News

Lido Backers vs EigenLayer — TradingView News

I must admit to choking on my tequila drink a couple weeks ago after hearing the phrase “investable asset class” applied to the category of digital tokens known as meme coins. But for many investors and projects, the opportunity is being taken quite seriously. See our riff below.

ALSO:

This article is featured in the latest issue of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Also please check out our weekly The Protocol podcast.

Network news

MEME RUSH! An industry source told me over margaritas a few weeks ago, “You’re starting to hear venture capital firms make the argument that meme coins are becoming an investable asset class.” What’s undeniable is that meme coins are popping, and there does appear to be a thriving industry in promoting them. In April alone, CoinMarketCap added 138 meme coins to its listings, versus 18 in the same month a year earlier, bringing the total to 2,229, with a market capitalization of more than $50 billion, as reported by our Omkar Godbole. Last week, VanEck, a crypto-friendly institutional investment firm, started a new Meme Coin Index, tracking prices of doggy-themed tokens dogecoin DOGEUSD and dogwifhat WWIF as well as other ridiculousness like BONK. Another dog token, FLOKI, shared the title sponsorship for a cricket series between Pakistan and Ireland. Crypto analysts are talking up the election-related meme coins TRUMP and BODEN, and tokens associated with the X-Men character Wolverine flooded several blockchains after TheRoaringKitty, the personality behind the GameStop meme stock frenzy, posted a related video on X. Even independent Bitcoin programmer Jimmy Song, often a vocal critic of non-Bitcoin token creation, wrote in a Substack post that he appreciated the “honesty” of the movement: “Meme coins obsoleted the VCs and ultimately brought some more honesty to the Nietzschean will-to-power games that were always being played.” Speaking of Bitcoin, the OG blockchain now has meme coins too, many of them created with the Runes protocol launched last month. Sovryn, a decentralized trading platform with Ethereum-compatible smart contracts and secured by Bitcoin through merge-mining on the Rootstock sidechain, announced Wednesday that it has created a fully-premined rune called POWA, airdropped the tokens to users and established pools for trading them. “Runes provide a way for projects to create and distribute tokens natively on the Bitcoin blockchain for memes,” Sovryn said in a press release.

STAKERS NOW RESTAKERS? Our Sam Kessler has the scoop: “The co-founders of Lido, the biggest liquid staking protocol on Ethereum, are secretly funding a competitor to EigenLayer, the buzzy “restaking” service that has emerged rapidly this year to become a powerful force in decentralized finance. According to several people with knowledge of the matter, the project is called Symbiotic and has drawn backing from not only the Lido co-founders, Konstantin Lomashuk and Vasiliy Shapovalov, through their venture firm Cyber Fund, but also Paradigm, the crypto venture capital firm that is one of Lido’s lead investors. CoinDesk also obtained internal Symbiotic documents that describe the project, which allows users to “restake” using Lido’s staked ether (stETH) token and other popular assets that are not natively compatible with EigenLayer.”

JUST IN: Two brothers have been arrested by the U.S. Department of Justice for attacking the Ethereum blockchain and stealing $25 million of cryptocurrency during a 12-second exploit, according to an indictment unsealed on Wednesday.

THE WORDS OF VITALIK. We’ve written quite a bit in The Protocol newsletter about just how prolific (and prolix) the Ethereum co-founder Vitalik Buterin can be as a writer. It’s also true that when he writes, people tend to write a lot about whatever he writes – such as this opus on “multidimensional gas pricing,” which Decrypt covered. But apparently Buterin is also crazy fast as a scribbler, especially when it comes to banging out Ethereum improvement proposals on deadline, as chronicled on Tuesday by our Margaux Nijkerk. With time ticking down toward an important meeting to discuss new Ethereum wallet standards, it took Buterin just 22 minutes to draft EIP-7702, offered as a substitute for an earlier proposal, EIP-3074, that had drawn complaints from some developers. The hot-off-the-press publication drew plaudits from critics, with much of the Ethereum community quickly coming around in support of replacing the earlier effort with Buterin’s proposed solution.

The courtroom where Tornado Cash developer Alexey Pertsev was sentenced. (Camomile Shumba/CoinDesk)

Alexey Pertsev, 31, a developer of the coin mixer Tornado Cash, has been found guilty of money laundering by a Dutch judge, and was given 64 months of prison time. The case, along with other recent actions brought by prosecutors around the world, has raised questions about the extent of responsibility that developers might bear for any code they write. As reported by our Camomile Shumba, prosecutors in the Dutch case made the argument that Pertsev “should have at least suspected the criminal origins of illicit transactions on the Tornado Cash platform.”

Solana-based crypto trading protocol Cypher has endured its share of hacks and heists. But its latest loss was an inside job. On Tuesday, a pseudonymous developer known as Hoak admitted to stealing hundreds of thousands of dollars worth of cryptocurrencies from Cypher’s hack reimbursement fund. “I took the funds and gambled them away,” Hoak said in a statement, blaming his activity on a “crippling gambling addiction.”

El Salvador set up a new website to track its $350 million bitcoin stockpile, Bitcoin Magazine reported.

Degen Chain, an Ethereum layer-3 blockchain dedicated to meme coins, came back online after a two-day outage. (Launched in March, Degen Chain is an “an ultra-low-cost L3 for the Degen community built with Arbitrum Orbit, Base for settlement, and AnyTrust for data availability,” according to a blog post at the time by Syndicate, the blockchain’s infrastructure partner.)

ICYMI: CoinDesk’s Danny Nelson takes a look inside the shadowy world of crypto influencers known as “key opinion leaders,” or KOLs, who invest in the projects they promote on social media – in return for the privilege of selling out before other investors.

Protocol Village

Top picks of the past week from our Protocol Village column, highlighting key blockchain tech upgrades and news.

Hyperbolic’s Proof of Sampling architecture (Zhang et al)

1. Hyperbolic, the two-year-old startup that math olympian Jasper Zhang leads focused on decentralized AI computing, said Thursday that it is introducing a protocol called “Proof of Sampling (PoSP),” aimed at addressing challenges with trust in decentralized AI networks. Hyperbolic was co-founded in 2022 by Zhang and Yuchen Jin, who holds a Ph.D. in computer science from the University of Washington.

2. Lens Lab, a part of the Stani Kulechov-led Avara and the team behind Lens Protocol, a Web3 social platform built on Polygon PoS, announced that it is now developing its own blockchain network, Lens Network. The new network will be built on Matter Labs’ ZK Stack, powered by zkSync on Ethereum. “The Lens Network will set a new baseline/precedent for how social networks should be built,” Alex Gluchowski, co-founder and CEO of Matter Labs, said in a press release.

3. Polkadot, the layer-1 chain ecosystem co-founded by Ethereum co-founder Gavin Wood, has debuted Asynchronous Backing, according to the team: It sets the stage for Polkadot 2.0, “a wave of enhancements expected to significantly improve the scalability, cost, speed and flexibility of the network, and accelerate growth of decentralized applications,” according to the team. “Asynchronous Backing cuts block time in half (from 12 to 6 seconds) enables parallel transaction validation block production, and delivers up to 10x higher throughput for Polkadot’s parachain consensus protocol.”

4. Indian crypto exchange CoinDCX has expanded what started as the Okto wallet into an Okto ecosystem, which will include launching a blockchain, a token, and a points program starting Tuesday. The aim is to give global users a single-click mobile experience while traversing the Web3 space, its co-founders Neeraj Khandelwal and Sumit Gupta told CoinDesk in an interview.

5. Cyber, the just-unveiled rebranding for the developer formerly known as CyberConnect, has launched its own layer-2 network in the Ethereum blockchain ecosystem, describing it as the “first L2 for social.” According to the team, the new chain relies on “top modular solutions. Cyber integrates Optimism’s OP Stack, EigenDA and custom features to provide low fees, high TPS and a user-friendly experience.” According to a blog post: “AltLayer will manage the rollup’s technical launch, ongoing management, operations and future upgrades.”

EasyA Consensus Hackathon – Call for Participants

This year, Consensus is hosting its first ever in-person hackathon together with the world’s number 1 Web3 learning app, EasyA. This will be a three-day, multi-chain IRL hackathon with world-class sponsors from Sui to Stellar to Polkadot and beyond, and will attract the world’s best developers to build the future of Web3 and raise funding for their projects.

Projects launched by EasyA alumni are valued at over $2.5 billion. The EasyA Consensus hackathon is going to be 2024’s most important hackathon yet.

We have a few remaining spots left for hackers, so if you’re excited about participating, make sure you sign up here!

‘Liquid Vesting’ Is Oxymoronic Blockchain Feature That Lets Early Investors Sell Without Waiting

Avalanche Incubator Colony Lab Co-founders Wessal Erradi and Elie Le Rest (Colony Lab)

Even in anything-goes crypto trading, there are conventions designed to protect the little guy.

One of those is the vesting period – a window of time following a digital-token sale or airdrop where early investors, such as founders, project contributors and venture-capital backers, are locked up from dumping their allocations.

Projects typically do this so that the price of that token doesn’t crash immediately after a listing, say if big stakeholders were to sell right away. Another goal is to make sure insiders and early backers keep skin in the game, an assurance of good faith, as it were.

Now comes a new feature from Colony Lab, a developer and project incubator in the Avalanche blockchain ecosystem, called “liquid vesting.”

If it sounds like a workaround, that’s because it basically is. Have your bags and keep them too. Take liquidity now, without having to wait for the end of the vesting period.

Click here for the full article by CoinDesk’s Margaux Nijkerk

Money Center

Fundraisings

Data and Tokens

Runes Frenzy Fades

We covered last month’s launch of the Runes protocol atop Bitcoin, observing in real time as its instant popularity and uptake right after the bitcoin halving sent transaction fees to record levels, as users scrambled to mint new meme coins, competing to get transactions included in the suddenly-congested blockchain. (As a plug: I’m scheduled to interview Rodarmor onstage on May 31 at CoinDesk’s Consensus conference in Austin.) Even as recently as last week, Runes accounted for a majority of all transactions on the Bitcoin blockchain, outpacing the original bitcoin as well as Ordinals inscriptions and the rival fungible-token standard BRC-20.

But the Runes frenzy has now faded somewhat. Runes has been “written off as a flop, with waning interest failing to match the hype,” according to a report by the blockchain analysis firm Coin Metrics. The analysts noted, however, that there may still be hope for a resurgence: “Runes are yet to be validated in the form of listings on major exchanges, trading largely on niche collectibles platforms.” Transactions related to the new protocol appear to be ticking down:

Runes transactions of all types have shrunk since the launch around April 20. (@runes_is/Dune Analytics)

Calendar

May 18-27: Berlin Blockchain Week.

May 29-31: Consensus, Austin Texas.

May 29-31: Bitcoin Seoul.

June 11-13: Apex, the XRP Ledger Developer Summit, Amsterdam.

July 8-11: EthCC, Brussels.

July 25-27: Bitcoin 2024, Nashville.

Aug. 19-21: Web3 Summit, Berlin.

Sept. 19-21: Solana Breakpoint, Singapore.

Sept. 1-7: Korea Blockchain Week, Seoul.

Sept. 30-Oct. 2: Messari Mainnet, New York.

Oct. 9-11: Permissionless, Salt Lake City.

Oct. 21-22: Cosmoverse, Dubai.

Oct. 23-24: Cardano Summit, Dubai.

Oct. 30-31: Chainlink SmartCon, Hong Kong

Nov 12-14: Devcon 7, Bangkok.

Nov. 20-21: North American Blockchain Summit, Dallas.

Feb. 19-20, 2025: ConsensusHK, Hong Kong

News

Pepe Investors Seek New Rewards From Rival Token Mpeppe (MPEPE) at $0.0007

As the cryptocurrency market continues to expand, investors are constantly looking for new opportunities to maximize their returns. Pepe (PEPE), a meme coin inspired by the iconic Internet character Pepe the Frog, has been a staple in the meme coin arena. However, recent developments have shifted some investors’ attention to a promising new competitor: MPEPE (MPEPE). Currently trading at $0.0007, Mpeppe is attracting significant interest from those looking to diversify and capitalize on the next big thing.

Pepe’s appeal (PEPE)

Pepecoin (PEPE) has carved out a significant niche for itself in the cryptocurrency market, largely due to its vibrant community and roots in internet meme culture. Drawing inspiration from the popular meme character Pepe the Frog, Pepe (PEPE) has captured the attention of cryptocurrency enthusiasts and meme enthusiasts alike. This fusion of humor and community spirit has been instrumental in its rise within the cryptocurrency space.

The continued success of Pepecoin (PEPE) can be attributed to its active and dedicated community. Holders of the coin are known for their enthusiastic promotion on social media platforms, which helps maintain its visibility and popularity. This strong community support has been instrumental in sustaining Pepe (PEPE)’s momentum and driving its market performance. Recent whale activity, such as a massive transfer of 9 trillion PEPE tokens valued at $82 million to Bybit, further highlights the coin’s potential for significant price movements driven by large-scale transactions.

Mpeppe (MPEPE): the rising star

Mpeppe (MPEPE) differentiates itself by merging the realms of sports and cryptocurrency. Drawing inspiration from soccer sensation Kylian Mbappé and leveraging the legacy of the Pepe (PEPE) meme coin, Mpeppe offers a unique appeal that resonates with both sports fans and cryptocurrency investors. This innovative fusion is attracting a diverse and engaged audience, fostering a vibrant community around the token.

A large ecosystem

Differentiating itself from typical meme coins, Mpeppe (MPEPE) features a robust ecosystem that includes gaming and sports betting platforms, NFT collectibles, and social interaction features. These utilities provide real value to users, creating multiple channels for engagement and investment. This comprehensive approach positions Mpeppe as more than just a meme coin, offering a richer and more engaging experience for its users.

Investment Potential of Mpeppe (MPEPE)

Strategic Tokenomics

Mpeppe (MPEPE) has been strategically priced at $0.0007, making it accessible to a wide range of investors. Tokenomics is designed to support long-term growth, with allocations for presales, liquidity, and sports activities. This strategic distribution ensures stability and promotes community engagement, positioning Mpeppe for substantial growth.

Analysts’ optimism

Market analysts are optimistic about the potential of Mpeppe (MPEPE). The coin’s innovative approach, strong community, and strategic partnerships are expected to drive significant price increases. Early investors stand to benefit from substantial returns as Mpeppe gains traction in the market. Analysts note that Mpeppe’s combination of utility and community engagement positions it well for future growth, especially as the cryptocurrency market continues to evolve.

The impact of similar competing businesses

Driving Innovation

Competition between similar assets such as Pepe (PEPE) and Mpeppe (MPEPE) is a catalyst for innovation. Each project strives to outdo the other, resulting in continuous improvements and new features. This dynamic competition benefits investors, offering them better and more advanced products.

Market diversification

Having multiple competing assets in the market promotes diversification. Investors have more options to choose from, which can help spread risk and potentially increase returns. The presence of strong contenders like Pepe (PEPE) and Mpeppe (MPEPE) ensures a vibrant and resilient crypto ecosystem.

Increased market interest

Competition between similar assets also generates increased market interest. As projects compete for attention, they attract more investors and media coverage, leading to increased visibility and adoption. This increased interest can drive further investment and growth in the sector.

The Future of Mpeppe (MPEPE)

Strategic development

Mpeppe (MPEPE) has a clear and ambitious roadmap for the future. Development plans include expanding its gaming and sports betting platforms, launching new NFT collections, and forming strategic partnerships. These initiatives are designed to improve user experience and drive market growth.

Community Growth

The success of Mpeppe (MPEPE) will largely depend on its ability to build and sustain a strong community. By focusing on engagement and providing valuable utility, Mpeppe aims to foster a loyal and active user base. This community-driven approach is expected to play a significant role in its long-term success.

Conclusion: A New Horizon for Meme Coin Investors

In conclusion, while Pepe (PEPE) has established itself as a significant player in the meme coin market, Mpeppe (MPEPE) offers a fresh and innovative approach that is capturing the interest of investors. With its strategic pricing, comprehensive ecosystem, and potential for high returns, Mpeppe (MPEPE) represents an exciting opportunity for those looking to diversify their cryptocurrency portfolios. As always, investors should stay informed and consider multiple factors before making investment decisions. Embrace the potential of Mpeppe (MPEPE) and join the journey to new rewards in the cryptocurrency world.

For more information on the pre-sale of Mpeppe (MPEPE):

Visit Mpeppe (MPEPE)

Join and become a member of the community:

Italian: https://t.me/mpeppecoin

Italian: https://x.com/mpeppecommunity?s=11&t=hQv3guBuxfglZI-0YOTGuQ

News

Golem Project Joins ETH Staking Frenzy, Locks Up 40,000 Tokens

- The Golem project has moved over $124 million in ETH for staking.

- Ethereum staking frenzy has increased ahead of the launch of spot ETH ETFs in the US.

Ethereal [ETH]The Project Golem-based distributed computing marketplace has joined the ETH staking frenzy.

On July 11, contrary to its recent sell-off, the company reportedly staked 40K ETH worth over $124.6 million, according to Lookonchain data.

Golem Network has confirmed its Ethereum staking initiative and said its purpose was to “create space” to help participants contribute to the network.

“The Golem Ecosystem Fund is officially launched today! We have staked 40,000 ETH from Golem’s treasury. This will create a space where developers, researchers, and entrepreneurs can bring their ideas to life and contribute to the Golem Network and its ecosystem!”

Ethereum Staking Frenzy

The staking frenzy has infected Ethereum, with just days to go until the potential launch of a spot ETH ETF in the United States. Recently, an unmarked address blocked over 6K ETH.

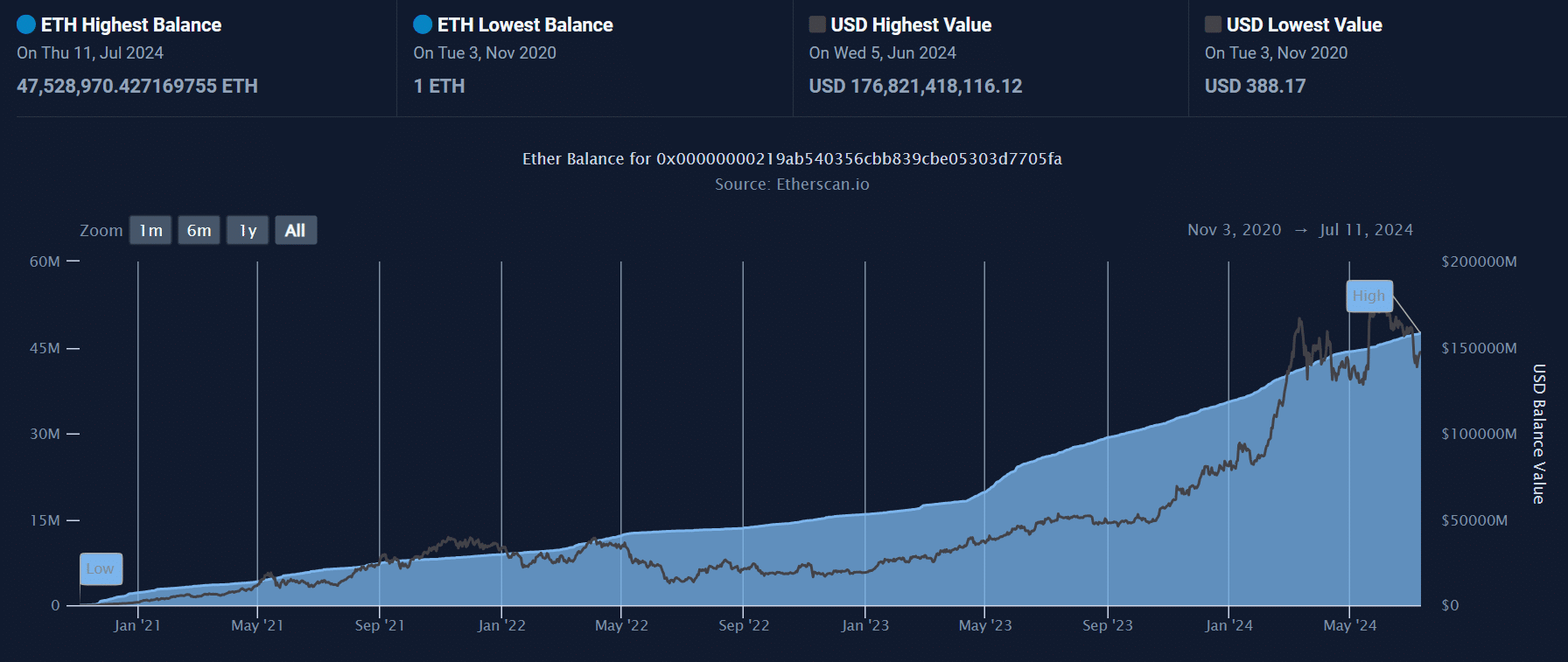

The Golem project’s decision to lock up 40K ETH on July 11th pushed the total ETH locked up to Chain of lights at an all-time high of 47.5 million ETH, worth over $140 billion based on market prices at press time.

Beacon Chain is Ethereum’s system that manages the validation of new blocks.

Source: Etherscan

According to a recent AMBCrypto relationshipIncreased ETH staking ahead of the debut of the ETH spot ETF in the US has underscored bullish sentiment.

More ETH has been moved from exchanges, further strengthening bullish expectations.

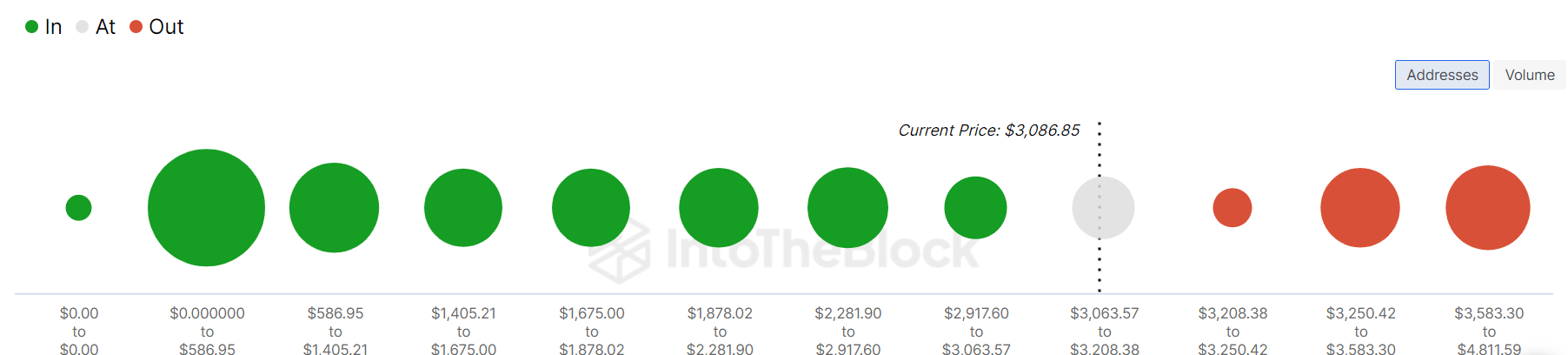

Meanwhile, from a short-term perspective, many addresses were losing at the $3.2K and $3.5K levels. Investors could try to take a profit if they break even.

These prices represent key levels to watch in the short term.

Source: IntoTheBlock

Next: Why Bitcoin Must Surpass $61K Soon, According to Analysts

News

BlockDAG Thrives While Chainlink and FTM Tokens Decline

As the cryptocurrency space turns bearish, giants like Chainlink and Fantom are facing setbacks with declining trends for LINK and FTM. Amid these changes, BlockDAG emerges as a prime target due to its promising pre-sales and long-term prospects. This Layer-1 project boasts an innovative Low Code No Code ecosystem, attracting investors with potential ROIs exceeding 30,000x. The pre-sales momentum has already accumulated over $57.6 million, driven by growing investor enthusiasm.

Impact of Chainlink’s Recent Token Release

Chainlink’s recent move to release 21 million LINK tokens, worth approximately $295 million, from its dormant supply contracts has significant market implications. This release sent 18.25 million LINK to Binance, fueling speculation that the price will drop. LINK is currently trading at $13.64, approaching its critical support at $13.5, with the potential to drop to $10 if this level breaks.

These releases, increasing the circulating supply above 600 million LINK, have previously maintained price stability, but the prevailing bearish conditions could alter this trend. With 391.5 million LINK pending release, market caution persists.

Fantom (FTM) Market Position Dynamics

Fantom experienced a strong buying spree last November, but its valuation has been challenging lately. After peaking near $1.20 in March, subsequent resistance and profit-taking pushed its price lower. FTM recently dipped below the crucial $0.600 mark but found some ground around $0.500. Fantom is currently valued at $0.559 with a market cap of $1.67 billion and daily trading volume of $257.56 million.

The Fantom Foundation’s decision to award over 55,000 FTMs quarterly to major dApps on the Opera network has invigorated user participation. Indicators such as RSI and MACD suggest a possible bounce if it surpasses the $0.600 mark. Failure to break above the 200-day EMA could prolong the bearish outlook.

BlockDAG Pre-Sale Triumph and Innovative Platform

BlockDAG’s pioneering low-code/no-code platform enables the seamless creation of utility tokens, meme tokens, and NFTs, catering to a broad user base. Its intuitive templates allow enthusiasts to quickly launch and customize projects, thereby democratizing blockchain development and accelerating market entry.

The cutting-edge features of this platform have attracted cryptocurrency investors, significantly increasing the interest in the presale. BlockDAG has successfully raised over $57.6 million, witnessing a 1300% escalation in the coin’s value from $0.001 to $0.014 in its 19th batch. This impressive rise underscores the immense return potential of BlockDAG for early backers.

Additionally, BlockDAG’s commitment to expanding its ecosystem extends to supporting the development of decentralized apps. This fosters a wide range of new projects in the blockchain domain, from digital art platforms to tokenized assets, enriching the blockchain ecosystem.

Key observations

While Chainlink and Fantom are currently navigating bearish trends due to token releases and resistance hurdles, BlockDAG’s innovative low-code/no-code framework positions it as an attractive investment option. With a presale raise of over $57.6 million and prices skyrocketing 1300% in recent batches, BlockDAG shows tremendous potential for returns of up to 30,000x. Amidst the market volatility impacting Chainlink Tokens and Fantom, BlockDAG stands out as a promising avenue for cryptocurrency traders.

Sign up for BlockDAG Pre-Sale now:

Website: https://blockdag.network

Pre-sale: https://acquisto.blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: Italian: https://discord.gg/Q7BxghMVyu

Disclaimer: The statements, views and opinions expressed in this article are solely those of the content provider and do not necessarily represent those of Crypto Reporter. Crypto Reporter is not responsible for the reliability, quality and accuracy of any material in this article. This article is provided for educational purposes only. Crypto Reporter is not responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Do your own research and invest at your own risk.

News

a new era for DEX tokens

The DEX aggregator Anger Trading is about to issue its RAGE token on the new Layer 1 blockchain Hyperliquid. The token sale is scheduled for August 7, with 20 million tokens out of a total supply of 100 million available on Fjord Foundry at a fixed price of $0.30.

Additionally, the “Rage Quit” feature has been introduced, which allows private investors to get their allocation early by accepting a 60% cut.

RAGE will be among the first tokens to be launched on Hyperliquidmarking a significant moment for this new blockchain. Let’s see all the details below.

DEX News Rage Trade: New RAGE Token Arrives on Hyperliquid

As expected, decentralized exchange (DEX) aggregator Rage Trade has announced the issuance of its new token ANGER. The launch is happening through a liquidity generation event and token sale on Fjord Foundry, scheduled for August 7th.

The token will be launched on the newly launched layer 1 blockchain Hyperliquidwhich has rapidly gained popularity due to its decentralized perpetual exchange.

Rage Trade currently aggregates platforms such as GMX, Synthetix, Dydx, Aevo and Hyperliquid, allowing traders to manage their positions across multiple blockchains and earn incentives.

During the event, 20 million RAGE tokens will be sold at a fixed price of $0.30, while another nine million will be used to inject liquidity into Hyperliquid.

Additionally, six million tokens have been reserved for future market making and product development incentives.

The token will have a total supply of 100 million, with 20% earmarked for sale and 30% for community treasury. The latter is subject to a 12-month lock-up period and a 24-month linear release.

The “Rage Quit” feature introduces a deflationary mechanismThis allows private investors and recipients of the air launch to receive their assignment after an initial three-month stalemate, accepting a 60% cut.

Rage Trade has chosen Hyperliquid as the platform for its token after the network became the preferred choice of users of the Anger Aggregatorwith over 1,300 users generating $445 million in volume.

Hyperliquid surpasses dYdX in TVL

Hyperliquid, the exchange decentralized based on Referee, recently introduced a new points program, which has catalyzed significant growth in total value locked (TVL) on the platform.

According to data from DefiLlama, Hyperliquid has reached a TVL of $530 million, surpassing dYdX’s $484 million and reaching a new all-time high.

This figure places Hyperliquid in second place among derivatives platforms, just behind GMX, which maintains a TVL of $542 million.

Rounding out the top five platforms by TVL are Solana-based Jupiter with $415 million and Drift with $365 million. Hyperliquid had a stellar year in 2024, jumping from eighth to second place in just six weeks.

This rapid increase was largely attributed to the new Hyperliquid points program, which launched on May 29.

The points program provides for the distribution of 700,000 points weekly for four months. With an additional 2 million points awarded for activity between May 1 and May 28.

Despite community criticism over the decision to extend the incentive program and delay the token launch and airdrop, the platform has continued to attract numerous traders.

From Perpetual DEX to Layer 1

Steven, founding member of Capital Yuntwhich has backed some of the largest cryptocurrency firms, including Zerion, noted that Hyperliquid has distributed approximately 51 million points in four periods.

He further stressed that the project aims to reward its early adopters and move from simply being a perpetual DEX to a true Layer 1:

“The team is clearly making an effort to communicate that Hyperliquid is an L1 and not just a DEX for derivatives.”

Furthermore, he highlighted that the token holders PURSUE were significantly rewarded, with a 23% increase in the token’s value.

PURR was the first spot token launched on Hyperliquid and looks set to continue receiving attention and incentives from the platform.

-

Videos6 months ago

Videos6 months agoJapan just triggered PANIC IN THE GLOBAL MARKET! [CRYPTO DUMP]

-

News9 months ago

News9 months agoNew Crypto Wallet Collects Over 350 Billion PEPE Tokens: Can This Make Memecoin Soar? ⋆ ZyCrypto

-

Memecoins8 months ago

Memecoins8 months agoOver 1 million new tokens launched since April

-

News6 months ago

News6 months agoGolem Project Joins ETH Staking Frenzy, Locks Up 40,000 Tokens

-

News6 months ago

News6 months agoa new era for DEX tokens

-

Memecoins7 months ago

Memecoins7 months agoSolana Sets New Records With Its Memecoins

-

Bitcoin8 months ago

Bitcoin8 months agoCrypto Analyst Predicts Record Bitcoin Gains Before October Amid Global Liquidity Shifts ⋆ ZyCrypto

-

Bitcoin7 months ago

Bitcoin7 months agoCrypto President Trump’s ‘Lesser’ Regulation Will Bless Coinbase’s Bitcoin Leverage, Expert Says – Coinbase Glb (NASDAQ:COIN)

-

News6 months ago

News6 months agoPepe Investors Seek New Rewards From Rival Token Mpeppe (MPEPE) at $0.0007

-

Memecoins9 months ago

Memecoins9 months agoSolana co-founder strongly supports meme coins; highlights memecoin migration from ETH to Solana ⋆ ZyCrypto

-

Videos9 months ago

Videos9 months agoLIVE FOMC 🚨 Could be CATASTROPHIC for Altcoins!

-

Memecoins9 months ago

Memecoins9 months agoAI Tokens Take the Baton from Memecoins to Drive a Market Rebirth ⋆ ZyCrypto