News

EIGEN’s airdrop of EigenLayer may signal the end of the once-popular “stitches.”

What is perhaps the most publicized cryptocurrency launch ever will begin on Friday, but not necessarily with the kind of enthusiasm its creators might have hoped for.

EigenLayer, a renewal platform on Ethereum, it accumulated cryptocurrency deposits worth $16 billion in the first year of opening to users, even before its official commercialization. launched last month. When most of that money arrived, the project was little more than a glorified blockchain wallet on the Ethereum blockchain: a non-functional safe that held the prospect of future rewards but still had no actual features. (Although the project “launched” its joint security service in April, many mission-critical features they remain missing).

But it is the details of token distribution that have generated the most criticism about X and other social media platforms. The tone has become so negative that some industry officials are wondering whether it will lead to the end of the wildly popular crypto incentive system known as “points” rewards.

As the main incentive model, EigenLayer depositors were rewarded points – counts tracked by EigenLayer and other third parties accumulated based on how much a person has deposited into the project and for how long. The dots were not themselves crypto tokens, but most depositors expected that they would eventually be converted into them, an expectation that followed months of similar programs from other emerging crypto projects.

In addition to earning points by depositing on EigenLayer, some people started trading them directly on platforms like Pendle, which offered up to “40x leverage” on trading points.

EigenLayer’s points program helped it attract users and attract billions of dollars, but when the EIGEN token airdrop was finally announced last week, the project’s community erupted in anger.

First, it was revealed that the tokens would not be transferable until a yet-to-be-determined future date, meaning users would have to wait even longer to cash out their investments.

“Although there was purposely no communication saying that the token would be transferable on day one, the fact that the EigenLayer points program has been going on for almost a year has certainly led to the expectation that depositors would be able to able to claim their tokens on day 1,” said Luxas Outumuro, who leads research at IntoTheBlock, a blockchain market intelligence firm. “It is understandable that they want to further decentralize their token, but this was a mismanagement of expectations that was not adequately addressed.”

Further backlash revolved around EigenLayer’s decision to limit its air launch to users from select regions, even though the project had not imposed geographic restrictions on users making deposits and earning points. Users from more than a dozen countries, including the United States, Canada and China, will be barred from the airdrop.

“There was so much ‘wink, wink’ going around about points and how they were making an infinite-sum game where everyone would win and all that shit. And then they basically cut off two-thirds of the potential users and recipients of the airdrop,” said an EigenLayer venture investor who agreed to speak on condition of anonymity. “I think it’s absolutely right to isolate the United States from an airdrop, but then not let them use it in the first place.”

More criticism has come over the “Season 1” token distribution plan, which will put EIGEN tokens in the hands of some point earners but force others to wait for a “Season 2” airdrop that has not been detailed. This means that users who have deposited to EigenLayer via some liquid retaking services and other third-party platforms do not yet know how many EIGEN tokens they will receive, despite these services being responsible for a large portion of EigenLayer’s overall deposits.

“EigenLayer chose to allow others to, in a sense, remortgage and play all these crazy games. They could have just said, ‘No, don’t do that. We’re not committed to honoring these points.’ ,’” said Mike Silgadze, founder of the liquid restaging platform Ether.Fi.

Autostratus he revised his symbolic plans in response to backlash from the community, but the changes are unlikely to be enough to bring EigenLayer back into the crypto community’s good graces.

EigenLayer isn’t the only recent project that has struggled to meet the expectations set by a points-based program.

Renzo, addressed a liquid restaking protocol on EigenLayer similar backlash last month when its points system failed to meet investor expectations. Blur, one of the creators of crypto points, received criticism for repeatedly extending its points window and changing the rules on when and how tokens would be distributed on planes.

Some point programs have turned into airdrops with little controversy, but more and more of them – particularly larger projects, like EigenLayer – have led to disappointment.

Many investors are starting to think that the practice, which has become ubiquitous among crypto startups, may finally be nearing an end.

Silgadze explains that the points were a way to “encourage protocol activity before the token launch.” This improved on the old system, where users “farmed” for an airdrop by interacting with a blockchain protocol, but didn’t know exactly what kind of activities would ultimately lead to the airdrops. Points-based systems “give a lot more clarity to people about what the protocol wants you to do,” Silgadze said.

While point systems are a great way to attract potential users, they also exist as a result of regulatory protection. Crypto companies are reluctant to sell tokens directly in ICO (Initial Coin Offer) style.as this could put them in the crosshairs of regulators.

But when it comes to protecting investors and offering transparency, Robert Leshner, founder of Compound and Robot Ventures, an investor in EigenLayer developer Eigen Labs, thinks the dots are the worst of all worlds. “The main goal of investor protection is to make sure that there is no information asymmetry between investors and sponsors. And the dots create the largest information asymmetry that exists in the cryptocurrency industry,” he said. “Everything is at the discretion of the team and users and investors just pray to be treated right by the team.”

Leshner believes last year’s streak of failed points will eventually lead to the practice of extinction.

“When you see one of the biggest, most ambitious, most authentic projects in all of crypto, EigenLayer, f*ck a points program: If EigenLayer can’t do it properly, who can do it? Nobody can do it.”

News

Pepe Investors Seek New Rewards From Rival Token Mpeppe (MPEPE) at $0.0007

As the cryptocurrency market continues to expand, investors are constantly looking for new opportunities to maximize their returns. Pepe (PEPE), a meme coin inspired by the iconic Internet character Pepe the Frog, has been a staple in the meme coin arena. However, recent developments have shifted some investors’ attention to a promising new competitor: MPEPE (MPEPE). Currently trading at $0.0007, Mpeppe is attracting significant interest from those looking to diversify and capitalize on the next big thing.

Pepe’s appeal (PEPE)

Pepecoin (PEPE) has carved out a significant niche for itself in the cryptocurrency market, largely due to its vibrant community and roots in internet meme culture. Drawing inspiration from the popular meme character Pepe the Frog, Pepe (PEPE) has captured the attention of cryptocurrency enthusiasts and meme enthusiasts alike. This fusion of humor and community spirit has been instrumental in its rise within the cryptocurrency space.

The continued success of Pepecoin (PEPE) can be attributed to its active and dedicated community. Holders of the coin are known for their enthusiastic promotion on social media platforms, which helps maintain its visibility and popularity. This strong community support has been instrumental in sustaining Pepe (PEPE)’s momentum and driving its market performance. Recent whale activity, such as a massive transfer of 9 trillion PEPE tokens valued at $82 million to Bybit, further highlights the coin’s potential for significant price movements driven by large-scale transactions.

Mpeppe (MPEPE): the rising star

Mpeppe (MPEPE) differentiates itself by merging the realms of sports and cryptocurrency. Drawing inspiration from soccer sensation Kylian Mbappé and leveraging the legacy of the Pepe (PEPE) meme coin, Mpeppe offers a unique appeal that resonates with both sports fans and cryptocurrency investors. This innovative fusion is attracting a diverse and engaged audience, fostering a vibrant community around the token.

A large ecosystem

Differentiating itself from typical meme coins, Mpeppe (MPEPE) features a robust ecosystem that includes gaming and sports betting platforms, NFT collectibles, and social interaction features. These utilities provide real value to users, creating multiple channels for engagement and investment. This comprehensive approach positions Mpeppe as more than just a meme coin, offering a richer and more engaging experience for its users.

Investment Potential of Mpeppe (MPEPE)

Strategic Tokenomics

Mpeppe (MPEPE) has been strategically priced at $0.0007, making it accessible to a wide range of investors. Tokenomics is designed to support long-term growth, with allocations for presales, liquidity, and sports activities. This strategic distribution ensures stability and promotes community engagement, positioning Mpeppe for substantial growth.

Analysts’ optimism

Market analysts are optimistic about the potential of Mpeppe (MPEPE). The coin’s innovative approach, strong community, and strategic partnerships are expected to drive significant price increases. Early investors stand to benefit from substantial returns as Mpeppe gains traction in the market. Analysts note that Mpeppe’s combination of utility and community engagement positions it well for future growth, especially as the cryptocurrency market continues to evolve.

The impact of similar competing businesses

Driving Innovation

Competition between similar assets such as Pepe (PEPE) and Mpeppe (MPEPE) is a catalyst for innovation. Each project strives to outdo the other, resulting in continuous improvements and new features. This dynamic competition benefits investors, offering them better and more advanced products.

Market diversification

Having multiple competing assets in the market promotes diversification. Investors have more options to choose from, which can help spread risk and potentially increase returns. The presence of strong contenders like Pepe (PEPE) and Mpeppe (MPEPE) ensures a vibrant and resilient crypto ecosystem.

Increased market interest

Competition between similar assets also generates increased market interest. As projects compete for attention, they attract more investors and media coverage, leading to increased visibility and adoption. This increased interest can drive further investment and growth in the sector.

The Future of Mpeppe (MPEPE)

Strategic development

Mpeppe (MPEPE) has a clear and ambitious roadmap for the future. Development plans include expanding its gaming and sports betting platforms, launching new NFT collections, and forming strategic partnerships. These initiatives are designed to improve user experience and drive market growth.

Community Growth

The success of Mpeppe (MPEPE) will largely depend on its ability to build and sustain a strong community. By focusing on engagement and providing valuable utility, Mpeppe aims to foster a loyal and active user base. This community-driven approach is expected to play a significant role in its long-term success.

Conclusion: A New Horizon for Meme Coin Investors

In conclusion, while Pepe (PEPE) has established itself as a significant player in the meme coin market, Mpeppe (MPEPE) offers a fresh and innovative approach that is capturing the interest of investors. With its strategic pricing, comprehensive ecosystem, and potential for high returns, Mpeppe (MPEPE) represents an exciting opportunity for those looking to diversify their cryptocurrency portfolios. As always, investors should stay informed and consider multiple factors before making investment decisions. Embrace the potential of Mpeppe (MPEPE) and join the journey to new rewards in the cryptocurrency world.

For more information on the pre-sale of Mpeppe (MPEPE):

Visit Mpeppe (MPEPE)

Join and become a member of the community:

Italian: https://t.me/mpeppecoin

Italian: https://x.com/mpeppecommunity?s=11&t=hQv3guBuxfglZI-0YOTGuQ

News

Golem Project Joins ETH Staking Frenzy, Locks Up 40,000 Tokens

- The Golem project has moved over $124 million in ETH for staking.

- Ethereum staking frenzy has increased ahead of the launch of spot ETH ETFs in the US.

Ethereal [ETH]The Project Golem-based distributed computing marketplace has joined the ETH staking frenzy.

On July 11, contrary to its recent sell-off, the company reportedly staked 40K ETH worth over $124.6 million, according to Lookonchain data.

Golem Network has confirmed its Ethereum staking initiative and said its purpose was to “create space” to help participants contribute to the network.

“The Golem Ecosystem Fund is officially launched today! We have staked 40,000 ETH from Golem’s treasury. This will create a space where developers, researchers, and entrepreneurs can bring their ideas to life and contribute to the Golem Network and its ecosystem!”

Ethereum Staking Frenzy

The staking frenzy has infected Ethereum, with just days to go until the potential launch of a spot ETH ETF in the United States. Recently, an unmarked address blocked over 6K ETH.

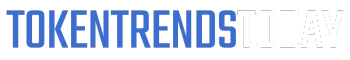

The Golem project’s decision to lock up 40K ETH on July 11th pushed the total ETH locked up to Chain of lights at an all-time high of 47.5 million ETH, worth over $140 billion based on market prices at press time.

Beacon Chain is Ethereum’s system that manages the validation of new blocks.

Source: Etherscan

According to a recent AMBCrypto relationshipIncreased ETH staking ahead of the debut of the ETH spot ETF in the US has underscored bullish sentiment.

More ETH has been moved from exchanges, further strengthening bullish expectations.

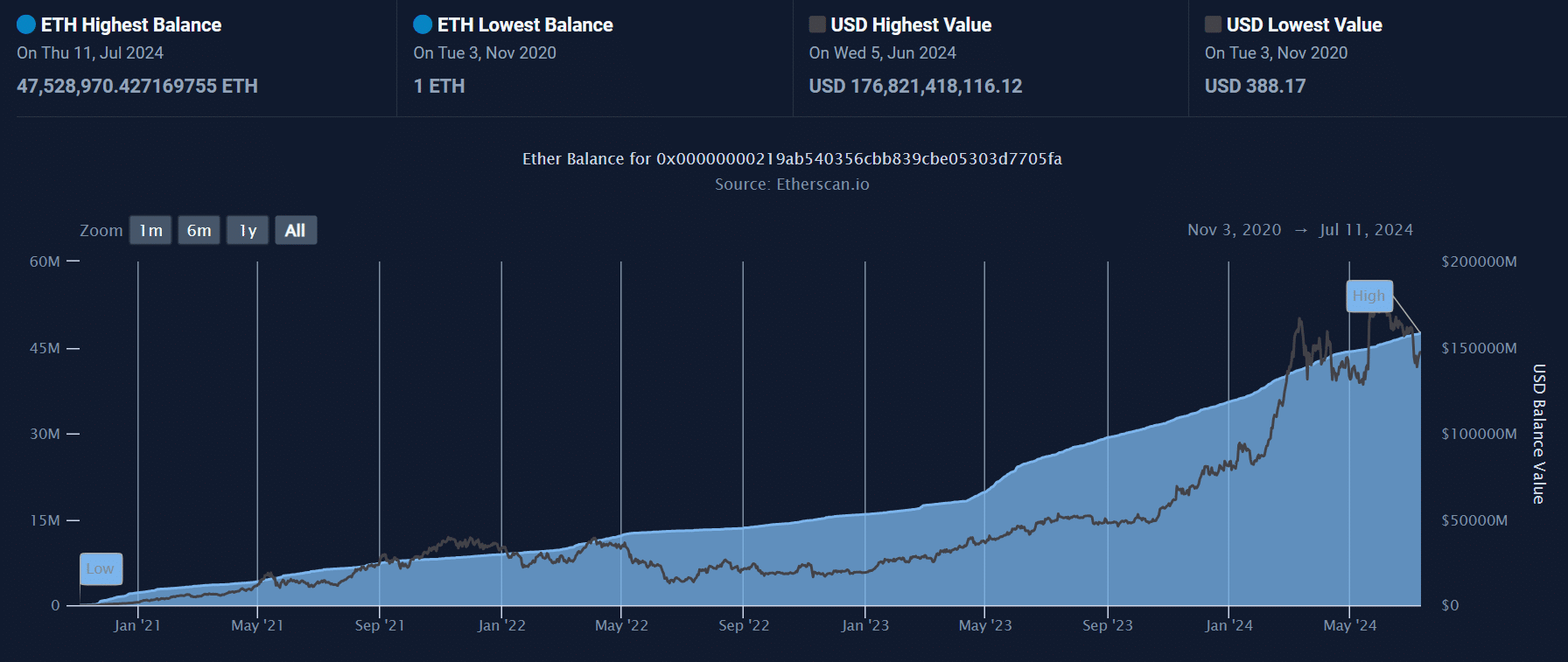

Meanwhile, from a short-term perspective, many addresses were losing at the $3.2K and $3.5K levels. Investors could try to take a profit if they break even.

These prices represent key levels to watch in the short term.

Source: IntoTheBlock

Next: Why Bitcoin Must Surpass $61K Soon, According to Analysts

News

BlockDAG Thrives While Chainlink and FTM Tokens Decline

As the cryptocurrency space turns bearish, giants like Chainlink and Fantom are facing setbacks with declining trends for LINK and FTM. Amid these changes, BlockDAG emerges as a prime target due to its promising pre-sales and long-term prospects. This Layer-1 project boasts an innovative Low Code No Code ecosystem, attracting investors with potential ROIs exceeding 30,000x. The pre-sales momentum has already accumulated over $57.6 million, driven by growing investor enthusiasm.

Impact of Chainlink’s Recent Token Release

Chainlink’s recent move to release 21 million LINK tokens, worth approximately $295 million, from its dormant supply contracts has significant market implications. This release sent 18.25 million LINK to Binance, fueling speculation that the price will drop. LINK is currently trading at $13.64, approaching its critical support at $13.5, with the potential to drop to $10 if this level breaks.

These releases, increasing the circulating supply above 600 million LINK, have previously maintained price stability, but the prevailing bearish conditions could alter this trend. With 391.5 million LINK pending release, market caution persists.

Fantom (FTM) Market Position Dynamics

Fantom experienced a strong buying spree last November, but its valuation has been challenging lately. After peaking near $1.20 in March, subsequent resistance and profit-taking pushed its price lower. FTM recently dipped below the crucial $0.600 mark but found some ground around $0.500. Fantom is currently valued at $0.559 with a market cap of $1.67 billion and daily trading volume of $257.56 million.

The Fantom Foundation’s decision to award over 55,000 FTMs quarterly to major dApps on the Opera network has invigorated user participation. Indicators such as RSI and MACD suggest a possible bounce if it surpasses the $0.600 mark. Failure to break above the 200-day EMA could prolong the bearish outlook.

BlockDAG Pre-Sale Triumph and Innovative Platform

BlockDAG’s pioneering low-code/no-code platform enables the seamless creation of utility tokens, meme tokens, and NFTs, catering to a broad user base. Its intuitive templates allow enthusiasts to quickly launch and customize projects, thereby democratizing blockchain development and accelerating market entry.

The cutting-edge features of this platform have attracted cryptocurrency investors, significantly increasing the interest in the presale. BlockDAG has successfully raised over $57.6 million, witnessing a 1300% escalation in the coin’s value from $0.001 to $0.014 in its 19th batch. This impressive rise underscores the immense return potential of BlockDAG for early backers.

Additionally, BlockDAG’s commitment to expanding its ecosystem extends to supporting the development of decentralized apps. This fosters a wide range of new projects in the blockchain domain, from digital art platforms to tokenized assets, enriching the blockchain ecosystem.

Key observations

While Chainlink and Fantom are currently navigating bearish trends due to token releases and resistance hurdles, BlockDAG’s innovative low-code/no-code framework positions it as an attractive investment option. With a presale raise of over $57.6 million and prices skyrocketing 1300% in recent batches, BlockDAG shows tremendous potential for returns of up to 30,000x. Amidst the market volatility impacting Chainlink Tokens and Fantom, BlockDAG stands out as a promising avenue for cryptocurrency traders.

Sign up for BlockDAG Pre-Sale now:

Website: https://blockdag.network

Pre-sale: https://acquisto.blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: Italian: https://discord.gg/Q7BxghMVyu

Disclaimer: The statements, views and opinions expressed in this article are solely those of the content provider and do not necessarily represent those of Crypto Reporter. Crypto Reporter is not responsible for the reliability, quality and accuracy of any material in this article. This article is provided for educational purposes only. Crypto Reporter is not responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Do your own research and invest at your own risk.

News

a new era for DEX tokens

The DEX aggregator Anger Trading is about to issue its RAGE token on the new Layer 1 blockchain Hyperliquid. The token sale is scheduled for August 7, with 20 million tokens out of a total supply of 100 million available on Fjord Foundry at a fixed price of $0.30.

Additionally, the “Rage Quit” feature has been introduced, which allows private investors to get their allocation early by accepting a 60% cut.

RAGE will be among the first tokens to be launched on Hyperliquidmarking a significant moment for this new blockchain. Let’s see all the details below.

DEX News Rage Trade: New RAGE Token Arrives on Hyperliquid

As expected, decentralized exchange (DEX) aggregator Rage Trade has announced the issuance of its new token ANGER. The launch is happening through a liquidity generation event and token sale on Fjord Foundry, scheduled for August 7th.

The token will be launched on the newly launched layer 1 blockchain Hyperliquidwhich has rapidly gained popularity due to its decentralized perpetual exchange.

Rage Trade currently aggregates platforms such as GMX, Synthetix, Dydx, Aevo and Hyperliquid, allowing traders to manage their positions across multiple blockchains and earn incentives.

During the event, 20 million RAGE tokens will be sold at a fixed price of $0.30, while another nine million will be used to inject liquidity into Hyperliquid.

Additionally, six million tokens have been reserved for future market making and product development incentives.

The token will have a total supply of 100 million, with 20% earmarked for sale and 30% for community treasury. The latter is subject to a 12-month lock-up period and a 24-month linear release.

The “Rage Quit” feature introduces a deflationary mechanismThis allows private investors and recipients of the air launch to receive their assignment after an initial three-month stalemate, accepting a 60% cut.

Rage Trade has chosen Hyperliquid as the platform for its token after the network became the preferred choice of users of the Anger Aggregatorwith over 1,300 users generating $445 million in volume.

Hyperliquid surpasses dYdX in TVL

Hyperliquid, the exchange decentralized based on Referee, recently introduced a new points program, which has catalyzed significant growth in total value locked (TVL) on the platform.

According to data from DefiLlama, Hyperliquid has reached a TVL of $530 million, surpassing dYdX’s $484 million and reaching a new all-time high.

This figure places Hyperliquid in second place among derivatives platforms, just behind GMX, which maintains a TVL of $542 million.

Rounding out the top five platforms by TVL are Solana-based Jupiter with $415 million and Drift with $365 million. Hyperliquid had a stellar year in 2024, jumping from eighth to second place in just six weeks.

This rapid increase was largely attributed to the new Hyperliquid points program, which launched on May 29.

The points program provides for the distribution of 700,000 points weekly for four months. With an additional 2 million points awarded for activity between May 1 and May 28.

Despite community criticism over the decision to extend the incentive program and delay the token launch and airdrop, the platform has continued to attract numerous traders.

From Perpetual DEX to Layer 1

Steven, founding member of Capital Yuntwhich has backed some of the largest cryptocurrency firms, including Zerion, noted that Hyperliquid has distributed approximately 51 million points in four periods.

He further stressed that the project aims to reward its early adopters and move from simply being a perpetual DEX to a true Layer 1:

“The team is clearly making an effort to communicate that Hyperliquid is an L1 and not just a DEX for derivatives.”

Furthermore, he highlighted that the token holders PURSUE were significantly rewarded, with a 23% increase in the token’s value.

PURR was the first spot token launched on Hyperliquid and looks set to continue receiving attention and incentives from the platform.

-

Videos6 months ago

Videos6 months agoJapan just triggered PANIC IN THE GLOBAL MARKET! [CRYPTO DUMP]

-

News9 months ago

News9 months agoNew Crypto Wallet Collects Over 350 Billion PEPE Tokens: Can This Make Memecoin Soar? ⋆ ZyCrypto

-

Memecoins8 months ago

Memecoins8 months agoOver 1 million new tokens launched since April

-

News6 months ago

News6 months agoGolem Project Joins ETH Staking Frenzy, Locks Up 40,000 Tokens

-

News6 months ago

News6 months agoa new era for DEX tokens

-

Memecoins7 months ago

Memecoins7 months agoSolana Sets New Records With Its Memecoins

-

Bitcoin8 months ago

Bitcoin8 months agoCrypto Analyst Predicts Record Bitcoin Gains Before October Amid Global Liquidity Shifts ⋆ ZyCrypto

-

Bitcoin7 months ago

Bitcoin7 months agoCrypto President Trump’s ‘Lesser’ Regulation Will Bless Coinbase’s Bitcoin Leverage, Expert Says – Coinbase Glb (NASDAQ:COIN)

-

News6 months ago

News6 months agoPepe Investors Seek New Rewards From Rival Token Mpeppe (MPEPE) at $0.0007

-

Memecoins9 months ago

Memecoins9 months agoSolana co-founder strongly supports meme coins; highlights memecoin migration from ETH to Solana ⋆ ZyCrypto

-

Videos9 months ago

Videos9 months agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

Memecoins9 months ago

Memecoins9 months agoAI Tokens Take the Baton from Memecoins to Drive a Market Rebirth ⋆ ZyCrypto