News

Pros and cons, types and future

What is an Altcoin?

Altcoins are generally defined as all cryptocurrencies other than Bitcoin (Bitcoin). However, some people consider altcoins to be all cryptocurrencies other than Bitcoin and Ethereum (ETH) because most cryptocurrencies are forked from one of the two. Some altcoins use different consensus mechanisms to validate transactions, open new blocks, or attempt to distinguish themselves from Bitcoin and Ethereum by providing new or additional features or purposes.

Most altcoins are designed and released by developers with different visions or uses for their tokens or cryptocurrencies. Learn more about altcoins and what makes them different from Bitcoin.

Key points

- The term altcoin refers to all cryptocurrencies other than Bitcoin (and, for some people, Ethereum).

- There are tens of thousands of altcoins on the market.

- Altcoins come in different types based on the purpose they were designed for.

- The future of altcoins is impossible to predict, but if the blockchain they were designed for continues to be used and developed, altcoins will continue to exist.

Investopedia / Michela Buttignol

Understanding Altcoins

“Altcoin” is a combination of the two words “alternative” and “coin”. The term generally includes all cryptocurrencies and tokens that are not Bitcoin. Altcoins belong to the blockchains for which they were explicitly designed. Many are forks, or the creation of a blockchain from another chain, from Bitcoin and Ethereum. These forks generally have more than one reason for occurring. Most of the time, one group of developers disagrees with others and goes off to create their own coin.

Many altcoins are used within their respective blockchains to make something, such as ether, which is used in Ethereum to pay transaction fees. Some developers have created forks of Bitcoin and resurfaced as an attempt to compete with it as a payment method, like the fork that created Bitcoin Cash.

Others fork or are developed from scratch, attempting to create a blockchain and token that appeals to a specific industry or group, such as Ripple’s attempt to use the XRP Ledger and XRP to appeal to the banking industry with a faster payment system.

Dogemonetathe popular memetic currency, was apparently created as some kind of joke. It was forked from Litecoinwhich in turn was forked from Bitcoin in 2011. Whatever the intent behind its creation, it was still designed to be a digital payment method.

Altcoins attempt to improve on the perceived limitations of whatever cryptocurrency and blockchain they derive from or compete with. The first altcoin was Litecoin, forked from the Bitcoin blockchain in 2011. Litecoin uses a different proof-of-work (PoW) consensus mechanism than Bitcoin, called Scrypt (pronounced ess-crypt), which requires less power and is faster than that of Bitcoin. SHA-256 PoW consensus mechanism.

Ether it is another altcoin. However, it has not separated from Bitcoin. It was designed by Vitalik Buterin, Dr. Gavin Wood and a few others to be used in Ethereum, the world’s largest blockchain-based virtual machine. Ether (ETH) is used to pay network participants for the transaction validation work performed by their machines. It is also used as collateral (called staking) for the privilege of becoming a block validator and proposer.

Types of Altcoins

Altcoins come in various flavors and categories. Here is a quick summary of some types of altcoins and what they are intended to be used for.

It is possible for an altcoin to fall into more than one category, such as TerraUSD, which was a stablecoin and a utility token.

Payment token

As the name suggests, payment tokens are designed to be used as currency, to exchange value between parties. Bitcoin is the first example of a payment token.

Stablecoins

The trading and use of cryptocurrencies have been marked by volatility since its launch. Stablecoins aim to reduce this overall volatility by pegging value to another asset. This is achieved by holding assets in reserve. Some of the assets held by stablecoin creators are fiat currencies, precious metals or investment goods. Price fluctuations for stablecoins are not expected to exceed a very narrow range.

Noteworthy stablecoins include Tether USDTMakerDAO’s DAI and the Currency in USD (USDC). In March 2021, payment processing giant Visa Inc. (V) announced that it will begin settling some transactions on its network in USDC on Ethereum blockchainwith the intention of introducing further settlement solutions.

Security token

Security token are tokens that represent fundraising efforts or ownership. They could also represent tokenized assets. Tokenization is the transfer of value from an asset to a token. Any asset can be tokenized, such as real estate or stocks. For this to work, the asset must be protected and held transparently. Otherwise the tokens would have no value because they would represent nothing. Security tokens are regulated by the Securities and Exchange Commission because they are designed to act as securities.

In 2021, Bitcoin wallet company Exodus successfully completed a Reg A+ token offering qualified by the Securities and Exchange Commission, enabling the conversion of $75 million of common stock into tokens on the Algorand blockchain. This landmark event was the first digital asset stock to offer equity in a US-based issuer.

Utility tokens

Utility tokens are used to provide services within a network. For example, they could be used to purchase services, pay network fees or redeem rewards. Filecoin, used to purchase storage space on a network and protect information, is an example of a utility token.

Ether (ETH) is also a utility token. It is designed to be used in Ethereum Blockchain and virtual machine to pay transactions. The former stablecoin USTerra used utility tokens to attempt to maintain its peg to the dollar, which it lost on May 11, 2022, by minting and burning two utility tokens to create downward or upward pressure on its price.

Utility tokens can be purchased on exchanges and held, but they are meant to be used in the blockchain network to keep it functioning.

Meme coins

As the name suggests, meme coins are inspired by a joke or silly interpretation of other well-known cryptocurrencies. They typically gain popularity quickly, often advertised online by major influencers or investors attempting to capitalize on short-term gains.

Many are referring to the sharp surge in these types of altcoins in April and May 2021 as “meme coin season,” with hundreds of these cryptocurrencies posting huge percentage gains based on sheer speculation.

An initial coin offering (ICO) is the equivalent of a cryptocurrency offering initial public offering (IPO). A company looking to raise money to create a new coin, app, or service launches an ICO to raise money.

Governance tokens

Governance tokens allow holders certain rights within a blockchain, such as voting for changes to protocols or having a say in the decisions of a decentralized autonomous organization (DAO). Since they are generally native to a private blockchain and used for blockchain purposes, they are utility tokens but have been accepted as a separate type due to their purpose.

Pros and cons of Altcoins

Against

-

Lower popularity and lower market capitalization

-

Less liquid than Bitcoin

-

Difficult to determine use cases

-

Many altcoins are scams or have lost the interest of developers and the community

The professionals explained

- Altcoins are “enhanced versions” of the cryptocurrency they are derived from because they aim to address perceived shortcomings.

- Altcoins with greater utility have a better chance of surviving because they have uses, like Ethereum’s ether.

- Investors can choose from a wide variety of altcoins that perform different functions in the cryptocurrency economy.

Cons explained

- Altcoins have a smaller investment market than Bitcoin. Since 2016, Bitcoin has generally remained above 40% of the global cryptocurrency market.

- The altcoin market is characterized by fewer investors and less activity, resulting in low liquidity.

- It is not always easy to distinguish between different altcoins and their use cases, making investment decisions even more complicated and confusing.

- Several “dead” altcoins have ended up sinking investor dollars.

The future of Altcoins

Discussions about the future of altcoins and cryptocurrencies have a precedent in the circumstances that led to the issuance of a federal dollar in the 19th century. Various forms of local currencies circulated in the United States. Each had unique features and was supported by a different tool.

Local banks also issued currency, sometimes backed by fictitious reserves. This diversity of currencies and financial instruments parallels the current situation in altcoin markets. There are thousands of altcoins available on the markets today, each claiming to serve a different purpose and market.

The current situation in the altcoin market indicates that it is unlikely to consolidate into a single cryptocurrency. However, it is likely that most of the thousands of altcoins listed in cryptocurrency markets will not survive. The altcoin market will likely coalesce around a few altcoins, those with strong utility, use cases, and a solid blockchain purpose, which will dominate the markets.

If you are looking to diversify into the cryptocurrency market, altcoins can be less expensive than Bitcoin. However, the cryptocurrency market, regardless of the type of coin, is young and volatile. Cryptocurrency is still finding its role in the global economy, so it is best to approach all cryptocurrencies with caution.

What is considered an Altcoin?

An altcoin is any cryptocurrency other than Bitcoin (and, for some people, Ethereum).

What are the 5 best Altcoins?

By market capitalization, the top five altcoins are ETH, USDT, BNB, SOL, and USDC.

Which Altcoin Will Explode in 2024?

No one knows which altcoin will take off in 2024. There may be no change in the market, or a new one could be introduced that would attract a flurry of investors.

The bottom line

Altcoins are any cryptocurrency that is not Bitcoin (or Ethereum). There are thousands of altcoins on the market, so it’s hard to say which ones might be legitimate and which ones aren’t. It’s best to read all the documentation behind whatever cryptocurrency piques your interest.

If there is a purpose for the blockchain and token, it might be worth keeping an eye on, otherwise consider other coins or investments. If you’re unsure, talk to a financial advisor who is familiar with cryptocurrencies to help you decide if they’re right for your portfolio.

The comments, opinions and analyzes expressed on Investopedia are for informational purposes only. Read ours warranty and exclusion of liability for more information.

News

Pepe Investors Seek New Rewards From Rival Token Mpeppe (MPEPE) at $0.0007

As the cryptocurrency market continues to expand, investors are constantly looking for new opportunities to maximize their returns. Pepe (PEPE), a meme coin inspired by the iconic Internet character Pepe the Frog, has been a staple in the meme coin arena. However, recent developments have shifted some investors’ attention to a promising new competitor: MPEPE (MPEPE). Currently trading at $0.0007, Mpeppe is attracting significant interest from those looking to diversify and capitalize on the next big thing.

Pepe’s appeal (PEPE)

Pepecoin (PEPE) has carved out a significant niche for itself in the cryptocurrency market, largely due to its vibrant community and roots in internet meme culture. Drawing inspiration from the popular meme character Pepe the Frog, Pepe (PEPE) has captured the attention of cryptocurrency enthusiasts and meme enthusiasts alike. This fusion of humor and community spirit has been instrumental in its rise within the cryptocurrency space.

The continued success of Pepecoin (PEPE) can be attributed to its active and dedicated community. Holders of the coin are known for their enthusiastic promotion on social media platforms, which helps maintain its visibility and popularity. This strong community support has been instrumental in sustaining Pepe (PEPE)’s momentum and driving its market performance. Recent whale activity, such as a massive transfer of 9 trillion PEPE tokens valued at $82 million to Bybit, further highlights the coin’s potential for significant price movements driven by large-scale transactions.

Mpeppe (MPEPE): the rising star

Mpeppe (MPEPE) differentiates itself by merging the realms of sports and cryptocurrency. Drawing inspiration from soccer sensation Kylian Mbappé and leveraging the legacy of the Pepe (PEPE) meme coin, Mpeppe offers a unique appeal that resonates with both sports fans and cryptocurrency investors. This innovative fusion is attracting a diverse and engaged audience, fostering a vibrant community around the token.

A large ecosystem

Differentiating itself from typical meme coins, Mpeppe (MPEPE) features a robust ecosystem that includes gaming and sports betting platforms, NFT collectibles, and social interaction features. These utilities provide real value to users, creating multiple channels for engagement and investment. This comprehensive approach positions Mpeppe as more than just a meme coin, offering a richer and more engaging experience for its users.

Investment Potential of Mpeppe (MPEPE)

Strategic Tokenomics

Mpeppe (MPEPE) has been strategically priced at $0.0007, making it accessible to a wide range of investors. Tokenomics is designed to support long-term growth, with allocations for presales, liquidity, and sports activities. This strategic distribution ensures stability and promotes community engagement, positioning Mpeppe for substantial growth.

Analysts’ optimism

Market analysts are optimistic about the potential of Mpeppe (MPEPE). The coin’s innovative approach, strong community, and strategic partnerships are expected to drive significant price increases. Early investors stand to benefit from substantial returns as Mpeppe gains traction in the market. Analysts note that Mpeppe’s combination of utility and community engagement positions it well for future growth, especially as the cryptocurrency market continues to evolve.

The impact of similar competing businesses

Driving Innovation

Competition between similar assets such as Pepe (PEPE) and Mpeppe (MPEPE) is a catalyst for innovation. Each project strives to outdo the other, resulting in continuous improvements and new features. This dynamic competition benefits investors, offering them better and more advanced products.

Market diversification

Having multiple competing assets in the market promotes diversification. Investors have more options to choose from, which can help spread risk and potentially increase returns. The presence of strong contenders like Pepe (PEPE) and Mpeppe (MPEPE) ensures a vibrant and resilient crypto ecosystem.

Increased market interest

Competition between similar assets also generates increased market interest. As projects compete for attention, they attract more investors and media coverage, leading to increased visibility and adoption. This increased interest can drive further investment and growth in the sector.

The Future of Mpeppe (MPEPE)

Strategic development

Mpeppe (MPEPE) has a clear and ambitious roadmap for the future. Development plans include expanding its gaming and sports betting platforms, launching new NFT collections, and forming strategic partnerships. These initiatives are designed to improve user experience and drive market growth.

Community Growth

The success of Mpeppe (MPEPE) will largely depend on its ability to build and sustain a strong community. By focusing on engagement and providing valuable utility, Mpeppe aims to foster a loyal and active user base. This community-driven approach is expected to play a significant role in its long-term success.

Conclusion: A New Horizon for Meme Coin Investors

In conclusion, while Pepe (PEPE) has established itself as a significant player in the meme coin market, Mpeppe (MPEPE) offers a fresh and innovative approach that is capturing the interest of investors. With its strategic pricing, comprehensive ecosystem, and potential for high returns, Mpeppe (MPEPE) represents an exciting opportunity for those looking to diversify their cryptocurrency portfolios. As always, investors should stay informed and consider multiple factors before making investment decisions. Embrace the potential of Mpeppe (MPEPE) and join the journey to new rewards in the cryptocurrency world.

For more information on the pre-sale of Mpeppe (MPEPE):

Visit Mpeppe (MPEPE)

Join and become a member of the community:

Italian: https://t.me/mpeppecoin

Italian: https://x.com/mpeppecommunity?s=11&t=hQv3guBuxfglZI-0YOTGuQ

News

Golem Project Joins ETH Staking Frenzy, Locks Up 40,000 Tokens

- The Golem project has moved over $124 million in ETH for staking.

- Ethereum staking frenzy has increased ahead of the launch of spot ETH ETFs in the US.

Ethereal [ETH]The Project Golem-based distributed computing marketplace has joined the ETH staking frenzy.

On July 11, contrary to its recent sell-off, the company reportedly staked 40K ETH worth over $124.6 million, according to Lookonchain data.

Golem Network has confirmed its Ethereum staking initiative and said its purpose was to “create space” to help participants contribute to the network.

“The Golem Ecosystem Fund is officially launched today! We have staked 40,000 ETH from Golem’s treasury. This will create a space where developers, researchers, and entrepreneurs can bring their ideas to life and contribute to the Golem Network and its ecosystem!”

Ethereum Staking Frenzy

The staking frenzy has infected Ethereum, with just days to go until the potential launch of a spot ETH ETF in the United States. Recently, an unmarked address blocked over 6K ETH.

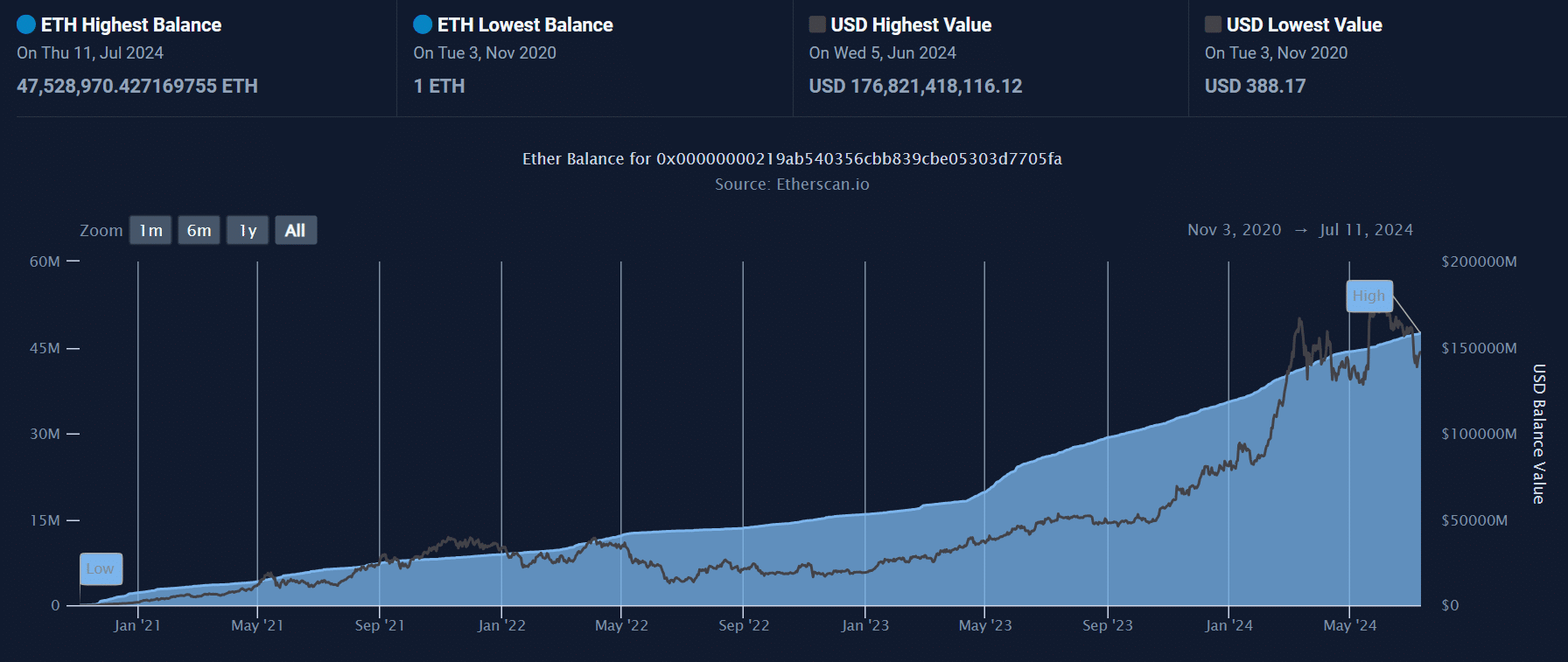

The Golem project’s decision to lock up 40K ETH on July 11th pushed the total ETH locked up to Chain of lights at an all-time high of 47.5 million ETH, worth over $140 billion based on market prices at press time.

Beacon Chain is Ethereum’s system that manages the validation of new blocks.

Source: Etherscan

According to a recent AMBCrypto relationshipIncreased ETH staking ahead of the debut of the ETH spot ETF in the US has underscored bullish sentiment.

More ETH has been moved from exchanges, further strengthening bullish expectations.

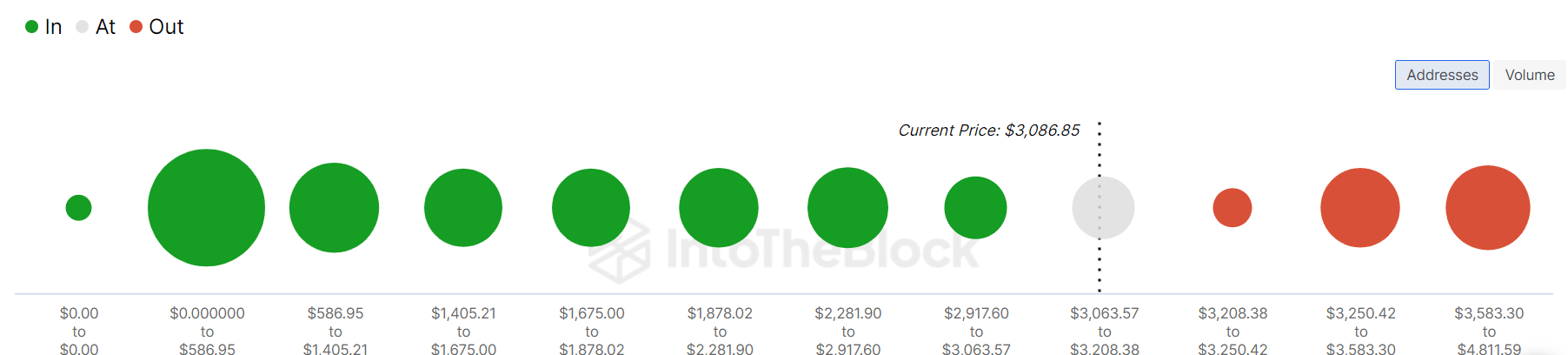

Meanwhile, from a short-term perspective, many addresses were losing at the $3.2K and $3.5K levels. Investors could try to take a profit if they break even.

These prices represent key levels to watch in the short term.

Source: IntoTheBlock

Next: Why Bitcoin Must Surpass $61K Soon, According to Analysts

News

BlockDAG Thrives While Chainlink and FTM Tokens Decline

As the cryptocurrency space turns bearish, giants like Chainlink and Fantom are facing setbacks with declining trends for LINK and FTM. Amid these changes, BlockDAG emerges as a prime target due to its promising pre-sales and long-term prospects. This Layer-1 project boasts an innovative Low Code No Code ecosystem, attracting investors with potential ROIs exceeding 30,000x. The pre-sales momentum has already accumulated over $57.6 million, driven by growing investor enthusiasm.

Impact of Chainlink’s Recent Token Release

Chainlink’s recent move to release 21 million LINK tokens, worth approximately $295 million, from its dormant supply contracts has significant market implications. This release sent 18.25 million LINK to Binance, fueling speculation that the price will drop. LINK is currently trading at $13.64, approaching its critical support at $13.5, with the potential to drop to $10 if this level breaks.

These releases, increasing the circulating supply above 600 million LINK, have previously maintained price stability, but the prevailing bearish conditions could alter this trend. With 391.5 million LINK pending release, market caution persists.

Fantom (FTM) Market Position Dynamics

Fantom experienced a strong buying spree last November, but its valuation has been challenging lately. After peaking near $1.20 in March, subsequent resistance and profit-taking pushed its price lower. FTM recently dipped below the crucial $0.600 mark but found some ground around $0.500. Fantom is currently valued at $0.559 with a market cap of $1.67 billion and daily trading volume of $257.56 million.

The Fantom Foundation’s decision to award over 55,000 FTMs quarterly to major dApps on the Opera network has invigorated user participation. Indicators such as RSI and MACD suggest a possible bounce if it surpasses the $0.600 mark. Failure to break above the 200-day EMA could prolong the bearish outlook.

BlockDAG Pre-Sale Triumph and Innovative Platform

BlockDAG’s pioneering low-code/no-code platform enables the seamless creation of utility tokens, meme tokens, and NFTs, catering to a broad user base. Its intuitive templates allow enthusiasts to quickly launch and customize projects, thereby democratizing blockchain development and accelerating market entry.

The cutting-edge features of this platform have attracted cryptocurrency investors, significantly increasing the interest in the presale. BlockDAG has successfully raised over $57.6 million, witnessing a 1300% escalation in the coin’s value from $0.001 to $0.014 in its 19th batch. This impressive rise underscores the immense return potential of BlockDAG for early backers.

Additionally, BlockDAG’s commitment to expanding its ecosystem extends to supporting the development of decentralized apps. This fosters a wide range of new projects in the blockchain domain, from digital art platforms to tokenized assets, enriching the blockchain ecosystem.

Key observations

While Chainlink and Fantom are currently navigating bearish trends due to token releases and resistance hurdles, BlockDAG’s innovative low-code/no-code framework positions it as an attractive investment option. With a presale raise of over $57.6 million and prices skyrocketing 1300% in recent batches, BlockDAG shows tremendous potential for returns of up to 30,000x. Amidst the market volatility impacting Chainlink Tokens and Fantom, BlockDAG stands out as a promising avenue for cryptocurrency traders.

Sign up for BlockDAG Pre-Sale now:

Website: https://blockdag.network

Pre-sale: https://acquisto.blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: Italian: https://discord.gg/Q7BxghMVyu

Disclaimer: The statements, views and opinions expressed in this article are solely those of the content provider and do not necessarily represent those of Crypto Reporter. Crypto Reporter is not responsible for the reliability, quality and accuracy of any material in this article. This article is provided for educational purposes only. Crypto Reporter is not responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Do your own research and invest at your own risk.

News

a new era for DEX tokens

The DEX aggregator Anger Trading is about to issue its RAGE token on the new Layer 1 blockchain Hyperliquid. The token sale is scheduled for August 7, with 20 million tokens out of a total supply of 100 million available on Fjord Foundry at a fixed price of $0.30.

Additionally, the “Rage Quit” feature has been introduced, which allows private investors to get their allocation early by accepting a 60% cut.

RAGE will be among the first tokens to be launched on Hyperliquidmarking a significant moment for this new blockchain. Let’s see all the details below.

DEX News Rage Trade: New RAGE Token Arrives on Hyperliquid

As expected, decentralized exchange (DEX) aggregator Rage Trade has announced the issuance of its new token ANGER. The launch is happening through a liquidity generation event and token sale on Fjord Foundry, scheduled for August 7th.

The token will be launched on the newly launched layer 1 blockchain Hyperliquidwhich has rapidly gained popularity due to its decentralized perpetual exchange.

Rage Trade currently aggregates platforms such as GMX, Synthetix, Dydx, Aevo and Hyperliquid, allowing traders to manage their positions across multiple blockchains and earn incentives.

During the event, 20 million RAGE tokens will be sold at a fixed price of $0.30, while another nine million will be used to inject liquidity into Hyperliquid.

Additionally, six million tokens have been reserved for future market making and product development incentives.

The token will have a total supply of 100 million, with 20% earmarked for sale and 30% for community treasury. The latter is subject to a 12-month lock-up period and a 24-month linear release.

The “Rage Quit” feature introduces a deflationary mechanismThis allows private investors and recipients of the air launch to receive their assignment after an initial three-month stalemate, accepting a 60% cut.

Rage Trade has chosen Hyperliquid as the platform for its token after the network became the preferred choice of users of the Anger Aggregatorwith over 1,300 users generating $445 million in volume.

Hyperliquid surpasses dYdX in TVL

Hyperliquid, the exchange decentralized based on Referee, recently introduced a new points program, which has catalyzed significant growth in total value locked (TVL) on the platform.

According to data from DefiLlama, Hyperliquid has reached a TVL of $530 million, surpassing dYdX’s $484 million and reaching a new all-time high.

This figure places Hyperliquid in second place among derivatives platforms, just behind GMX, which maintains a TVL of $542 million.

Rounding out the top five platforms by TVL are Solana-based Jupiter with $415 million and Drift with $365 million. Hyperliquid had a stellar year in 2024, jumping from eighth to second place in just six weeks.

This rapid increase was largely attributed to the new Hyperliquid points program, which launched on May 29.

The points program provides for the distribution of 700,000 points weekly for four months. With an additional 2 million points awarded for activity between May 1 and May 28.

Despite community criticism over the decision to extend the incentive program and delay the token launch and airdrop, the platform has continued to attract numerous traders.

From Perpetual DEX to Layer 1

Steven, founding member of Capital Yuntwhich has backed some of the largest cryptocurrency firms, including Zerion, noted that Hyperliquid has distributed approximately 51 million points in four periods.

He further stressed that the project aims to reward its early adopters and move from simply being a perpetual DEX to a true Layer 1:

“The team is clearly making an effort to communicate that Hyperliquid is an L1 and not just a DEX for derivatives.”

Furthermore, he highlighted that the token holders PURSUE were significantly rewarded, with a 23% increase in the token’s value.

PURR was the first spot token launched on Hyperliquid and looks set to continue receiving attention and incentives from the platform.

-

Videos6 months ago

Videos6 months agoJapan just triggered PANIC IN THE GLOBAL MARKET! [CRYPTO DUMP]

-

News9 months ago

News9 months agoNew Crypto Wallet Collects Over 350 Billion PEPE Tokens: Can This Make Memecoin Soar? ⋆ ZyCrypto

-

Memecoins8 months ago

Memecoins8 months agoOver 1 million new tokens launched since April

-

News7 months ago

News7 months agoGolem Project Joins ETH Staking Frenzy, Locks Up 40,000 Tokens

-

News7 months ago

News7 months agoa new era for DEX tokens

-

Memecoins7 months ago

Memecoins7 months agoSolana Sets New Records With Its Memecoins

-

Bitcoin8 months ago

Bitcoin8 months agoCrypto Analyst Predicts Record Bitcoin Gains Before October Amid Global Liquidity Shifts ⋆ ZyCrypto

-

Bitcoin7 months ago

Bitcoin7 months agoCrypto President Trump’s ‘Lesser’ Regulation Will Bless Coinbase’s Bitcoin Leverage, Expert Says – Coinbase Glb (NASDAQ:COIN)

-

News7 months ago

News7 months agoPepe Investors Seek New Rewards From Rival Token Mpeppe (MPEPE) at $0.0007

-

Memecoins9 months ago

Memecoins9 months agoSolana co-founder strongly supports meme coins; highlights memecoin migration from ETH to Solana ⋆ ZyCrypto

-

Videos9 months ago

Videos9 months agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

Memecoins9 months ago

Memecoins9 months agoAI Tokens Take the Baton from Memecoins to Drive a Market Rebirth ⋆ ZyCrypto