the recognition process itself, the DFSA has provided further information as to how it sees it working. For instance, the DFSA will generally issue a notice on its website of the fact that it has received an application for recognition of a specific crypto-token. It does not also rule out the possibility of receiving duplicate applications from separate firms. The DFSA feels that duplicative applications may be a useful source of insight on the same token, and will address them on a case-by-case basis.

The DFSA will publish a notice on its website every time a new crypto-token is recognised for use in the DIFC. The list on its website will be updated accordingly. It will also publish a notice when it decides not to recognise a crypto-token. The intention here is to help potential applicants avoid making an application that has been previously refused.

The feedback statement discusses the position as regards the recognition process in the event of forks4 and air-drops5. In terms of forks, the DFSA confirms that it will need to re-assess and conclude whether one or both tokens coming out of the fork are to retain recognition status. As forks are usually planned the DFSA states that applicants should, where possible, identify them and their expected effects when applying for initial recognition. For air-drops the recognition approach will be the same.

In relation to ongoing monitoring to ensure that the crypto-token remains suitable for recognition the DFSA states that this is not a daily obligation but one that requires vigilance from firms. The DFSA expects firms, in the normal course of business, to make themselves aware of changes or significant developments in products they offer to clients.

In line with its proposals in CP143 the DFSA will create an initial list of recognised crypto tokens that will not need separate recognition via the formal application process. Those crypto-tokens on the list will be recognised when the regime comes into force. Significantly, the DFSA states that the list will be a one-off exercise and whilst it can be altered it cannot be expanded.

The feedback statement also touches on the de-recognition process where a crypto-token’s recognised status is revoked. Importantly, the DFSA states that a crypto-token’s falling price should not of itself be a reason for de-recognition. Instead major hacks, serious fraud, lack of transparency are cited as potential reasons for revocation of recognition status. Where de-recognition occurs the DFSA will publish a notice on its website.

Requirements

The feedback statement covers various miscellaneous on-going requirements. These include:

- Despite some objections the requirement for technology governance and audit remains. The DFSA has clarified its expectations in this area in COB6 15.8 and adjusted the requirements and expectations that a technology audit should be an audit of a firm’s compliance with the technology in 15.7.

- Disclosure requirements for fiat crypto-tokens have been strengthened and added to COB 15.3.2 and, in respect of the Key Features Document, 15.3.1 and 15.5.1.

- Further guidance has been added to COB 15.5 regarding what the DFSA would consider “fair and balanced” when a firm provides forecasts for crypto-tokens based on past performance.

- The hair cut for professional clients has changed from 80% to 66% of the market value of the crypto-token. However, only recognised crypto-tokens may be taken into account.

- It is down to firms themselves to decide on the appropriate method of proving ownership in a crypto-token. The DFSA provides certain examples including that a firm may use a blockchain analytics firm, documentary evidence from a custodian, a demonstration of the client holding private keys in a hosted or un-hosted wallet or any other method they deem reliable.

Branches

The starting point is that the DFSA wants firms providing services in crypto-tokens to be incorporated in the DIFC. Significantly, the DFSA has, however, changed its position as consulted on in CP143 and is prepared to allow authorised firms in the DIFC, who are currently operating as a branch of a foreign financial institution, to continue operating as a branch and provide services relating to crypto-tokens without having to establish a DIFC body corporate. However, such authorised firms will need to meet the conditions set out in GEN 7.2.2(8) and these conditions include that the head office of the branch is authorised to carry on the crypto activity. This proposal will have the effect of prohibiting, at least for the foreseeable future, many DIFC firms which are established as branches from providing services in crypto-tokens, since many jurisdictions do not currently regulate crypto activities.

Equivalence

The DFSA will publish on its website a list of regional and foreign jurisdictions that it has recognised as having an equivalent regulatory regime. The DFSA may recognise jurisdictions as being equivalent for only specific activities or services.

Funds

The feedback statement makes a number of points clarifying the position for the asset management industry. These include:

- Any business set up to manage assets that include crypto-tokens must be established in the DIFC and consist only of recognised crypto-tokens.

- The offering and marketing of funds of funds that contain crypto-tokens must consist of recognised crypto-tokens.

- The offering and marketing of exchange traded funds that contain crypto-tokens must consist of recognised crypto-tokens.

- Where a fund invests in another fund or entity which has a total exposure to crypto-tokens that does not exceed 5% of the gross value of the fund or entity, then those crypto-tokens do not have to be recognised crypto-tokens.

- No self-custody for funds consisting of crypto-tokens will be permitted.

- The DFSA has rejected the idea of a threshold for crypto-token funds.

- The DFSA will not allow foreign or external funds in relation to crypto-tokens to be offered or marketed in or from the DIFC, even to sophisticated investors. It will also not allow an external fund manager to manage a domestic (i.e. DIFC) fund that invests in crypto tokens.

Trading venues

The feedback statement also makes a number of points clarifying the position as regards trading venues. These include:

- The DFSA has changed its position as consulted on in CP143 that a crypto trading venue could be operated as either an exchange or a multilateral trading facility (MTF). The DFSA is now of the view that only an MTF will be permitted to be used as a trading venue for crypto-tokens.

- An operator of an MTF should carry out an appropriateness test for providing services relating to crypto-tokens.

- The DFSA has changed the position in terms of forums and the requirement in the Markets Law and the Code of Market Conduct that “all persons using the forum had equal access to information posted on that forum”. The DFSA has made a change to the text so that it is clear that the provision excludes the operator given that it will naturally have access to different information.

- Trading on own account by the operator is not permitted on their own venue under any circumstances.

Exposures

The DFSA confirms in the feedback statement that firms should treat any direct crypto exposures for prudential purposes using the following formula found in the Bank for International Settlements’ June 2022 consultation paper, Prudential treatment of cryptoasset exposures:

Risk-weight of 1250% * MAX [Long Positions; Short Positions]

where gross positions to Crypto Tokens are kept under 1% of Tier One Capital.

Implementation

The DFSA will be introducing a transition period for the new regime as trailed in CP143.

A six month transitional period will start on the date when the new rules come into force – 1 November 2022. However, the transitional period only applies to persons who before 1 November were authorised persons and were carrying on a financial services activity relating to a crypto-token. Furthermore, it only applies to the continuation of those same activities. Once the transitional period ends such authorised persons will need to have in place the correct permissions from the DFSA.

The feedback statement contains some useful information for those firms that wish to submit a pre-application form including a link where the form can be found (it will be available from 1 November) and the supporting documents that will be required.

Firms should also note that the transitional period does not relieve them from complying with key obligations such as the Principles for Authorised Firms, financial promotion requirements, market abuse provisions, AML requirements, provisions prohibiting misconduct (e.g. misleading, deceptive, fraudulent or dishonest conduct), and the prohibition relating to the use of privacy tokens. Authorised firms looking to vary their licence, or new companies seeking a DFSA licence to carry out crypto token business will need to ensure that their AM/CFT policies and procedures are effective for combatting money laundering / terrorist financing risks associated with their business model.

Future work

Finally, the feedback statement contains a short section covering the DFSA’S future work on crypto-tokens. Among other things the DFSA accepts that there are areas in its Rulebook where further guidance is needed. Decentralised Finance (DeFi) is also touched on and the DFSA will be presenting its regulatory strategy on this in its next consultation on crypto-tokens. In the meantime the DFSA has introduced (COB 15.6.5) a requirement that staking is permitted in the DIFC where facilitated or arranged by DFSA licensed entities, only where the activity is provided to non-retail clients and the purpose of the staking is for the borrower to take part in the proof-of-stake consensus mechanism for a recognised crypto-token.

Final comment

With the publication of the feedback statement and final rules authorised firms will need to assess whether they wish to vary their licence or, if they are a branch, whether they can. New firms looking to carry out crypto-token business will need to apply for a new licence. In both instances, the firm will need to be prepared and be able to show its fitness and readiness to operate a crypto-token business. In this regard the DFSA picks out the following that it will assess among other things:

- The business model and the firms understanding of the application of the DFSA rules.

- The level and fitness of the firm’s human and financial resources.

- The level of preparations the firm has undertaken to operate a regulated crypto-token business.

As mentioned above the DFSA has stated that further guidance is needed. But in the meantime it stresses that it expects both authorised firms looking to vary their licence and new firms to ensure that their AML/CFT policies and procedures are effective in combatting money laundering / terrorist financing risks associated with their business model. Firms that pose a higher level of money laundering / terrorist financing risk can expect to receive an increased level of supervisory focus.

News

Pepe Investors Seek New Rewards From Rival Token Mpeppe (MPEPE) at $0.0007

As the cryptocurrency market continues to expand, investors are constantly looking for new opportunities to maximize their returns. Pepe (PEPE), a meme coin inspired by the iconic Internet character Pepe the Frog, has been a staple in the meme coin arena. However, recent developments have shifted some investors’ attention to a promising new competitor: MPEPE (MPEPE). Currently trading at $0.0007, Mpeppe is attracting significant interest from those looking to diversify and capitalize on the next big thing.

Pepe’s appeal (PEPE)

Pepecoin (PEPE) has carved out a significant niche for itself in the cryptocurrency market, largely due to its vibrant community and roots in internet meme culture. Drawing inspiration from the popular meme character Pepe the Frog, Pepe (PEPE) has captured the attention of cryptocurrency enthusiasts and meme enthusiasts alike. This fusion of humor and community spirit has been instrumental in its rise within the cryptocurrency space.

The continued success of Pepecoin (PEPE) can be attributed to its active and dedicated community. Holders of the coin are known for their enthusiastic promotion on social media platforms, which helps maintain its visibility and popularity. This strong community support has been instrumental in sustaining Pepe (PEPE)’s momentum and driving its market performance. Recent whale activity, such as a massive transfer of 9 trillion PEPE tokens valued at $82 million to Bybit, further highlights the coin’s potential for significant price movements driven by large-scale transactions.

Mpeppe (MPEPE): the rising star

Mpeppe (MPEPE) differentiates itself by merging the realms of sports and cryptocurrency. Drawing inspiration from soccer sensation Kylian Mbappé and leveraging the legacy of the Pepe (PEPE) meme coin, Mpeppe offers a unique appeal that resonates with both sports fans and cryptocurrency investors. This innovative fusion is attracting a diverse and engaged audience, fostering a vibrant community around the token.

A large ecosystem

Differentiating itself from typical meme coins, Mpeppe (MPEPE) features a robust ecosystem that includes gaming and sports betting platforms, NFT collectibles, and social interaction features. These utilities provide real value to users, creating multiple channels for engagement and investment. This comprehensive approach positions Mpeppe as more than just a meme coin, offering a richer and more engaging experience for its users.

Investment Potential of Mpeppe (MPEPE)

Strategic Tokenomics

Mpeppe (MPEPE) has been strategically priced at $0.0007, making it accessible to a wide range of investors. Tokenomics is designed to support long-term growth, with allocations for presales, liquidity, and sports activities. This strategic distribution ensures stability and promotes community engagement, positioning Mpeppe for substantial growth.

Analysts’ optimism

Market analysts are optimistic about the potential of Mpeppe (MPEPE). The coin’s innovative approach, strong community, and strategic partnerships are expected to drive significant price increases. Early investors stand to benefit from substantial returns as Mpeppe gains traction in the market. Analysts note that Mpeppe’s combination of utility and community engagement positions it well for future growth, especially as the cryptocurrency market continues to evolve.

The impact of similar competing businesses

Driving Innovation

Competition between similar assets such as Pepe (PEPE) and Mpeppe (MPEPE) is a catalyst for innovation. Each project strives to outdo the other, resulting in continuous improvements and new features. This dynamic competition benefits investors, offering them better and more advanced products.

Market diversification

Having multiple competing assets in the market promotes diversification. Investors have more options to choose from, which can help spread risk and potentially increase returns. The presence of strong contenders like Pepe (PEPE) and Mpeppe (MPEPE) ensures a vibrant and resilient crypto ecosystem.

Increased market interest

Competition between similar assets also generates increased market interest. As projects compete for attention, they attract more investors and media coverage, leading to increased visibility and adoption. This increased interest can drive further investment and growth in the sector.

The Future of Mpeppe (MPEPE)

Strategic development

Mpeppe (MPEPE) has a clear and ambitious roadmap for the future. Development plans include expanding its gaming and sports betting platforms, launching new NFT collections, and forming strategic partnerships. These initiatives are designed to improve user experience and drive market growth.

Community Growth

The success of Mpeppe (MPEPE) will largely depend on its ability to build and sustain a strong community. By focusing on engagement and providing valuable utility, Mpeppe aims to foster a loyal and active user base. This community-driven approach is expected to play a significant role in its long-term success.

Conclusion: A New Horizon for Meme Coin Investors

In conclusion, while Pepe (PEPE) has established itself as a significant player in the meme coin market, Mpeppe (MPEPE) offers a fresh and innovative approach that is capturing the interest of investors. With its strategic pricing, comprehensive ecosystem, and potential for high returns, Mpeppe (MPEPE) represents an exciting opportunity for those looking to diversify their cryptocurrency portfolios. As always, investors should stay informed and consider multiple factors before making investment decisions. Embrace the potential of Mpeppe (MPEPE) and join the journey to new rewards in the cryptocurrency world.

For more information on the pre-sale of Mpeppe (MPEPE):

Visit Mpeppe (MPEPE)

Join and become a member of the community:

Italian: https://t.me/mpeppecoin

Italian: https://x.com/mpeppecommunity?s=11&t=hQv3guBuxfglZI-0YOTGuQ

News

Golem Project Joins ETH Staking Frenzy, Locks Up 40,000 Tokens

- The Golem project has moved over $124 million in ETH for staking.

- Ethereum staking frenzy has increased ahead of the launch of spot ETH ETFs in the US.

Ethereal [ETH]The Project Golem-based distributed computing marketplace has joined the ETH staking frenzy.

On July 11, contrary to its recent sell-off, the company reportedly staked 40K ETH worth over $124.6 million, according to Lookonchain data.

Golem Network has confirmed its Ethereum staking initiative and said its purpose was to “create space” to help participants contribute to the network.

“The Golem Ecosystem Fund is officially launched today! We have staked 40,000 ETH from Golem’s treasury. This will create a space where developers, researchers, and entrepreneurs can bring their ideas to life and contribute to the Golem Network and its ecosystem!”

Ethereum Staking Frenzy

The staking frenzy has infected Ethereum, with just days to go until the potential launch of a spot ETH ETF in the United States. Recently, an unmarked address blocked over 6K ETH.

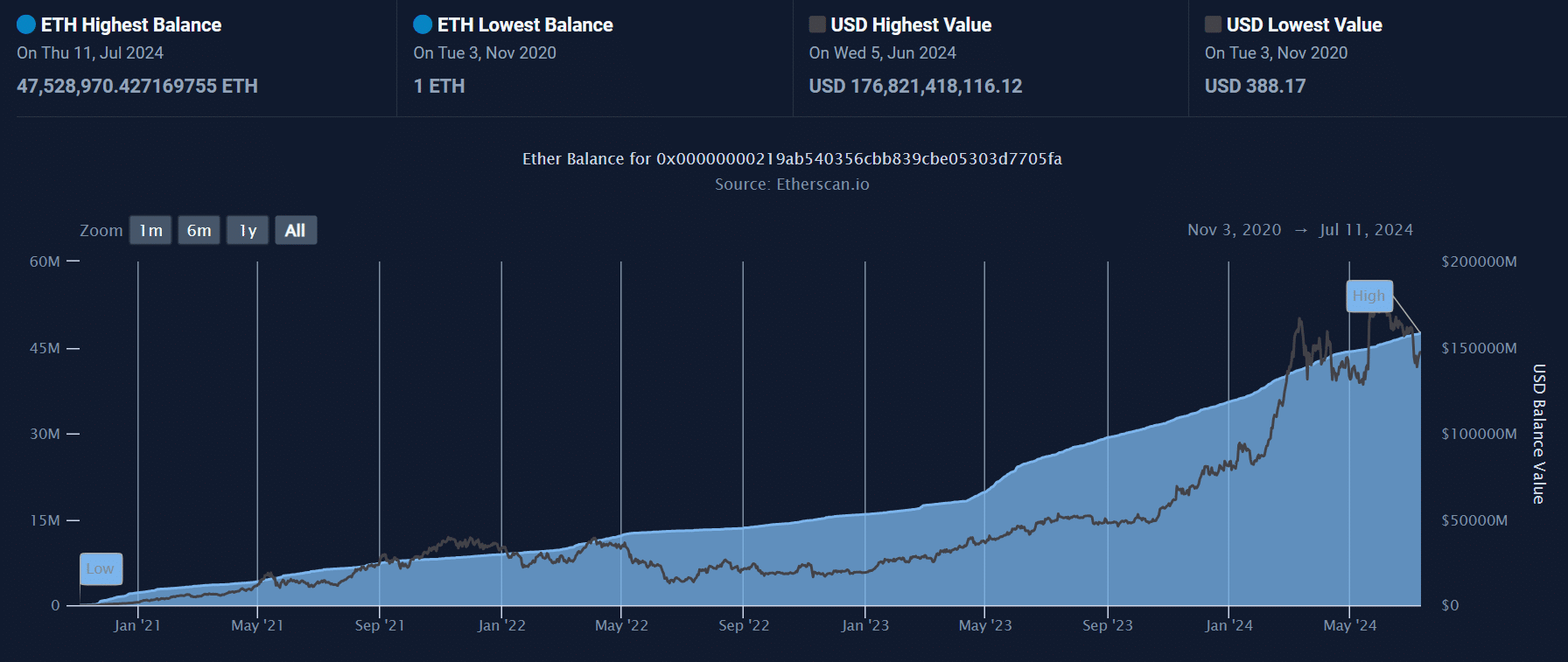

The Golem project’s decision to lock up 40K ETH on July 11th pushed the total ETH locked up to Chain of lights at an all-time high of 47.5 million ETH, worth over $140 billion based on market prices at press time.

Beacon Chain is Ethereum’s system that manages the validation of new blocks.

Source: Etherscan

According to a recent AMBCrypto relationshipIncreased ETH staking ahead of the debut of the ETH spot ETF in the US has underscored bullish sentiment.

More ETH has been moved from exchanges, further strengthening bullish expectations.

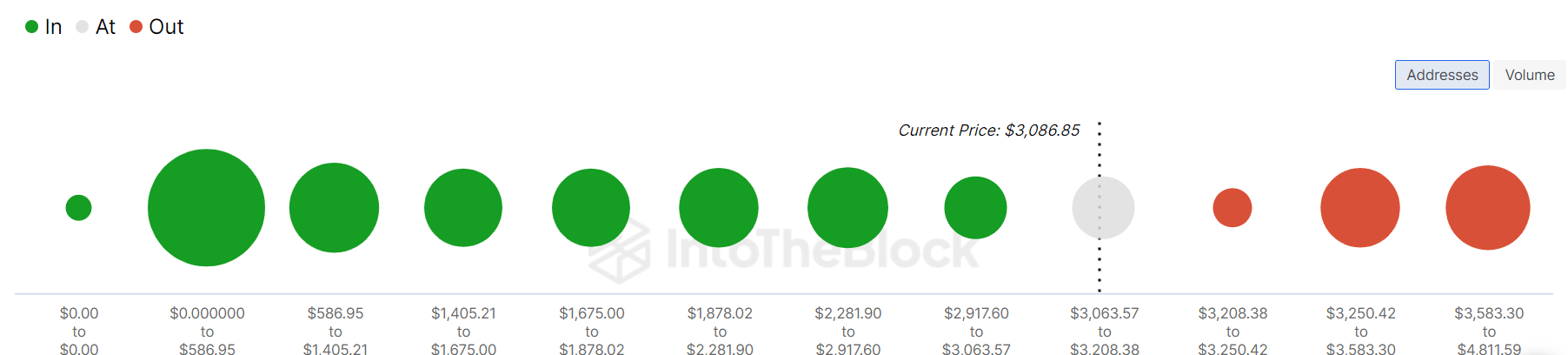

Meanwhile, from a short-term perspective, many addresses were losing at the $3.2K and $3.5K levels. Investors could try to take a profit if they break even.

These prices represent key levels to watch in the short term.

Source: IntoTheBlock

Next: Why Bitcoin Must Surpass $61K Soon, According to Analysts

News

BlockDAG Thrives While Chainlink and FTM Tokens Decline

As the cryptocurrency space turns bearish, giants like Chainlink and Fantom are facing setbacks with declining trends for LINK and FTM. Amid these changes, BlockDAG emerges as a prime target due to its promising pre-sales and long-term prospects. This Layer-1 project boasts an innovative Low Code No Code ecosystem, attracting investors with potential ROIs exceeding 30,000x. The pre-sales momentum has already accumulated over $57.6 million, driven by growing investor enthusiasm.

Impact of Chainlink’s Recent Token Release

Chainlink’s recent move to release 21 million LINK tokens, worth approximately $295 million, from its dormant supply contracts has significant market implications. This release sent 18.25 million LINK to Binance, fueling speculation that the price will drop. LINK is currently trading at $13.64, approaching its critical support at $13.5, with the potential to drop to $10 if this level breaks.

These releases, increasing the circulating supply above 600 million LINK, have previously maintained price stability, but the prevailing bearish conditions could alter this trend. With 391.5 million LINK pending release, market caution persists.

Fantom (FTM) Market Position Dynamics

Fantom experienced a strong buying spree last November, but its valuation has been challenging lately. After peaking near $1.20 in March, subsequent resistance and profit-taking pushed its price lower. FTM recently dipped below the crucial $0.600 mark but found some ground around $0.500. Fantom is currently valued at $0.559 with a market cap of $1.67 billion and daily trading volume of $257.56 million.

The Fantom Foundation’s decision to award over 55,000 FTMs quarterly to major dApps on the Opera network has invigorated user participation. Indicators such as RSI and MACD suggest a possible bounce if it surpasses the $0.600 mark. Failure to break above the 200-day EMA could prolong the bearish outlook.

BlockDAG Pre-Sale Triumph and Innovative Platform

BlockDAG’s pioneering low-code/no-code platform enables the seamless creation of utility tokens, meme tokens, and NFTs, catering to a broad user base. Its intuitive templates allow enthusiasts to quickly launch and customize projects, thereby democratizing blockchain development and accelerating market entry.

The cutting-edge features of this platform have attracted cryptocurrency investors, significantly increasing the interest in the presale. BlockDAG has successfully raised over $57.6 million, witnessing a 1300% escalation in the coin’s value from $0.001 to $0.014 in its 19th batch. This impressive rise underscores the immense return potential of BlockDAG for early backers.

Additionally, BlockDAG’s commitment to expanding its ecosystem extends to supporting the development of decentralized apps. This fosters a wide range of new projects in the blockchain domain, from digital art platforms to tokenized assets, enriching the blockchain ecosystem.

Key observations

While Chainlink and Fantom are currently navigating bearish trends due to token releases and resistance hurdles, BlockDAG’s innovative low-code/no-code framework positions it as an attractive investment option. With a presale raise of over $57.6 million and prices skyrocketing 1300% in recent batches, BlockDAG shows tremendous potential for returns of up to 30,000x. Amidst the market volatility impacting Chainlink Tokens and Fantom, BlockDAG stands out as a promising avenue for cryptocurrency traders.

Sign up for BlockDAG Pre-Sale now:

Website: https://blockdag.network

Pre-sale: https://acquisto.blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: Italian: https://discord.gg/Q7BxghMVyu

Disclaimer: The statements, views and opinions expressed in this article are solely those of the content provider and do not necessarily represent those of Crypto Reporter. Crypto Reporter is not responsible for the reliability, quality and accuracy of any material in this article. This article is provided for educational purposes only. Crypto Reporter is not responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Do your own research and invest at your own risk.

News

a new era for DEX tokens

The DEX aggregator Anger Trading is about to issue its RAGE token on the new Layer 1 blockchain Hyperliquid. The token sale is scheduled for August 7, with 20 million tokens out of a total supply of 100 million available on Fjord Foundry at a fixed price of $0.30.

Additionally, the “Rage Quit” feature has been introduced, which allows private investors to get their allocation early by accepting a 60% cut.

RAGE will be among the first tokens to be launched on Hyperliquidmarking a significant moment for this new blockchain. Let’s see all the details below.

DEX News Rage Trade: New RAGE Token Arrives on Hyperliquid

As expected, decentralized exchange (DEX) aggregator Rage Trade has announced the issuance of its new token ANGER. The launch is happening through a liquidity generation event and token sale on Fjord Foundry, scheduled for August 7th.

The token will be launched on the newly launched layer 1 blockchain Hyperliquidwhich has rapidly gained popularity due to its decentralized perpetual exchange.

Rage Trade currently aggregates platforms such as GMX, Synthetix, Dydx, Aevo and Hyperliquid, allowing traders to manage their positions across multiple blockchains and earn incentives.

During the event, 20 million RAGE tokens will be sold at a fixed price of $0.30, while another nine million will be used to inject liquidity into Hyperliquid.

Additionally, six million tokens have been reserved for future market making and product development incentives.

The token will have a total supply of 100 million, with 20% earmarked for sale and 30% for community treasury. The latter is subject to a 12-month lock-up period and a 24-month linear release.

The “Rage Quit” feature introduces a deflationary mechanismThis allows private investors and recipients of the air launch to receive their assignment after an initial three-month stalemate, accepting a 60% cut.

Rage Trade has chosen Hyperliquid as the platform for its token after the network became the preferred choice of users of the Anger Aggregatorwith over 1,300 users generating $445 million in volume.

Hyperliquid surpasses dYdX in TVL

Hyperliquid, the exchange decentralized based on Referee, recently introduced a new points program, which has catalyzed significant growth in total value locked (TVL) on the platform.

According to data from DefiLlama, Hyperliquid has reached a TVL of $530 million, surpassing dYdX’s $484 million and reaching a new all-time high.

This figure places Hyperliquid in second place among derivatives platforms, just behind GMX, which maintains a TVL of $542 million.

Rounding out the top five platforms by TVL are Solana-based Jupiter with $415 million and Drift with $365 million. Hyperliquid had a stellar year in 2024, jumping from eighth to second place in just six weeks.

This rapid increase was largely attributed to the new Hyperliquid points program, which launched on May 29.

The points program provides for the distribution of 700,000 points weekly for four months. With an additional 2 million points awarded for activity between May 1 and May 28.

Despite community criticism over the decision to extend the incentive program and delay the token launch and airdrop, the platform has continued to attract numerous traders.

From Perpetual DEX to Layer 1

Steven, founding member of Capital Yuntwhich has backed some of the largest cryptocurrency firms, including Zerion, noted that Hyperliquid has distributed approximately 51 million points in four periods.

He further stressed that the project aims to reward its early adopters and move from simply being a perpetual DEX to a true Layer 1:

“The team is clearly making an effort to communicate that Hyperliquid is an L1 and not just a DEX for derivatives.”

Furthermore, he highlighted that the token holders PURSUE were significantly rewarded, with a 23% increase in the token’s value.

PURR was the first spot token launched on Hyperliquid and looks set to continue receiving attention and incentives from the platform.

-

Videos8 months ago

Videos8 months agoJapan just triggered PANIC IN THE GLOBAL MARKET! [CRYPTO DUMP]

-

News11 months ago

News11 months agoNew Crypto Wallet Collects Over 350 Billion PEPE Tokens: Can This Make Memecoin Soar? ⋆ ZyCrypto

-

News9 months ago

News9 months agoa new era for DEX tokens

-

News9 months ago

News9 months agoGolem Project Joins ETH Staking Frenzy, Locks Up 40,000 Tokens

-

Memecoins11 months ago

Memecoins11 months agoOver 1 million new tokens launched since April

-

Bitcoin9 months ago

Bitcoin9 months agoCrypto President Trump’s ‘Lesser’ Regulation Will Bless Coinbase’s Bitcoin Leverage, Expert Says – Coinbase Glb (NASDAQ:COIN)

-

Memecoins9 months ago

Memecoins9 months agoSolana Sets New Records With Its Memecoins

-

News9 months ago

News9 months agoPepe Investors Seek New Rewards From Rival Token Mpeppe (MPEPE) at $0.0007

-

Bitcoin11 months ago

Bitcoin11 months agoCrypto Analyst Predicts Record Bitcoin Gains Before October Amid Global Liquidity Shifts ⋆ ZyCrypto

-

Memecoins11 months ago

Memecoins11 months agoSolana co-founder strongly supports meme coins; highlights memecoin migration from ETH to Solana ⋆ ZyCrypto

-

Memecoins11 months ago

Memecoins11 months agoAI Tokens Take the Baton from Memecoins to Drive a Market Rebirth ⋆ ZyCrypto

-

Videos11 months ago

Videos11 months agoLIVE FOMC

Could be CATASTROPHIC for Altcoins!